No loading or subscription fees

Available for Irish. See availability

Regulated by national authorities around the globe

100,000+ reviews on Trustpilot

Customers love Wise

.png)

Questions? Get 24/7 help in 14 languages

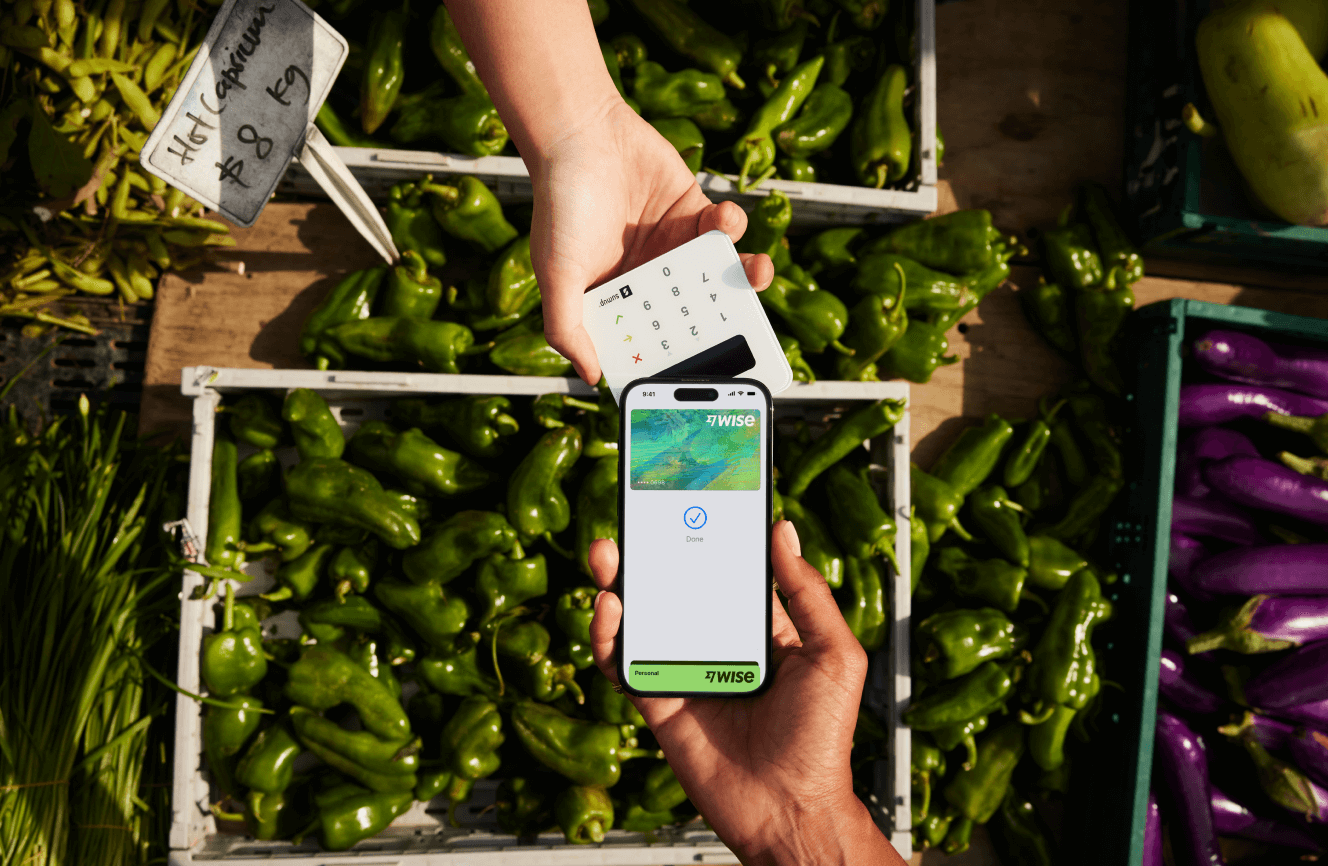

The Wise travel money card can be ordered from Ireland for sending, spending, and receiving Singapore dollar abroad. Enjoy the exchange rate you see on Google for transactions in over 40 different currencies.

Use your card in more than 160 countries and withdraw money from 3 million ATMs worldwide.

If you don't have an address in Ireland, it's best to check if Wise travel card is available in your country.

We asked an independent research agency to compare our travel money card to some bank accounts in the UK. They found that we’re on average 4x cheaper for spending abroad.

| Cost to send £250 in EUR | |

|---|---|

| £1.22 |

| £9.26 |

| £6.87 |

| £8.92 |

| Fees to spend £250 on debit card in EUR | |

| £1.03 |

| £6.88 |

| £7.48 |

| £7.48 |

| Withdraw £250 worth of Euro internationally | |

| £1.90 |

| £11.88 |

| £7.48 |

| £7.48 |

Data collected by an independent research agency. Learn more

With our Smart Conversion feature, you can explore the world without worrying about fluctuating exchange rates.

If your local currency balance runs low, you can still spend money. Our intelligent system will automatically select the balance for you that has the lowest conversion fee from your other available currencies.

No more sneaky transaction fees or facing unfavourable rates at airport counters. Our travel money card ensures you get the most out of every penny, making your holiday money go further than ever before.

Don’t exchange your travel money at the airport – it’s much cheaper to withdraw money from an ATM with your travel money card.

Always choose the local currency (without conversion) when withdrawing money from ATMs or using your travel money card in shops and restaurants.

If you need to pay for your holiday in a foreign currency, transfer your money with Wise.

Download the free Wise money transfer app and manage your balance on the go.

Don’t worry – it’s easy to freeze and replace your Wise card. If it’s lost or stolen, here’s what to do.

Freeze your card by logging into your Wise account. This will stop any transactions from taking place.

Contact us via email or phone. We’ll put a permanent block on your card.

Confirm via email that you understand your card will be blocked. We want to make sure before going ahead.

Order a new card like you did the first time. We’ll ask you to confirm your name and mailing address.

Once we have these details, we’ll get your new card on its way to you. Meanwhile, you can create a digital card for free and use with Google or Apple Pay straight away.