Tmall vs Taobao: Is Tmall and Taobao the same?

Explore the differences between Taobao vs Tmall, two popular e-commerce platforms. This guide helps expats in China choose the best site for their needs.

You've probably heard that foreigners who have just moved to China to live or work find themselves uneasy about the country’s widespread usage of electronic payment systems for online shopping, paying bills and just about everything else!. Well, to be sure, China's online payment system is very powerful and ubiquitous, however, all payment methods must be linked in some way to a client bank account.

Getting a Chinese bank card is essential if you want to make financial services more accessible in China. But, expats who have just arrived in China probably do not have a Chinese bank card. So, can foreigners open a bank account in China? How do I open a bank account in China as a foreigner? Below are the detailed steps and key points to understand for getting a Chinese bank card.

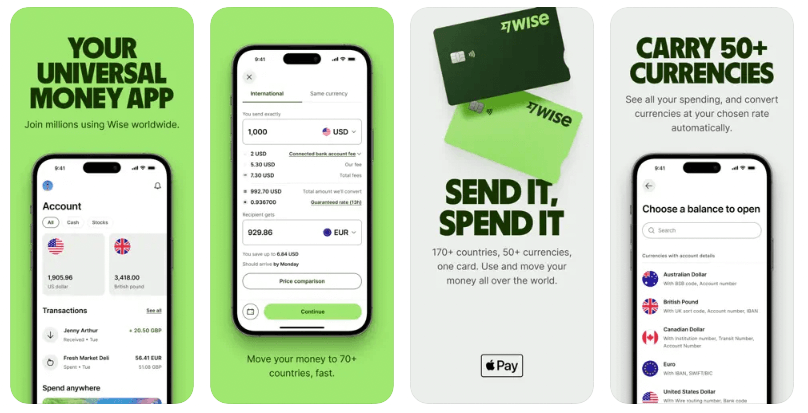

Are you wondering if there is another option if you are pressed for time and unable to open a bank account right away? Wise is definitely a great alternative -- it is cheaper and faster than most traditional banks when it comes to converting currencies, receiving money, and making international transfers. Also think about opening a Wise debit card, which has no annual management fee, and use it to pay like a local in China.

Yes, foreigners can open bank accounts in China, including accounts with Bank of China (BOC)¹, Industrial and Commercial Bank of China (ICBC)², Bank of Communications (BOCOM)³, etc.

Foreign nationals must present their valid passports and residency permits to the bank counter, and fill in an account opening application. They are able to use a bank card once the application is approved.

When a user opens an account at a bank, the bank will carefully verify the authenticity, validity and compliance of documents. If necessary, you will be required to provide supporting documents. Foreign nationals from the list of high-risk countries and regions may be restricted from conducting banking related business³.

Please note: the documents for bank account opening vary depending on the banks and their business branches. You need to refer to the regulations of your local business branch when handling the account.

Generally speaking, there are a few more requirements for expats who want to apply for a credit card. For instance, if a foreigner wants to open an ICBC bank credit card, they need to be a respectable person with full capacity for civilized behavior and be between the ages of 25 and 65. The workplace is in the location of the card issuer and their income is stable and above the local average wage².

There are a number of banks in China that offer various types of bank cards. Overall, Chinese bank cards can be categorized into two types: debit card and credit card¹.

Debit card is a common type of bank card that can be used for savings and electronic payments. Furthermore, saving accounts are categorized into on-demand deposits and time-limited deposits. Credit cards can be used for credit spending and installment payments. You can select the appropriate bank and type of bank card based on your requirements.

The process of opening a bank account may vary slightly from bank to bank. Here is the step guide for a routine process:

Please note:

Most Chinese banks support online account opening service. Take ICBC² as an example; yyou can open a savings account through the "ICBC Customer Service" WeChat official account. Select "Finance” > “Savings Card" in the menu bar below, and fill in the information as prompted.

But for a foreign national to open a bank account in China, you will very probably have to visit a branch in person.

China offers a plethora of banks for expats to select from. Every bank has a vast network of branches and ATMs, particularly in major cities, like Beijing and Shanghai. These are just a handful of the options:

In addition to local banks, there are also international banks, such as Citibank, Standard Chartered Bank, and HSBC, with which foreigners can open an account in China.

Before deciding which bank to visit, you might want to consider which Chinese banks have branches abroad. Currently, the Bank of China and the Industrial and Commercial Bank of China have the most overseas branches.

ICBC has 404 foreign branches spreading across 42 countries and regions (as at 2015⁴). While the Bank of China has even more, with 643 overseas branches in Hong Kong, Macau, Taiwan, Dubai, Abu Dhabi, Asia-Pacific Area, Europe, America, and Africa⁵.

Besides these, China Construction Bank, China Merchants Bank, and Bank of Communications have also established branches abroad.

What currency rates are banks using?

When making an international transfer through a Chinese bank, it typically uses a rate set by itself, so as to make more money from exchanging currencies. But you should know that there is an actual rate in place -- the mid-market rate. It is the midpoint of a buy rate and a sell rate set by banks, and known as the fairest rate.

How long does it usually take?

Take Bank of China as an example.

First, the remittance will be credited your account within three to five working days. The exact crediting time will depend on whether the information you have provided about the remittance satisfies the applicable requirements of the country to which it is being sent. Meanwhile, the transferring bank's processing speed has an impact on the crediting time as well.

Secondly, after accepting an individual's international outward remittance, the Bank of China will send a remittance telegram to the receiving bank abroad on the same day (working day). The foreign bank (including the transferring bank) should process the remittance on the next one or two working days¹.

What documents do you need to take with you?

It depends on the branch of the bank where you make the international transfer. Usually your passport is an absolute must. And you might want to consult the bank in your location to check whether you should bring your tax record in China.

What forms and files you need to fill in?

To send money out of China with Bank of China, customers need fill in an English-language telegraph transfer application form with the following remittance information⁶:

What are the transfer limits?

Again using the Bank of China as an example. The daily cumulative limit is equal to US$ 50,000. If the limit is exceeded, proof of the authenticity of the transaction amount under the current account must also be submitted⁶.

What if you would like to manage your finances in China, or any foreign country, better and more easily? Instead of opening an account at a traditional Chinese bank, you have a better option -- open a Wise account for free, and get a Wise debit card.

You can pay less and avoid wasting time visiting a physical bank in person. This is because Wise supports international money transfer among 70+ countries, and use mid-market rate for over 70 countries -- all done quickly via your Wise app or online.

Another benefit of having a Wise account, you can hold more than 40 currencies, including CNY, USD, GBP, EUR, JPY, etc. -- and it’s hassle-free to convert currencies you need. The Wise debit card enables you to make payments in 150+ countries, including China. And it is so convenient to use Wise to top up your Alipay and Wechat pay, to shop for everything!

This service is provided in partnership with a licensed third party payment provider in China.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore the differences between Taobao vs Tmall, two popular e-commerce platforms. This guide helps expats in China choose the best site for their needs.

Navigating China's e-commerce? Understand 1688 vs Taobao! This guide clarifies their differences for wholesale vs retail, plus tips for expats on payments.

Explore the differences between Taobao vs Temu, two popular e-commerce platforms. This guide helps expats in China choose the best site for their needs.

Explore the differences between Taobao vs AliExpress to find the best platform for your needs, focusing on audience, pricing, shipping, and more.

With our guide on how to buy from Taobao, you can easily find items you want and buy them, and find out if you can buy from Taobao directly as a foreigner.

Is there an English version of Taobao? How to change Taobao to English? Learn from this step-by-step guide plus the relationship between Ali Express and Taobao.