How to open a business bank account in China as a foreigner?

China is seeing an ever-growing influx of foreign investors and companies. In major first-tier cities such as Beijing, Shanghai and Shenzhen, there are foreigners or Chinese expatriates from all over the world applying to register a foreign company almost every day. These recently established foreign-invested enterprises need to open bank accounts in China to carry out day-to-day business.

These days, though, opening a business bank account in China is very strict in terms of booking bank appointments and vetting information. So how do you open a business bank account in China as a foreigner? In this article we will go over the factors that need to be taken into account for an FIE to open a business account.

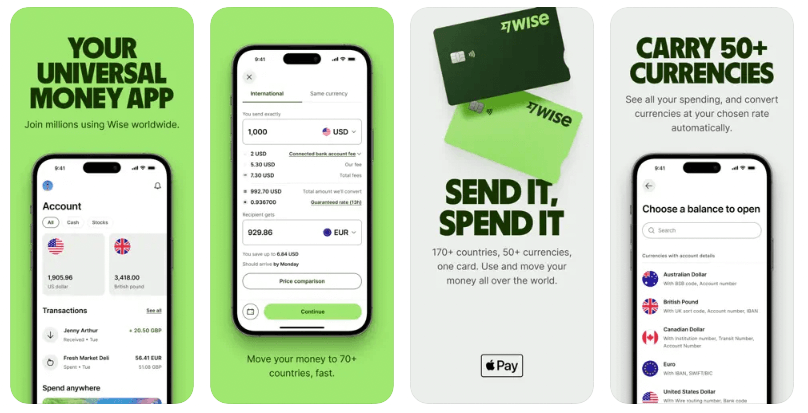

Since your business will definitely need several currency accounts to receive capital injections and withdraw funds, Wise is here to assist with its multi-currency account. You can receive, hold and convert 40+ currencies, including Chinese Yuan (RMB) and other primary currencies of the world global economy. Additionally, a foreign-invested enterprise you can use Wise to send RMB money out of China.

Can I open a business bank account in China as a foreigner?

Yes, foreigners are legally permitted to open a bank account after establishing a company in China. It’s quite necessary and urgent. Why is a business bank account crucial to your company?

First of all, an FIE will need a RMB basic account to withdraw RMB cash and to pay tax in China.

Second, an FIE will need at least one foreign currency capital contribution account (approved by the State Administration of Foreign Exchange) to receive capital injections from the foreign investor, to settle foreign exchange, and for other purposes.

What are the business bank account types in China?

In China, corporate bank accounts are typically classified as the settlement account, foreign exchange account, deposit account, and loan account, each with unique characteristics and financial uses, and different service fees¹.

Here we take the Bank of China as an example to understand the general services of each account.

- RMB settlement accountRMB bank settlement accounts of enterprises are divided into basic deposit accounts, general deposit accounts, special deposit accounts and temporary deposit accounts according to their purposes of daily use or special use².

- Corporate foreign exchange accountThis includes foreign exchange accounts opened and used for the purpose of conducting foreign exchange business with the Bank of China in freely convertible currencies, as well as some accounts in lesser-used currencies.The Bank of China can open foreign exchange accounts in 36 foreign currencies, including the US dollar, the Euro, the Japanese yen, the Hong Kong dollar and the British pound sterling³.

- Deposit accountThis includes corporate demand deposits in RMB, corporate demand deposits in foreign currency, corporate term deposits in RMB, corporate term deposits in foreign currency, corporate notice deposits, agreement deposits in RMB, and certificates of corporate deposit¹.

- Loan accountThe Bank of China’s corporate financing service includes global credit line, syndicated Loan, export buyer's credit, export supplier's credit, electronic commercial draft discounting, etc⁴.

What requirements are there for opening a business bank account in China?

Foreign-invested enterprises wishing to open a bank account in China should complete an application form and provide any necessary documents. While the documents needed by different banks may vary slightly, the following documents are typically required by most banks:

- Documentation proving your business is properly registered, such as Tax Registration Certificates (obtained from local Taxation Bureau), a valid Business License (obtained from local Industrial and Commercial Administration), and Articles of Association.

- Directors' names along with a company seal (obtained from local Public Security Bureau).

- Identity documentation for the corporate's legal counsel, which includes directors, principal shareholders, and responsible officers.

- Information about the ownership and structure of the company.

- Proof of state approval of your business venture may be needed if it's a joint venture or foreign registered corporation (obtained from the Ministry of Commerce).

How to open a business bank account in China?

- Consult the local branch of the bank of your choice by phone, and make an appointment.

- Prepare all the necessary documents and papers to open an account according to the chosen bank’s policies.

- Go to the bank in person. Provide all documents and certificates needed, and sign the appropriate banking documents.

- Complete all processes and wait for the review of account opening.

How long does it usually take?

For enterprises that meet the conditions for opening a business account, a Chinese bank, e.g. Bank of China⁵, will generally complete the account opening audit and handle the procedures for opening an enterprise account within three working days. The business account can be used for fund collection and sending operations from the day it is formally opened.

How much to open a business account?

If you open a business account with the Bank of China, they charge up to RMB 300/account. There is also a general account maintenance fee -- up to RMB 50/account/month⁶.

Are there international banks that I can open a business account with?

Yes, Citibank, Hang Seng Bank, DBS Bank, HSBC, and some other international banks have branches in China. You may consult their local branches for opening a business account.

Which Chinese banks should I choose if I want a business account?

There are a wide range of Chinese banks that allow foreign-invested enterprises to open a business account. All banks have an extensive branch and ATM networks, so you can handle your banking business in most Chinese cities conveniently.

When picking one or two Chinese banks to open business accounts, it is wise to also think about which Chinese banks have branches abroad, and which ones have the most overseas branches. Below we list the top 5 leading banks in China, with the numbers of their overseas branches.

- Bank of China (BOC)

- 643 foreign branches in 28 countries⁷

- Industrial and Commercial Bank of China (ICBC)

- 404 foreign branches in 42 countries⁸

- Bank of Communications (BoCom)

- 23 overseas branches and banking subsidiaries⁹

- China Construction Bank (CCB)

- With foreign branches in Hong Kong, Singapore, Tokyo, Seoul, Frankfurt, Johannesburg, New York, Ho Chi Minh City, and Sydney¹⁰

- Agricultural Bank of China (ABC)

- 23 overseas branches, offices, and institutions in Hong Kong, Macau, Taiwan, Asia-Pacific Area, Europe, and America¹¹

Things to know when you using Chinese banks to make international transfers

Which currency rates are applied by Chinese banks?

Like other banks in the world, Chinese banks also use their own set rate. However, you ought to be aware that there is a ‘real rate’ --the mid-market rate -- the middle point between a buy and a sell rate that is established by banks.

How long does it usually take?

With the Bank of China as an example. It takes 72 hours to complete the review of the document for a business account to apply for a cross-border remittance. Plus it'll take a few more days for the funds to arrive at the destination account.

What document do you need to take with you?

Generally, the documents required for a business account to make an international transfer include order contract, international tracking number, customs declaration, invoice, etc. You’ll need to look for exact information from the bank branch in your location.

What forms and any files do you need to fill out?

To make an international transfer, you’ll probably need to fill out the following forms and files:

- The amount and currency of the remittance;

- The payee's name and address;

- The account number of the payee at the opening bank;

- The payee's opening bank name, SWIFT code, or address.

What is the limit for each international transfer?

It depends on the bank and the branch you choose.

Learn about Wise international money transfer: send money to over 160 countries including China, hold 40+ currencies and you can use Wise debit card in China!

As you can see, the steps involved in opening a business account in China and making an international money transfer using a Chinese bank are not easy, rather time-consuming and money-consuming. Wise is a better alternative for foreign-invested enterprises in China. It is easy, fast and free to open a Wise account. And then with just a few simple steps through the in-app or the web version, you can receive and send money abroad.

Wise is constantly expanding its service footprint and serving more people globally. Over 16 million people, including business account users, use Wise to make international transfers to 160+ countries including China. More importantly, Wise go straight to the mid-market currency rate, meaning you can save more from each transaction.

Wise multi-currency account and Wise debit card are must-have financial tools for FIEs. You can hold 40+ currencies, including CNY, USD, GBP, EUR, AUD, CAD, etc., in your account, and use Wise debit card for daily transfers, payments, and settlements. Open your Wise account today, and seize any opportunity to invest and make money in China!

*This service is provided in partnership with a licensed third party payment provider in China.

Source:

- Bank of China: Corporate banking > accounts and deposits

- Bank of China: RMB settlement account

- Bank of China: Corporate foreign exchange account

- Bank of China: Corporate banking > corporate loan financing

- Bank of China: Corporate account services

- Bank of China: Corporate and Financial Institutions Customer Service Fee Business

- Bank of China: Global website

- Industrial and Commercial Bank of China: overseas financial service

- Bank of Communications: Overview

- China Construction Bank: Overview

- Agricultural Bank of China: Overseas institutions

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.