Shanghai Commercial Bank account requirements, steps, fees

Everything about how to open a Shanghai Commercial Bank account, steps, required documents, charges and fees of deposit, international transfers

Foreigners in China can find it easier to make daily purchases, shop online, and book hotels and flights if they have a credit card issued by a Chinese bank. The Bank of China is the longest continually operating bank and the most globalized bank in China¹. It stands to reason, therefore, that, a Bank of China credit card is one of the best choices for expats. In this article, we will go over the types of Bank of China credit cards, along with the instructions on how to apply for a Bank of China credit card as a foreigner.

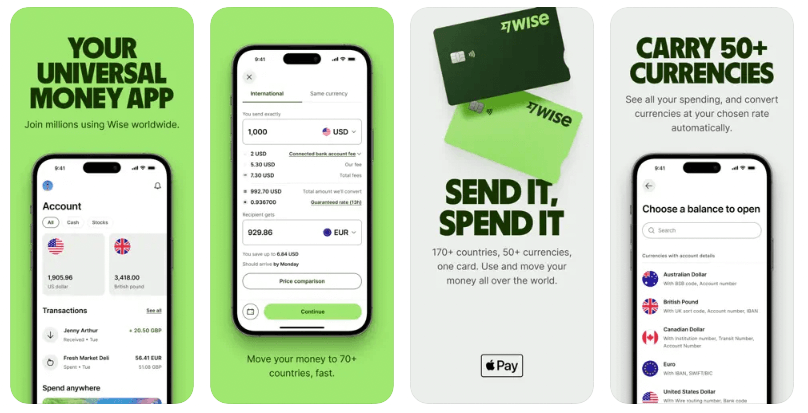

We know many people are looking for a fast and cheap way to send earnings out of China. Wise, founded in 2011, stands out for quality service and low fees as an international money transfer tool. With just a few taps or clicks, you can send and receive RMB in China or convert any other currency you require with the help of a Wise Multi-Currency Account.

Send money home using Wise today

Yes. At a local branch in the Chinese city you live in, foreign nationals holding a valid passport and a residence permit in China may apply for Bank of China City Card², Bank of China JCB Credit Card, Bank of China Globe-in-One Credit Card, Bank of China Great Wall RMB Credit Card, and also some other types of Bank of China credit card.

Bank of China credit card products can be categorized as follows³:

Here below are three types of Bank of China credit cards that are available for foreigners to apply for. Please call the local Bank of China hotline for information on card fees, overdraft fees, cash out fees, and interest rates.

Best for:

* Chinese nationals with consistent, legal income who are at least 18 years old and fully capable of acting civilly

* Foreigners with valid passport or Residence Permit in China

* Taiwanese, Macau, and Hong Kong citizens

Key features and benefits:

Best for:

* Chinese nationals with consistent, legal income who are at least 18 years old and fully capable of acting with civility.

* Foreigners with valid passport or Residence Permit in China

* Taiwanese, Macau, and Hong Kong citizens

Key features and benefits:

Best for:

* Chinese nationals with consistent, legal income who are at least 18 years old and fully capable of acting civilly

* Foreigners with valid passport or Residence Permit in China

* Taiwanese, Macau, and Hong Kong citizens

Key features and benefits:

From global money transfer to foreign currency holding and converting, Wise allows you to really manage your money in one place, and is available both online and through an app. Transfer money out of China -- there are 160+ countries you can choose to send to. Wise doesn’t make profit with the exchange rate. Instead, it uses the middle-market exchange rate to make sure the payee can receive more money.

Who needs to convert CNY money in China or any other currency in another country? A Wise multi-currency account not only helps you to receive and send money internationally, it gets for you the local currency. That’s why over 16 million people around the world have been using Wise since its foundation in 2011. Open a Wise account today and become one of the happy Wise users!

*This service is provided in partnership with a licensed third-party payment provider in China.

Source:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Everything about how to open a Shanghai Commercial Bank account, steps, required documents, charges and fees of deposit, international transfers