Compare Revolut Alternatives in Australia: Features and Fees

Compare Revolut and its alternatives in Australia on features and fees to find the best multi-currency account for your needs.

If you’re an Australian citizen or resident who frequently travels abroad for work or pleasure, you’ll know just how vital it is to find an inexpensive and easy money solution while overseas.

Whether for a long weekend in New Zealand, a winter escape to Hawaii, or a lifetime trip through Asia or Europe, the Wise card can help you effortlessly access your money and make it go further. Read on for all you need to know about using a Wise card abroad, including features, fees, and how to order.

| Table of contents |

|---|

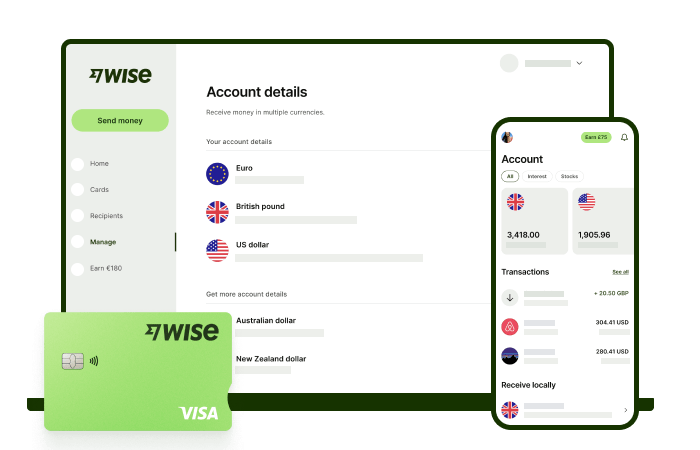

The Wise card is a multi-currency debit card that provides a simple way to save up to 7x when spending internationally. With no foreign transaction fees and low, transparent pricing, Wise typically offers the best value for your money. You can load, hold, and convert 40+ currencies at the mid-market exchange rate—the same one you see on Google.

Add money to your account in AUD and instantly convert it to popular currencies like USD, EUR, GBP, or NZD, as well as many others. This enables you to spend with no further fees as long as you have the balance to cover your purchase.

What you can do with the Wise card:

- Spend in 150+ countries: Use your card globally in 40+ currencies with no foreign transaction fees.

- Convert at the mid-market rate: Get the mid-market rate for every transaction.

- Withdraw cash abroad: Make up to 2 ATM withdrawals per month (up to a total of 350 AUD) for free.

- Free digital cards: Generate free digital cards to add to Google Pay or Apple Pay for secure online and contactless spending.

Ordering a Wise card in Australia is quick and straightforward, involving only a few simple steps:

The Wise card allows you to spend and withdraw funds easily while overseas. You can use it at ATMs, for EFTPOS transactions, for online payments, and for contactless mobile payments wherever the facility is enabled.

There are two ways to manage your holiday spending. You can top up your account in AUD and convert to your destination's currency whenever the rates are favourable. You can even set up a rate tracker in the Wise app to notify you when the exchange rate hits your target.

If you haven't converted in advance, you can let our Smart Conversion technology handle it for you. The Wise card will automatically draw from the relevant currency balance or convert the amount on the spot at the mid-market rate from the balance with the lowest available fee. To ensure you get the best value, always choose to be charged in the local currency (e.g., USD in the US) and let Wise handle the conversion for you.

The Wise Australia card can be used in more than 150+ countries globally; however, it is important to note that there are some countries where it won’t work. These are:

|

|

This list may change, so we recommend checking this guide for the most up-to-date information prior to travel.

Here are the most important Wise card fees – you can get a more detailed rundown on the Wise Australia pricing page.

| Service | Wise Card Australia fees¹ |

|---|---|

| Order a physical Wise card | 10 AUD |

| Wise digital card | No fee |

| Monthly/Annual fee | No fee |

| Spend a currency you hold in your balance | No fee |

| Currency conversion when spending a currency you don’t hold or when converting between currencies | From 0.63% (varies by currency) |

| International ATM withdrawals | 2 withdrawals to the value of 350 AUD/month free*, 1.75% of transaction amount + AUD$1.50 per transaction thereafter |

| Replace a lost or damaged Wise card | 6 AUD |

| Replace an expiring Wise card | No fee |

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

Offering transparent currency conversions, Wise utilises the mid-market exchange rate.

The mid-market exchange rate is the midpoint between the bid (buying) and ask (selling) prices of two currencies in the foreign exchange market. It reflects the value of one currency relative to another at a given moment, without any added profit margins, fees, or markups. To ensure the mid-market exchange rate is applied when using your Wise card, you’ll have to select to pay or withdraw in the local currency and prevent dynamic currency conversion.

You can use your Wise multi-currency account to convert your balance to the currencies you need ahead of time; however, if you need to spend in a currency you don’t have, the Smart Conversion technology will automatically convert sourcing from a currency balance that will have the lowest conversion fee.

Just like most debit and credit cards, some spending limits apply to your Wise Australia card. Below are the Wise card spending limits for Australia.

| Monthly spending limit | Monthly ATM withdrawal limit |

|---|---|

| AUD$52,500 | AUD$7,000 |

To make changes to your Wise card’s specific payment type spending limits (contactless, swipe, etc.), you can use the Wise app or log in online. Within either platform, simply select ‘Limits’ from the landing page and follow the prompts. Once saved, these changes apply immediately.

Opting to reduce your payment limits can help to prevent high-sum fraudulent transactions from occurring if the card is stolen or if skimming technology is used to steal its details.

Yes. Safety is incredibly important at Wise. In Australia, it is regulated by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services Licence (AFSL number 513764).

To comply with global regulations and keep customers and their money safe, all deposits are safeguarded at leading banks – and Wise has 24/7 automatic and manual anti-fraud measures in place to identify and prevent suspicious activity.

Here’s a quick look at what you can expect:

Whether due to loss, theft, or simply a desire to increase your account safety when not in use, you can easily freeze and unfreeze your card as needed.

Using the Wise app or website, you just click or tap on ‘Card’ and select ‘Freeze Card’. To reverse, simply follow the same process and select or tap ‘Unfreeze Card’.

To speak with Wise about your account or using your Wise card, you can contact them online or visit their help desk for answers to frequently asked questions.

If you’re looking for a flexible account that is great for daily spending in Australia and overseas, the Wise Account is worth a look. The Wise account is an easy way to save up to 5x when you send, spend, and withdraw money internationally. Hold and manage 40+ currencies, including AUD, USD, EUR, and more. All you need to do is sign up for a free account to get started, there's no monthly fees either.

You can exchange currencies at the mid-market rate on every conversion — basically the rate you see on Google. And with zero foreign transaction fees, and low, transparent pricing, Wise usually gives you the best value for your money. You can activate Wise Interest to earn returns* on your eligible balances while keeping your money available to spend.

You'll get 8+ local account details in AUD and a selection of other global currencies to get paid conveniently to your Wise account. And when it's time to send money abroad , enjoy fast, low-cost transfers to 140+ countries. Plus, you can get a linked Wise debit card for spending internationally at the same great mid-market rate.

When it comes to managing money globally, the Wise account is a handy tool that makes it easier and simpler.

*'Interest' is a custody and nominee service offered through Wise Australia Investments Pty Ltd. Growth is not guaranteed. Capital at risk.

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you. Savings claim based on our rates vs. selected Australian banks and other similar providers in Jan 2025. To learn more please visit https://wise.com/au/compare

Please see Terms of Use and product availability for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Explore Wise Interest to earn potential returns on your AUD and USD*

Your money is invested in a fund of government-backed securities—without being locked away. So, you can still spend your money as usual while it has the opportunity to grow.

* Wise Interest is a custody and nominee service offered through Wise Australia Investments Pty Ltd (ACN 659 961 083) (AFSL: 545411). Franklin Templeton is the issuer and manager of the Franklin Government Cash Fund. Capital at risk. Growth not guaranteed. Terms and conditions apply. Please refer to the Wise Australia Interest Legal page for Wise Australia Investment's Financial Services Guide and the fund's Product Disclosure Statement to see if this product is right for you.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Compare Revolut and its alternatives in Australia on features and fees to find the best multi-currency account for your needs.

Does your Bankwest credit card have travel insurance? Discover which cards still offer complimentary cover, the activation rules, and what it covers.

Thinking about buying US shares? Learn how to invest in the US market from Australia, from choosing a broker to managing tax.

How to make money online and from home in Australia: For beginners, students and more

Guide to the best trading platforms in Australia for beginners. Compare top providers on fees and features to find the right platform for you.

Looking for the best credit card for Krisflyer points in Australia? We’ve compared the top cards across key factors like earn rates, fees, and more.