AMP business account: Guide on features and benefits

Learn about AMB business account, their features and fees for transactions. More on how to open an AMP account online. Read here

Businesses of all types in Australia are always looking for ways to save money on financial transactions. Many financial institutions, on and offline, offer business accounts. It’s hard to know which one to choose.

We’re going to compare the Payoneer business account with the Wise Business Account. Let’s get in.

| Table of contents |

|---|

Founded in New York City in 2005, Payoneer offers a business multi-currency account for receiving payments, holding and sending payments globally. Its business clients range from freelancers to aspiring entrepreneurs to leading digital brands.1

| 👆Read here to know more about the Payoneer account for businesses |

|---|

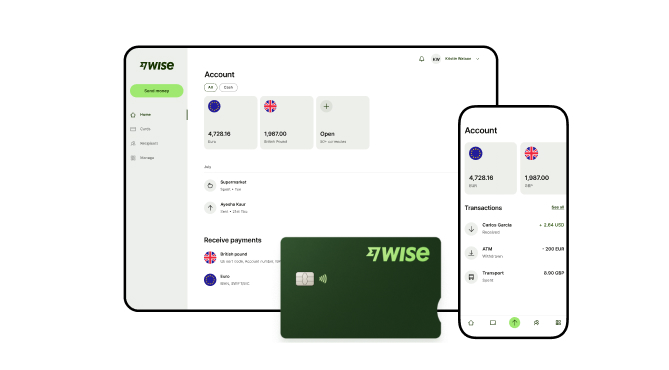

Wise, formerly known as Wise, was founded in 2011. Wise offers financial services to handle your international finances. From international transfers to holding money in multiple currencies, Wise also offers customers personal and business debit card access.

When choosing a business account, it’s the features that align with your daily operations that need to be considered.

| Service | Payoneer2 | Wise Business |

|---|---|---|

| Online sign-up | Yes | Yes |

| Local and international account details | Account details in 9 currencies3 | Account details in 8+ currencies |

| Foreign Exchange (FX) services | Yes | Yes |

| Physical and/or virtual business cards | Physical and virtual debit Mastercard | Physical and virtual debit Mastercard |

| Online payment function | Yes | Yes |

| Direct debits, recurring payments, batch payments | Direct debits are available Recurring payments are only available for businesses registered in the US | Yes |

| API integrations, accounting software, online financial management | Xero premium Quickbooks integration is available for UK and the EEA with other countries to follow soon7 | N26, Monzo, Xero, QuickBooks, Zoho Books, FreeAgent, Bonsai, Odoo + others (region dependent) |

| Mobile / Web App | Yes | Yes |

As seen on 3 February, 2026

They both have very similar business offerings. They differ slightly in the local account details and API integrations, where Wise has more options.

Here are the numerous ways Payoneer and Wise can receive and pay out funds.

| Payoneer3 | Wise | |

|---|---|---|

| Pay in options |

|

|

| Pay out options |

|

|

| As seen on 3 February, 2026 |

Wise and Payoneer both have a broad range of pay in options. They can also transfer to each other via local account details.

Local currency accounts and supported countries and currencies differ per provider. Here’s what Payoneer and Wise have:

| Payoneer | Wise | |

|---|---|---|

| Local currency account details (So you can receive in locally denominated currency) | AUD, USD, JPY, EUR, HKD, SGD, CAD, GBP, AED3 | AUD, NZD, SGD, USD, CAD, EUR, GBP, HKD, HUF |

| Currencies supported to send and convert transfers in | 190+ countries3 | 140+ countries and in 40+ currencies See the list here |

As seen on 3 February 2026

Wise has 2 different local currency accounts, but Payoneer has a larger number of supported countries to send transfers to.

Speed is extremely important when sending money internationally. Here’s what they both can offer:

Payoneer

Payoneer states that payments from Payoneer to Payoneer accounts appear within 2 hours. Payments to supplier bank accounts are 1–3 business days.3

Withdrawal to your nominated account can take 3-5 business days.6

Wise Business

Most of the time, transfers should take 1-2 working days. The speed depends on the currency route and payment method chosen. In some cases, Wise international transfers happen within seconds.

| 👆Note: The speed of transaction claim depends on funds availability, approval by Wise’s proprietary verification system and systems availability of our partners’ banking system, and may not be available for all transactions. |

|---|

Payoneer Australia PTY LTD (ACN 621 926 501) and is regulated by the Australian Securities and Investments Commission (ASIC) under the Australian Financial Services License number 504803.1

Wise meets the specific requirements set out by each country where it operates. In Australia, Wise is supervised by ASIC under Australian Financial Services Licence (AFSL licence number 513764) and authorised as a Purchased Payment Facility (PPF) provider by the Australian Prudential Regulation Authority (APRA).

Wise has dedicated compliance teams and systems working 24/7 to keep our customers’ money safe.

The main difference between financial providers is in the fees they charge. Here is the breakdown of the main fees charged by Payoneer and Wise in Australia.

| Service | Payoneer4 | Wise Business |

|---|---|---|

| Account opening fee | Free | Free to open an account for sending money One time 65 AUD fee for local account details in 8+ currencies |

| International transfer fees - receiving | Free Payoneer to Payoneer Free to your receiving accounts except: ACH bank debit by clients 1% Credit card by your clients 3.99% | Free Wise to Wise No fees for receiving payments into your Wise local account details except: $6.11 USD to receive USD via SWIFT or wire transfer into your USD |

| International transfer fees | Free Payoneer to Payoneer Up to 1% of the transaction amount Fixed fee of 1.50 - EUR/GBP/USD When you use your EUR, GBP or USD to make a payment to someone whose bank account:

| From 0.63% for sending Fixed fees for receiving. Find out here) |

| ATM Fees - Withdrawals | Based on the currency being withdrawn: 3.15 USD, 2.50 EUR, 1.95 GBP + up to 3.5% of the withdrawn amount | Free for two withdrawals collectively up to $350 AUD per month each card 1.75% + $1.50 AUD per withdrawal over the $350 per month limit |

As seen on 3 February 2026

Both companies are extremely transparent with their fees upfront. However, Payoneer has a few extra levels of charges based on transaction type and currencies.

You can obtain exchange rates from several places. Here’s how Payoneer and Wise get theirs.

| Payoneer5 | Wise |

|---|---|

| Based on wholesale market rates along with a 0.5% currency conversion fee | No margin. The FX is based on the mid-market rate like the one you’d see on XE or Google. |

As seen on 3 February 2026

Knowing what rate is used to convert your currencies is vital. Both companies make these rates available at the time of the transaction.

The difference is that Wise uses the transparent mid-market rate which you can easily confirm. Payoneer uses wholesale market rates that they source from various places.

Which one is the right choice for your Australian business needs? These pros and cons will help:

Pros

Cons

Pros

Cons

Here’s what Australia has to say about both Payoneer and Wise.

| Payoneer reviews8 | Wise reviews9 |

|---|---|

| Trustpilot Australia review: 3.7/5 star rating with around 62,400 reviews and 5 stars from more than 70%. | Trustpilot rating: Excellent 4.3 out of 5 stars from +230,000 reviews |

| As seen on 3 February 2026 |

Wise has a slightly higher score than Payoneer and considerably more reviews.

Payoneer and Wise have similar product offerings for Australian businesses. When deciding between the two, the decision is up to you, but consider these things:

Both offer multi-currency accounts that can receive, hold and send funds.Debit cards are also offered by both and can be used globally wherever Mastercard is accepted.

The differences are in the fees charged, and the countries offered to send payments.

Wise Business currently offers more local currency accounts than Payoneer. Wise and Payoneer compliment each other. Link your Wise account to Payoneer and then exchange money at the mid market rate.

Internal transfer speed is similar with both. Payoneer to Payroneer can take up to 2 hours, and Wise can do some of its own in seconds. The rest range from hours to a few days.

Wise’s fees are slightly lower and easier to understand. Payoneer currently supports payments to more countries.

Expanding a business internationally often introduces complexities with foreign exchange and multiple account management.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

**Capital at risk, growth not guaranteed. Interest is the name of a custody and nominee service provided by Wise Australia Investments Pty Ltd in partnership with Franklin Templeton.

Sources:

Sources checked on: 3 February 2026

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about AMB business account, their features and fees for transactions. More on how to open an AMP account online. Read here

Explore all of BankSA’s business account and finance solutions with a full run down of features, fees, and what you’ll need to do to sign up.

Check out our guide on the top business foreign currency accounts if you’re an Australian business looking to expand overseas.

Learn more about the requirements to open a Wise Business account in Australia. Discover what documents you need and how to set up your own account online.

Learn how the OFX business account works, its features, and how it compares to other international payments solutions. Find out more here!

Discover the best small business bank accounts in Australia for 2025. Compare fees, features, and benefits to find the perfect solution for your business.