Money Travels Review Australia: Fees, Limits, and How It Works

Planning an international transfer? Our Money Travels review covers everything from fees, exchange rates, and safety to help you decide if it's right for you.

Does moving money overseas really have to be so complicated? Every bank has its own processes, requirements and fees. It’s enough to make your head spin.

The best way to simplify international transfers is to know how they work for your bank. This guide will not only tell you about how to make an NAB transfer, but how you can likely save money by using Wise for your international transfers.

| Provider | Fees | Exchange rate | Total Cost |

|---|---|---|---|

| NAB | $30 | Exchange rate + markup | $30 + Exchange rate markup |

| Wise | $6.95 | The real exchange rate you see on Google | $6.95 |

Open your free Wise account now

Regardless, though, read on to learn everything you need to know about making an international money transfer to or from Australia’s National Australia Bank (NAB).

| Outward International payments | NAB Fees |

|---|---|

| International money transfer via NAB Internet Banking (in foreign currency) | A$ 10 ⁺ |

| International money transfer via NAB Internet Banking (in Australian dollars) | A$ 30 ⁺⁺ |

| Banker assisted | A$ 30 |

| Requested by email or fax – email and fax written instructions will only be acted on where an Email/Fax Authority is held | A$ 35 |

| Request for cancellation of international money transfer - any cancellation request will be subject to the agreement of the beneficiary, whether that beneficiary is the intended beneficiary or not | A$ 20 ⁺ |

⁺ Any overseas bank charges incurred will be charged to the customer.

⁺⁺ In most cases, NAB will pay overseas bank charges on your behalf. However, in some instances beyond NAB’s control, overseas banks will directly deduct these overseas bank charges from the money you send instead.

| Outward International payments | NAB Fees |

|---|---|

| Deposited to NAB account | Up to A$ 15 |

| Deposited to non-NAB account (NAB acting as intermediary) | Up to A$ 30 |

| Transfer of overseas currency received by NAB and transferred to another bank unconverted | Up to A$ 35 |

Checked as of 31 March, 2021

💵 Moving big money? Send over 20,000 GBP or equivalent within a month with Wise, and you'll get even lower fees - as low as 0.1% - for all your transfers that month. Whether it's one large transfer or multiple smaller ones in any of the global currencies we support, you can save more with Wise.

👉🏻 Learn more about large amount transfers with Wise

When you send or receive money in a currency that’s different from what’s used in your home bank account, usually either the recipient bank or an intermediary bank will convert it at an exchange rate of its choosing unless you agree upfront to send the foreign currency at the outset from NAB.

When banks convert money in an international transfer, that exchange rate quite often can be somewhere around 4-6% poorer than the mid-market rate you’d find if you Googled it. Which means your money is, essentially, worth less than if you were trading on international trade platforms. What that translates to in an international transfer is that, if you compare that exchange rate to the one you’d find in an online currency converter, you’ll find that the transfer recipient may actually receive quite a bit less in his or her home currency than what you might have expected.

(Source 1 Source 2 Source 3 31 March, 2021)

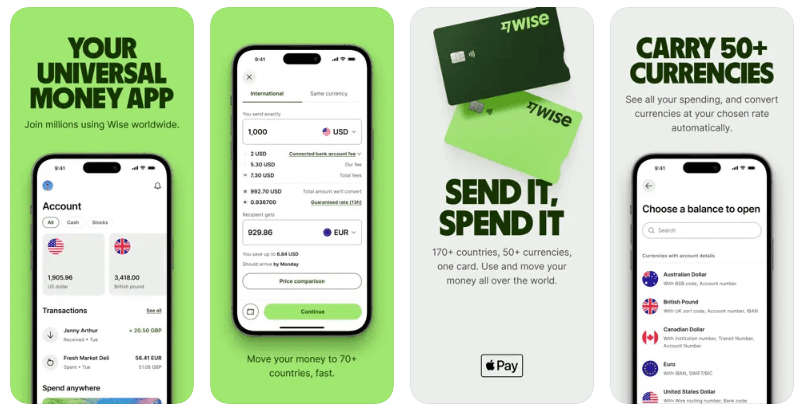

One alternative to using banks to make international money transfers is using Wise. Wise allows users to send money at the mid-market rate. And Wise charges a minimal transfer fee that’s spelled out upfront: 0.35-2.5% of the amount you’re sending, depending on the destination country. With Wise, money is moved using only local banks and local transfers, so your money never crosses borders. That means there are no international or intermediary bank fees involved. Ever.

(https://wise.com/au/account/)

(https://wise.com/au/account/)

Open your free Wise account now

Wise users can also create multi-currency accounts, which allow users to send, receive, hold and manage money in a number of different global currencies all at the same time, so there’s no money lost on unfavorable exchange rates. Not only that, if you live in one country but get paid in the UK, the US, the EU or Australia, you can also get local bank details so your money can be sent locally. And, beginning in 2018, borderless account holders will also be issued consumer debit cards.

Not convinced? Send money and see for yourself how easy it is at Wise. Or send half with NAB and half with Wise and see how much you end up with on the other end.

NAB offers a few ways to transfer money internationally:

NAB doesn’t offer international money transfers by phone.

Transferring money online is faster and, with NAB, it’s also cheaper, but you can also make an international transfer at an NAB branch. Just gather all the necessary information — see below for more on that — and tell the teller/cashier what you need.

To make an international transfer with NAB, you’ll need:

To receive an international money transfer to NAB, you’ll need to give the sender:

To find out your BSB and account number, you can log in to NAB internet banking or call 13 22 65.

Typically, international money transfers from NAB take 1-3 business days to process depending on the currencies and countries involved. Once you’ve set one up with NAB, the money will leave your account within 1 business day.

When you pay for an international transfer with NAB, both the transfer amount and the fees are both deducted from your bank account. You may also be able to note that you want to cover all of the fees involved, share them with the recipient, or have the recipient pay all of them. Check with NAB to see what your full options are.

NAB doesn’t currently offer a faster transfer for an extra fee.

Transfer times aren’t guaranteed and some countries and recipient banks may take longer to process international transfers.

NAB’s customer support has quite a few options for contact. The phone and email will depend on your location, however, so check their site for details.

Sending money overseas doesn’t have to be complicated or costly, if you know what you’re doing. Knowing your options for making international money transfers is the best way to choose the best one for you.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Planning an international transfer? Our Money Travels review covers everything from fees, exchange rates, and safety to help you decide if it's right for you.

Planning a large money transfer with ING Bank in Australia? Discover fees, daily limits, processing times, and alternatives.

Thinking of transferring money with Revolut? Our guide breaks down their money transfer fees, exchange rates, and limits.

If you’re looking for a way to send money abroad, especially to China, you may have come across Panda Remit. A relative newcomer among money transfer...

Planning a large money transfer with St. George Bank in Australia? Discover fees, daily limits, processing times, and alternatives.

Planning a large money transfer with Bankwest Bank in Australia? Discover fees, daily limits, processing times, and alternatives.