Commbank large amount transfers. How do they work

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Sending money overseas seems like it should be a simple process, right? Not necessarily. Every bank has different processes and requirements, and knowing them is the easiest way to make sure your transfer goes as smoothly as possible. Read on to learn everything you need to know about making an international money transfer (often called an IMT) to or from Australia’s Commonwealth Bank.

Commonwealth Bank offers a number of ways to transfer money internationally:

Commonwealth Bank doesn’t offer international money transfers by phone.

At a Commonwealth Bank branch, a teller will help you complete your transaction. Make sure you have all the information you need - more details on that later - and let the teller/cashier know what you need.

To make an international transfer with Commonwealth Bank, you’ll need:

To receive an international money transfer to Commonwealth Bank, you’ll need to give the sender:

You can log into NetBank to find this information, or visit a branch or call 13 2221.

International money transfers take 2-5 days to process, but can take longer depending on the recipient’s country and bank. If the transfer is initiated on a weekend, bank holiday or after the currency cut-off time, processing will begin on the following business day.

(Source 1 Source 2 13 October 2017)

Payment for an international transfer occurs automatically from your bank account. As the sender, you can choose to pay any overseas bank fees, which will be added to the transfer amount. Otherwise, the fees for the transfer will be deducted from the amount the recipient receives.

Commonwealth Bank doesn’t currently offer a faster transfer for an extra fee.

Transfer times aren’t guaranteed, and some countries and recipient banks may take longer to process international transfers.

| Commonwealth International Transfers | Regular Fees |

|---|---|

| Incoming international transfer | Up to A$11 to an AUD account, Up to A$11 to a foreign currency account, Up to A$25 to an AUD account at another bank, Up to A$35 to a foreign currency account at another bank |

| Outgoing international transfer | A$22 via NetBank, A$22 via CommBank app, A$30 at a bank branch |

| Additional fees may apply | See ‘Paying for correspondent bank processing fees’ and ‘Additional Fees’ sections for more information |

(Source 1 Source 2 31 March, 2021)

Sending or receiving money in a currency different than what’s used in your home bank account means that either the recipient bank or one of the intermediary banks will convert the currency at an exchange rate of its choice. That bank is likely to choose an exchange rate that’s poorer than the mid-market rate and keep a profit for itself. In general, that means the bank may take an average margin of 4-6% off of the exchange rate that you’ll find online on places like Google or with online currency converters.

What that means is that often the person receiving the transfer will receive an amount in his or her home currency that’s less than what the transferred amount is actually worth according to the rates you can find on Google, because of the exchange rate applied by one of the banks.

(Source 31 March, 2021)

International transfers are nearly always sent via the SWIFT network. What that means is that once the money leaves Commonwealth bank, there may be up to 3 intermediary banks involved in addition to the recipient bank. And normally each of the banks takes a chunk out of the money you’re sending. As such, Commonwealth bank, if you make your transfer in person at a branch or via CommBiz, gives you the option to pay those intermediary and receiving bank fees in some instances.

If you want to do that, to make sure your recipient gets the amount you intended, here are the intermediary/correspondent bank(s) fees you’ll need to pay depending on the country and the currency you want to reach the destination bank account.

| Additional Overseas Banks Fee ⁺ | Fees |

|---|---|

| EUR | A$33.00 |

| GBP | A$17.00 |

| NZD | A$17.00 |

| USD | A$37.00 |

⁺ This fee is waived when sending a cross currency IMT

(Source 31 March, 2021)

As noted previously, on top of likely poor exchange rates given by an intermediary or recipient bank, there will very likely be additional fees deducted from your amount along the way. So double check once your money arrives at its destination.

| Commonwealth International Transfers | Additional Fees |

|---|---|

| Sending/recipient bank and/or intermediary bank(s) | Commonwealth Bank notes, “overseas banks may deduct processing fees from the amount you transfer, which could result in the recipient receiving less than the amount you intend” |

| Tracing/investigating an international money transfer | A$25 per investigation |

| Changing details on an international money transfer | A$25 + overseas bank’s costs |

| Cancelling an international money transfer | A$25 + overseas bank’s costs |

(Source 1 Source 2 Source 3 31 March, 2021)

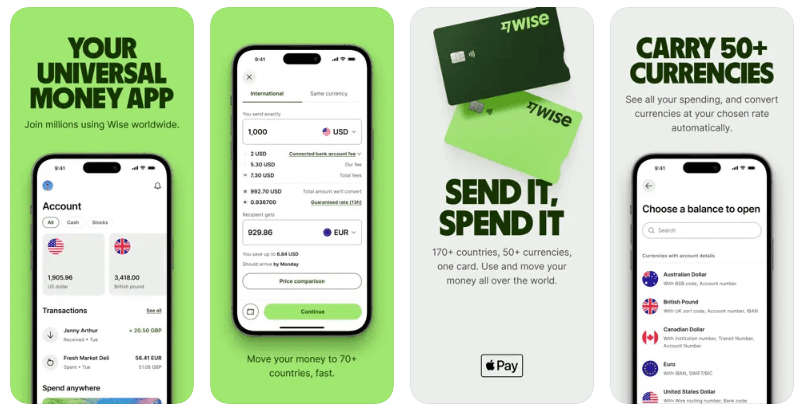

An alternative to making international bank transfers is Wise, which allows you to send money at the exact mid-market rate - the same rate you find on Google. The fees are also spelled out upfront. Minimal, fair transfer fees of 0.5-2.5% depending on your destination country. There’s no international nor intermediary bank fees because Wise moves money by only using local bank transfers. So money never crosses borders.

(https://wise.com/au/account/)

(https://wise.com/au/account/)

Open your free Wise account now

Wise also offers multi-currency accounts, which allow account holders to send, receive and manage money in a number of different global currencies all at once.

Send money and see for yourself how easy it is at Wise.

Commonwealth Bank’s customer support has quite a few options for contact. The phone and email will depend on your location, however. So check their site for details.

Sending money across international borders can be complicated and costly, but knowing the ins and outs means finding a way to send money at the lowest possible cost. Protect your money by educating yourself on the best ways to make international transfers, with Commonwealth Bank or through another avenue.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with ANZ, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with Westpac, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Check out our overview of the international transfer limits you get with the top Australia banks.

Learn about Rabobank Australia international transfers. How they work, the fees, exchange rates and timeframes

These days, there's a whole range of ways to receive money. From cash exchange, bank transfers, to online remittance services, getting money from someone is a...