Calls for price transparency

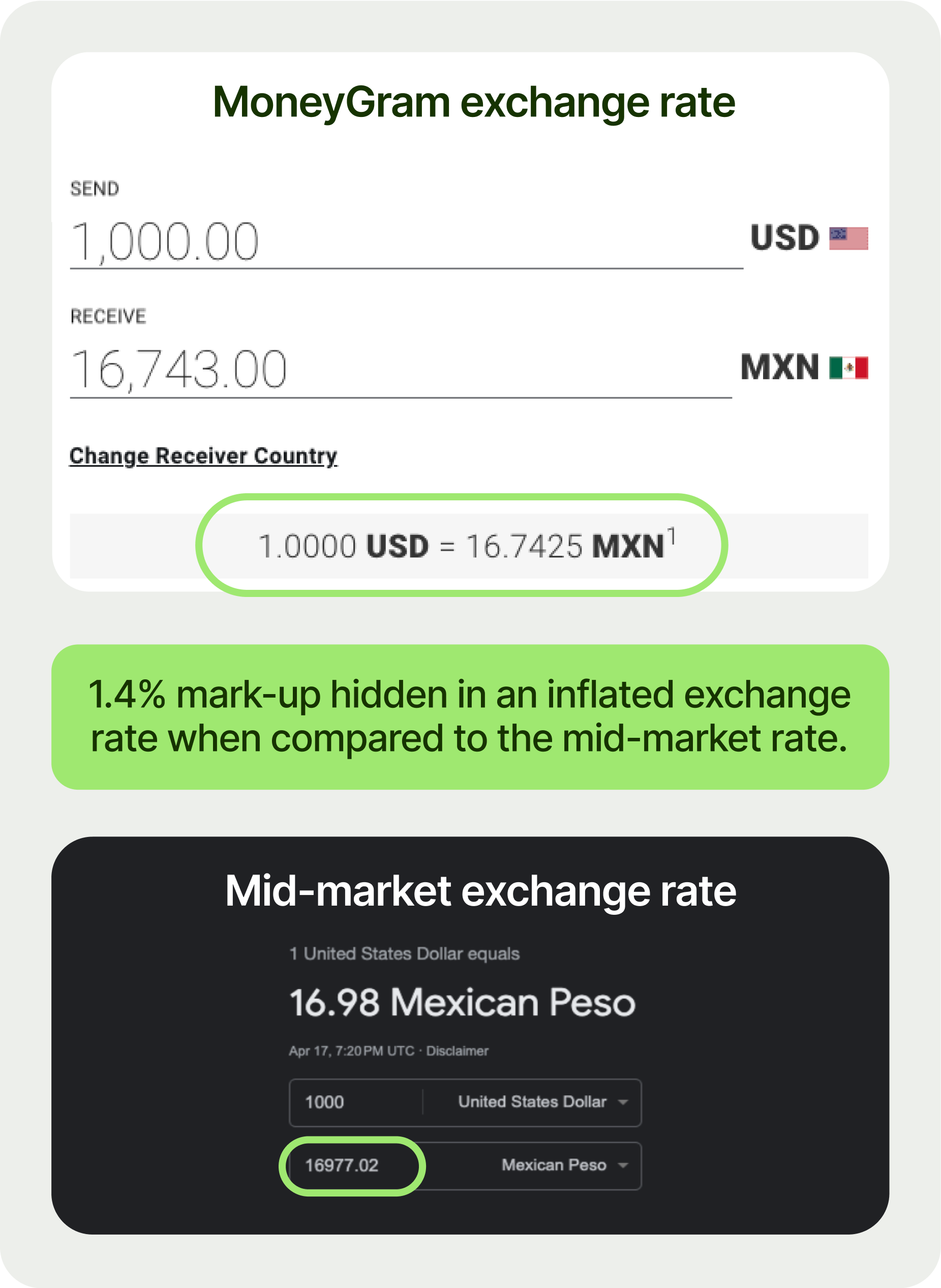

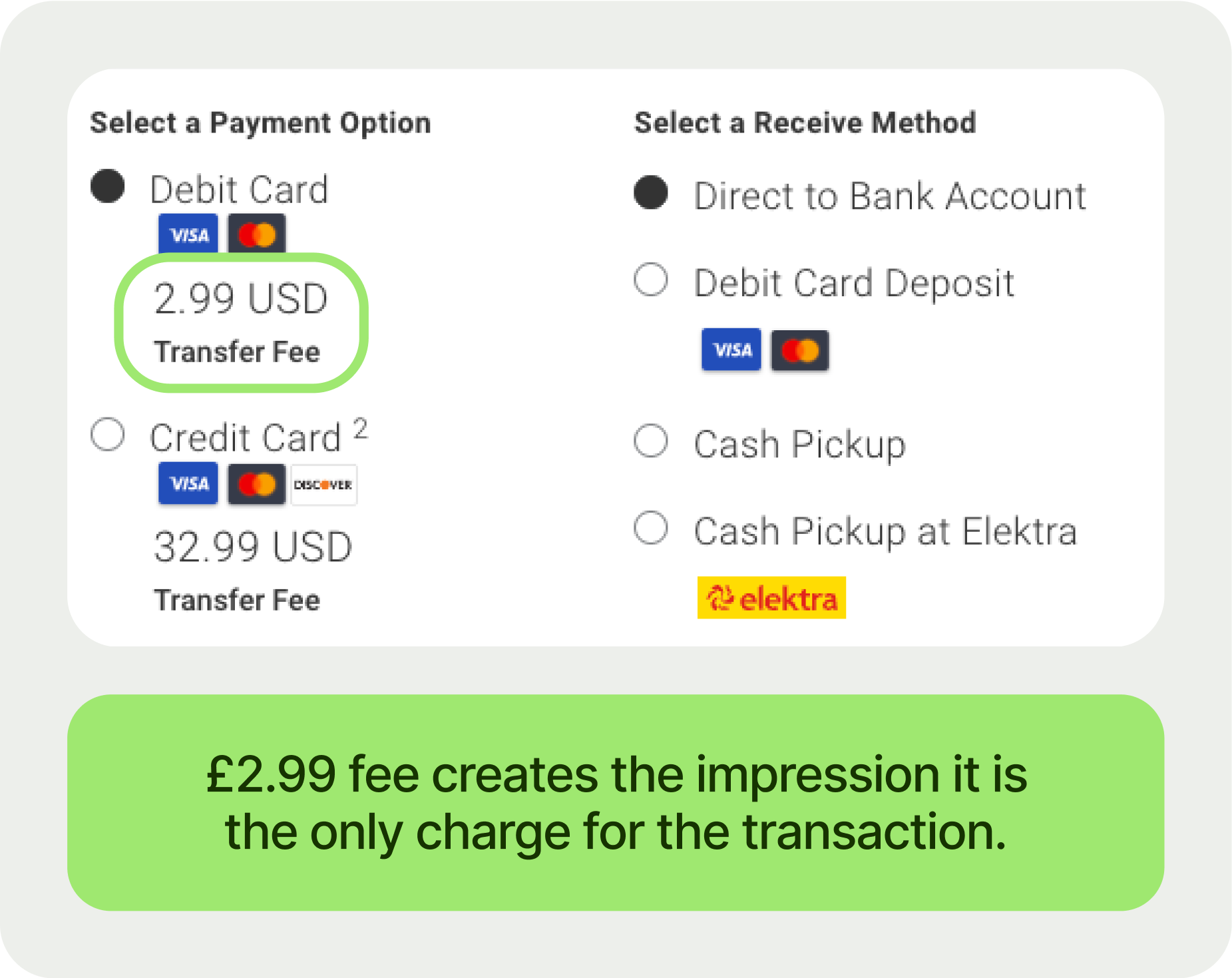

The vast majority (82%) of small business leaders surveyed either don’t believe that their bank is transparent about the costs of cross-border payments, or aren’t sure. '**'

To change this, a resounding 77%* of SMB leaders in the US agree that regulators and/or policymakers should ensure that financial services providers are honest and transparent about what they charge small businesses for international payments.

Even more (81%*) believe that financial services providers should proactively demonstrate honesty and price transparency on their own, without regulatory interventions.

There is a clear expectation that financial services are transparent and honest with their customers by default. Because, of course, that’s the right thing to do.

To create change, SMBs should be putting the pressure on their own financial providers to be clear on costs, and if they won’t, they should trust someone else with their hard-earned cash. Otherwise, financial providers can continue to get away with inflating exchange rates and putting more money in their own coffers.

Wise has been fighting for price transparency since our founding. It’s what keeps us ticking and makes us different. We’re so transparent that we’ll tell you when we’re not the cheapest provider, so that you can make the best decision for your business.

Compare providers here.