How to get mortgage for overseas property as an American

Learn all about different ways to get an overseas property mortgage as an American and gain unique insights to prepare yourself for the whole process.

A reverse mortgage is a popular way to free up cash later in life. You can borrow a sum of money from your property’s equity, without losing your home.

We’ll take a look at everything you need to know about reverse mortgages. How does a reverse mortgage work in Canada? What are the pros and cons of Canadian reverse mortgages?

We’ll also look at Wise – your international money transfer alternative. Spend, send, and receive your money across the globe in over 40 currencies. Let’s dive in!

In Canada, a reverse mortgage is a loan for homeowners aged 55 or older. You can borrow money from your home’s equity without selling the property – and you’ll typically get a tax-free lump sum in exchange.¹

Also known as equity release, you can borrow up to 55% of the appraised value of your home’s equity. You won’t pay your loan back until you move or sell – and you can use the money for whatever you want.²

There are a few different types of reverse mortgages in Canada. You’ll need to choose the right interest rate, mortgage provider, and loan type for you.

Some reverse mortgages use a fixed rate of interest. This means your interest rate will stay the same during your mortgage term. However, if you take out a variable-rate reverse mortgage, your interest may fluctuate.³

Reverse mortgage interest rates are typically higher than a regular mortgage – and you won’t have a traditional amortization period. This means your interest can accumulate indefinitely over time.⁴

You’ll also need to think about open vs closed reverse mortgages. Open mortgages usually have more flexible repayment terms.

For example, you may be able to make additional voluntary payments towards your debt. Make sure to speak to your lender about your prepayment options.⁵

So, exactly how does a reverse mortgage work in Canada?

You’ll need to apply for your mortgage through a bank or lender. Your provider can help you understand the value of your home and how much you can borrow.

When you take out a standard mortgage to buy property in Canada, you’ll pay off your full debt, plus any interest, in monthly increments.

For a reverse mortgage, however, you’ll receive a lump sum from your bank in exchange for equity in your home. You won’t have to pay back your loan each month – but the amount you owe will grow over time.

When you sell your property or die, the proceeds are used to pay off your reverse mortgage loan. You (or your beneficiaries) can keep any equity that’s left over.⁶

You’ll need to meet certain eligibility requirements to get your reverse mortgage:

- You’ll need to be a homeowner aged 55 or older

- The property must be your primary address

- Your home needs to be worth at least 250,000 CAD

You may also need to pay off any outstanding loans secured by your home – and your lender may require you to get independent legal advice.⁶

HomeEquity Bank and Equitable Bank® are 2 of the most popular Canadian reverse mortgage providers. These lenders offer a range of mortgage types for Canadian homeowners.

The HomeEquity CHIP Reverse Mortgage lets Canadian homeowners release up to 55% of their home’s equity. You won’t make payments until you sell your property – and you’ll get your loan as a lump sum.⁷

Equitable Bank also offers a range of reverse mortgage products, including Reverse Mortgage Flex, Reverse Mortgage Flex Plus, and Reverse Mortgage Flex Lite.⁸

You may be able to get your money as an advance or opt for recurring payments, but you’ll need to live in a city or large town in British Columbia, Alberta, Ontario, or Quebec to qualify.⁹

Your Canadian reverse mortgage rate will depend on your lender, but it should range from roughly 7% to 10%.¹⁰

Let’s take a closer look at HomeEquity Bank’s interest rates.

| Term | Interest rate | Annual Percentage Rate (APR) |

|---|---|---|

| Variable | 8.86% | 9.23% |

| 6 month | 8.04% | 8.38% |

| 1 year | 8.59% | 8.95% |

| 3 years | 7.79% | 8.12% |

| 5 years | 7.29% | 7.61%¹¹ |

You can access a range of mortgage types and rates at Equitable Bank. Let’s take a look at Equitable Bank’s Reverse Mortgage Flex interest rates.

| Term | Interest rate | Annual Percentage Rate (APR) |

|---|---|---|

| 6 month fixed | 7.94% | 9.543% |

| 1 year fixed | 8.09% | 8.761% |

| 2 year fixed | 7.74% | 7.994% |

| 3 year fixed | 7.19% | 7.323% |

| 5 year fixed | 6.59% | 6.634% |

| 5 year adjustable | P + 2.65% | 8.713% |

You may also need to pay setup fees for your reverse mortgage. For example, you’ll pay a 995 CAD setup fee for your Equitable Bank Reverse Mortgage Flex.⁸

It’s important to consider whether a reverse mortgage is the right choice for you. Let’s take a look at some reverse mortgage pros and cons in Canada.

| Pros | Cons |

|---|---|

| You won’t have to make regular loan payments | You’ll typically pay a higher interest rate, compared to a regular mortgage |

| You’ll still own your home – and you can spend your lump sum on whatever you want¹ | Your home equity may decrease as you accumulate interest¹ |

| You won’t pay tax on the money you borrow | Your estate will likely need to repay your reverse mortgage when you die¹ |

| You won’t have to pay the loan back until you sell your home or pass away¹² | You may have to pay setup fees, appraisal costs, and closing expenses for your mortgage¹⁰ |

There are a few key differences between reverse mortgages in the US vs Canada. Let’s take a look.

| Canada | US |

|---|---|

| You can apply for a reverse mortgage from age 55 | You can’t apply for a reverse mortgage until age 62¹³ |

| You can borrow up to 55% of your home’s current value | You’ll need to discuss how much you can borrow with your bank. You may need at least 50% equity in your home to qualify¹³ |

| In Canada, both spouses must meet the eligibility criteria¹⁴ | In the US, only one spouse needs to qualify¹⁴ |

| You’ll need to seek independent legal advice before you can get approval¹⁴ | You may be able to get your reverse mortgage without independent legal advice¹⁴ |

Now that we covered all the basics of a reverse mortgage in Canada, the only question left is: how to send money to pay for your property overseas?

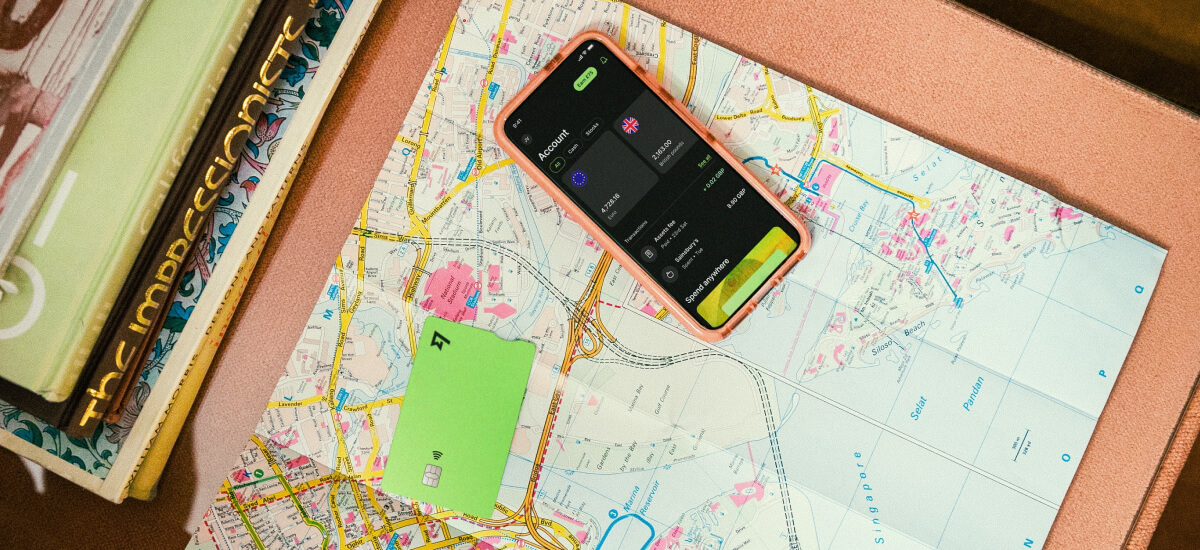

Wise offers you a quick, secure and transparent way of sending money to Canada. You get the mid-market exchange rate for your payments and see how much it’s charged for the transfer before sending the money from your bank.

With the Wise Account you can also hold 40+ currencies, spend money in 150+ countries, and receive like a local in 9 different currencies.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

Let’s take a look at how to get your reverse mortgage in Canada – a step-by-step guide for Americans.

Step 1. First, you’ll need to explore your options. Compare lenders and look into how much money you can qualify for

Step 2. Apply for your reverse mortgage. Your lender will ask for your personal information and you’ll need to give your bank permission to run a credit score

Step 3. Next, your lender will help you organize a property appraisal. This will determine your property’s value and how much you can borrow

Step 4. Submit a few documents to support your application, such as property tax statements, bank statements, and identity verification

Step 5. Next, you’ll need to sign a commitment from your lender. This will include your loan amount, interest rate, and term. You’ll also need to get independent legal advice for your reverse mortgage

Step 6. Finally, you’ll need to sign your reverse mortgage and pick a closing day. Once all the paperwork has gone through, you’ll get your funds¹⁵

These steps may differ depending on your background, finances, and individual circumstances. Consult a lawyer or real estate professional for further advice.

Unlike a traditional mortgage, you won’t need to make regular payments towards your reverse mortgage loan.

Instead, you’ll repay the debt when you sell your home or die. However, you may be able to make voluntary payments towards your loan.

You’ll need to speak to your lender about your repayment schedule. Some banks will let you pay off your reverse mortgage early, but you may need to pay a fee.¹

CHIP® is a reverse mortgage product offered by HomeEquity Bank®. You can secure your debt against the value of your home and receive a lump sum towards retirement living costs, for example.⁷

Yes, you can get a mortgage to buy property in Canada as an American.

However, there are a few requirements. You may need to open a Canadian bank account – and you’ll need to meet your bank’s strict eligibility criteria.

Reverse mortgages can be risky. You could end up accumulating a large amount of interest on your loan – and your beneficiaries may need to pay off your debt.

You may also lose equity in your home. Make sure to seek independent financial and legal advice before applying for a reverse mortgage.

No, you won’t lose your home. A reverse mortgage lets you borrow up to 55% of your home’s equity, without losing control of the property.

This means you’ll still own your house, but you’ll need to pay back the loan if you ever sell it or move out.

A reverse mortgage is a popular way for Canadians to borrow money later in life. You can use the loan for whatever you want, but it’s important to think carefully.

Consult a lawyer for support and research interest rates before applying for a reverse mortgage on your home.

Moving abroad? Use Wise to send and spend your money in the US, Canada, and further afield – all from one digital account!

Sources

Sources checked 11.07.2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn all about different ways to get an overseas property mortgage as an American and gain unique insights to prepare yourself for the whole process.

Get a full overview of the best property management software systems for small landlords to easily track and manage their overseas property.

How to buy your first rental property overseas? Here's a detailed guide that can help you understand the challenges and steps for making an investment.

What are the best property management software systems for managing student housing? Take a look at our list and choose the most suitable option for you.

Are you thinking about making smart property investment decisions and wondering how rental yield is calculated? Have a look at our guide to find out.

Have a look at the in-depth guide on the Singapore rental yield market and get a detailed breakdown of opportunities in different areas within the country.