Can Singaporeans buy property in Thailand - All you need to know

Buying property in Thailand as a Singaporean? Learn more about how to buy, where to buy, restrictions and requirements.

If you’re thinking of investing with Saxo Markets in Singapore, one of the first things to check out is the cost. There can be a number of fees and charges associated with investing, and they’re not always easy to get to grips with.

In this guide, we’ll run through all of the essential Saxo Markets commission fees you need to know - for everything from stocks and ETFs to bonds and futures. Plus, how much it’ll cost you to withdraw your money from the online trading platform.

Lastly, we’ll show you how the Wise multi-currency account can help you save on transfer fees and currency conversion when trading internationally.

But first, let’s do a quick review covering the basics about the platform.

Saxo Markets is a Danish bank which specialises in global online trading and investment. It’s fully regulated and licensed, adhering to stringent regulatory requirements in 15 jurisdictions - including Singapore.

Saxo offers access to over 60,000 financial products, across a number of asset classes and markets. This makes it a popular choice for investors looking to build a diversified portfolio. The company claims to have over 850,000 clients worldwide, with more than 270,000 trades worth USD 20 billion taking place every day.

Saxo commission fees vary depending on what plan you’re signed up to. Each plan comes with a monthly fee, and the more expensive plans generally offer lower commission and other costs.

And the more you pay for your monthly plan, the more benefits you’ll get - including waived custody fees, commission credits and real-time price data for an expanded range of stocks.

Here are the Saxo Markets plans you can choose from:

| Plan | Monthly fee² |

|---|---|

| Bronze | Free |

| Silver | SGD 5 |

| Gold | SGD 15 |

| Platinum | SGD 45 |

| Diamond | SGD 145 |

*Fees correct at the time of research

There is also the option to have the monthly fee waived, through the earning of Saxo Rewards points. You can earn these by funding your account and trading, until you’ve earned at least 5,000 points within the month (to waive the fee on the Silver plan)².

Current plan not working out for you? You can change plans with Saxo Markets whenever you like. Upgrading your plan happens immediately, and your monthly fee will be calculated using the number of days you’ve been on each plan².

The charging structure for trading on Saxo Markets all depends on the investment product, as well as the Saxo plan you’re on. We’ll run through all of the relevant commission charges for stocks/ETFs, bonds and futures here.

Saxo’s commission fees for stocks and ETFs varies depending on the exchange. Take a look below to see the range of charges for three major markets - US/North America, Europe/Middle East/Africa and Asia/Pacific.

Remember that the lowest fees given here will usually be reserved for investors on Saxo Market’s Diamond plan (costing SGD 145 a month), while those on the free Bronze plan can expect to pay more in commission.

| Exchange | Saxo Markets commission costs (depending on plan)³ |

|---|---|

| US and North America | 0.015% to 0.06% |

| Europe/Middle East/Africa | 0.05% to 0.30% |

| Asia/Pacific | 0.03% to 0.20% |

*Fees correct at the time of research

At Saxo Markets, commission fees for bonds depend on both your plan and the Bond type. Here’s the range of charges you can expect, for both online and offline trading.

| Online/offline trading | Saxo Markets commission costs (depending on Bond type and plan)⁴ |

|---|---|

| Online trading | 0.05% to 0.20% |

| Offline trading | 0.05% to 0.20% |

*Fees correct at the time of research

As with all other investment products at Saxo Markets, you’ll pay a commission fee for online traded contracts based on your plan. However, fees are also based on the currency.

We’ve listed a selection of major currencies below, including the range of fees for each trade (buy, sell or at expiry). It’s important to remember though that these fees don’t include exchange fees⁵.

| Currency | Saxo Markets commission costs per trade (depending on plan)⁵ |

|---|---|

| USD | USD 1.25 to USD 6 |

| SGD | SGD 2 to SGD 7 |

| GBP | GBP 1 to GBP 5 |

| EUR | EUR 1 to EUR 6 |

| JPY | JPY 700 to JPY 1000 |

| AUD | AUD 1 to AUD 10 |

| HKD | HKD 10 to HKD 30 |

*Fees correct at the time of research

Another crucial thing to know before choosing an investment platform is how much it’ll charge you to withdraw your money.

The good news is that Saxo Markets doesn’t charge a withdrawal fee⁶, but there’s one important condition.

It’s only free to withdraw money if you use the Online Cash Withdrawal Module. If you have access to this but use the manual Funds Withdrawal Form, you’ll have to pay a processing fee of SGD 50⁶.

When you trade or invest internationally, it makes sense to do your homework on currency conversion and exchange rates.

All trading costs, plus profits and losses, on Saxo Markets are subject to the platform’s currency conversion rates. This can have a significant impact on how much it costs you to use Saxo, so you should always factor these in.

Saxo Market’s currency conversion fees are based on the mid-market exchange rate at the time⁷, plus an additional fee:

| Transaction/product | Currency conversion rate (depending on plan)⁷ |

|---|---|

| Account transfers | 0.30% |

| FX options | 0.10% |

| Cash products | 0.375% to 0.75% |

| Margin products | 0.375% to 0.75% |

*Fees correct at the time of research

| ❗ Read more below how to avoid high conversion fees by using a Wise account when trading in foreign currencies ↓ |

|---|

You can find the full list of Saxo Markets fees for Singapore here, including carrying costs, reporting fees, manual order fees and more.

No, Saxo Markets doesn’t charge an inactivity fee for investors in Singapore⁸.

If you fund your Saxo Markets using your bank and want to trade in foreign markets, you could find that you’re losing money to high transfer fees and poor exchange rates. The same goes for receiving profits in other currencies, which your bank then converts back into SGD.

Luckily, there’s a convenient, money-saving alternative available - Wise.

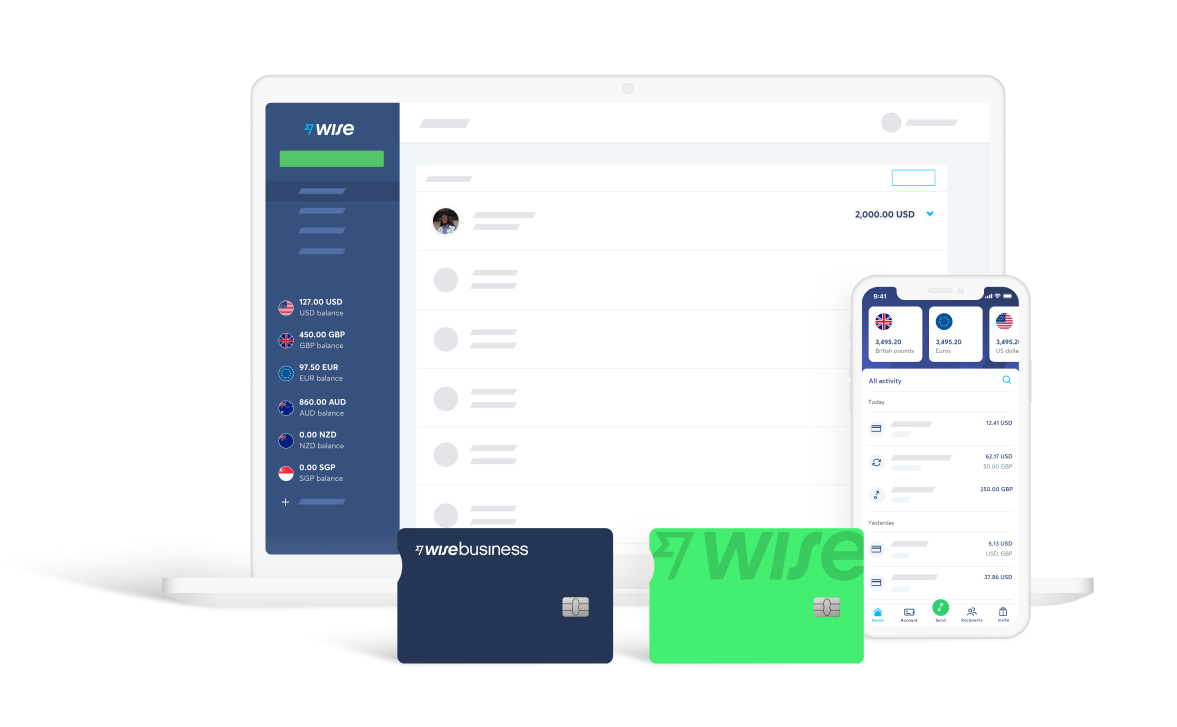

Open a Wise multi-currency account and you’ll be able to send money internationally for low transparent fees and the real mid-market rate. You can carry out transactions in 50+ currencies, and can send and convert funds for investing at the mid-market rate.

Best of all, you’ll get local bank account details for 9 currencies, including USD, EUR, SGD and GBP. This means you can withdraw your trading profits to your chosen local account without paying any international transfer fees.

For example, you can trade in the US stock market and use your Wise US account to receive your profits. If you need to convert back to SGD, you can do it at the mid-market rate - so you won’t lose out to unfavourable exchange rates.

See how much you can save with the Wise multi-currency account, today.

Sources used for this article:

Sources checked on 29.062022.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Buying property in Thailand as a Singaporean? Learn more about how to buy, where to buy, restrictions and requirements.

Want to transfer money from YouTrip to your bank account? Find out how to withdraw money directly from your YouTrip balance.

Buying property in China as a Singaporean? Learn more about how to buy, where to buy, restrictions and requirements.

Learn more about the GXS Debit Card including its requirements, eligibility, fees and more.

Looking for the best USD accounts in Singapore? Read more here about what USD accounts can you open in Singapore

Whether you have a business and receive money from abroad or you make personal money transfers, we covered 6 best PayPal alternatives in Singapore