Which is the Best Trading Platform in Singapore? A Beginner's Guide

Looking to start trading? Check out our guide which compares top platforms like Moomoo, Tiger Brokers, and more to help you start investing

You’ll be asked for a proof of address when you open a bank account, get a mobile phone contract or sign up for anything like insurance. But what proof of address is usually acceptable in Singapore?

This guide covers the proof of residence documents which are commonly required in Singapore, and also dives deeper into the options for proof of address for foreigners, and the specific documents accepted by Singapore’s biggest bank - DBS. We’ll also introduce the multi-currency account from Wise - as a more flexible way to manage your money, even if you don’t have a Singapore residential address.

Sending money overseas with Singapore’s big banks is expensive. Costs can be confusing, and you may not know all the fees that apply until the payment has been confirmed.

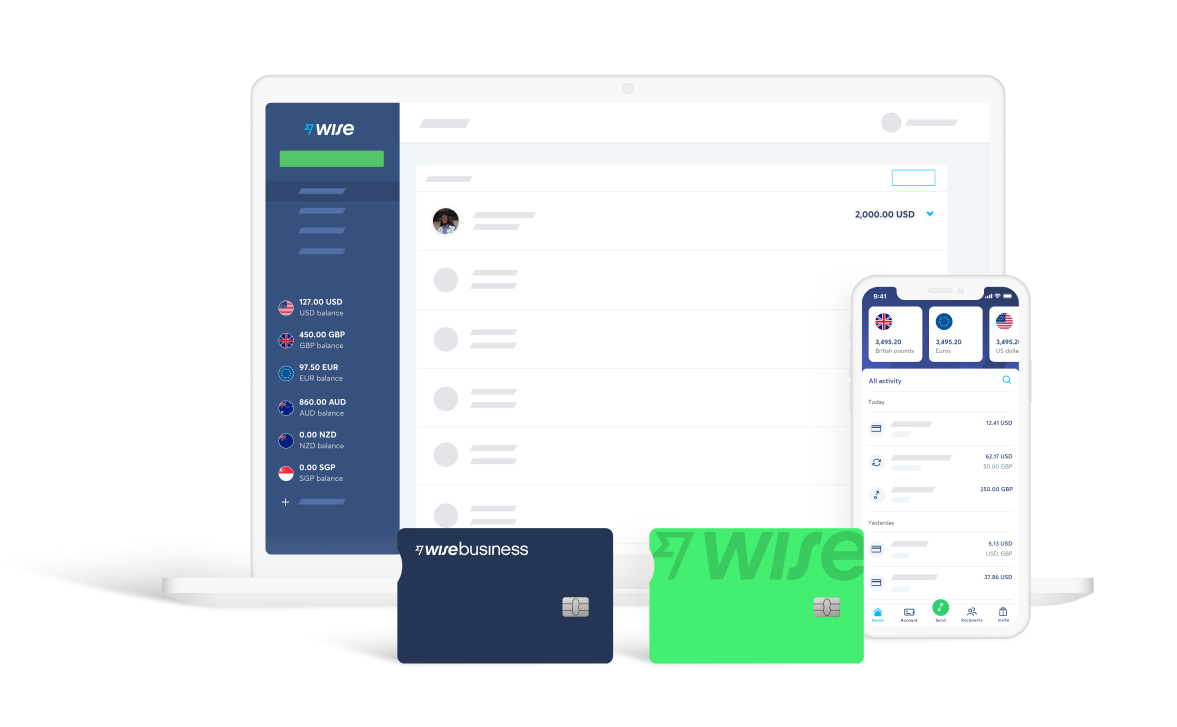

Wise works differently, with international transfers that always come with low, transparent fees² and the mid-market exchange rate. Send a payment overseas - or choose the Wise Account which lets you hold and exchange 50+ currencies, get paid from 30+ countries fee free, and spend in 170+ countries with the linked Wise card.

Proof of address documents are required by banks and similar organisations when you open an account. This is commonly known as the bank’s duty to ‘know your customer’ (KYC), and is a part of the bank’s obligation to help prevent money laundering and to stop money being used to finance terrorism.

Banks here in Singapore - and other organisations around the world - need to be sure the customers they offer services to are really who they say they are. This is why you’ll normally need to provide a proof of ID and address when you set up an account. The exact KYC processes followed by each organisation do vary, so you’ll need to double check exactly what’s accepted by your own bank as a proof of residence in Singapore.

Getting a proof of address document for Singapore usually means having official correspondence which includes your full name and address, either from a bank or financial service provider, a government agency, a utility company, or an employer. If you’re a student you may also be able to use a letter from your school or place of study.

It’s important to note that documents used to prove your address need to be recently issued - usually within the past 3 or 6 months. You’ll also need to prove your residential address, which means a company, business or PO Box address can’t be used.

The exact documents your bank will accept as a proof of residential address in Singapore does vary, based on the bank’s own policy. However, commonly accepted documents include:

No matter what documents you’re using, you’ll need to ensure your full name is shown, alongside your registered address.

To illustrate, let’s take a look at the documents approved for proof of address by DBS - Singapore’s largest bank.

In most cases, the paperwork DBS will accept for proof of address will be dictated by whether you’re a Singapore citizen, PR or foreigner living here. Here’s how it breaks down:

DBS account opening - DBS proof of address documents for Singapore citizens and Permanent Residents¹:

If you’re not a Singapore citizen or PR, your identity card won’t hold all the same information, which means you’ll have a different choice of documents when it comes to proving where you live.

If you’re a foreigner in Singapore you’ll be able to provide:

All documents need to be under 3 months old.

Learn more about how to open an account with DBS Singapore here.

Most Singapore banks do have accounts on offer for foreigners who live in Singapore, with a range of ways you can prove your legal status and address. However, if you’re not a Singapore resident and want an account you can use to hold and exchange Singapore dollars, you’ll find you have a rather limited choice. Without a Singapore proof of address, many major banks will either restrict account access, or require you to have an introducer - a local resident who can vouch for you.

If you’re looking for a more flexible option, you may be better off with an international provider like Wise. More on that next.

Learn more about how to open a bank account in Singapore as a foreigner in this full guide.

Big banks aren’t always the best option if you need an account for international spending in person or online. Check out Wise instead.

Wise Accounts can be opened online or in the Wise app, and let you hold 50+ currencies, with local bank details for SGD as well as 8 other currencies - so you can get paid fee free like a local, even if you don’t have a Singapore proof of address yet. Exchange currencies with the mid-market exchange rate every time, and only ever pay low, transparent fees² for the services you use. Overall, Wise could be a cheaper option than using a traditional bank for your international transfers - and for daily spending, it’s easy to spend SGD with the Wise card or when travelling.

Wise also offers business accounts if you need an easy way to manage your company finances across borders. See how much you can save with Wise, today.

Sources checked on 16.11.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking to start trading? Check out our guide which compares top platforms like Moomoo, Tiger Brokers, and more to help you start investing

Learn how to invest in the S&P 500 in Singapore. Discover S&P 500 ETFs to buy, compare top brokers, and get tips on minimizing fees and tax considerations.

Considering the Maybank Family & Friends card? Read our 2025 review on its cashback, benefits, and fees. Find out if it's the right fit for your spending.

Compare the OCBC 90°N, VOYAGE and Premier Visa Infinite cards to find Singapore’s best OCBC miles credit card for your spending habits and travel goals.

Looking for the best credit card with free travel insurance in Singapore? Compare top cards like UOB and AMEX to get complimentary coverage and save on trips.

Thinking about the Revolut metal plan and card in Singapore? Our detailed review covers the benefits, features and fees to help you decide if it’s worth it.