How to avoid credit card overseas charges when spending abroad

Using your credit card overseas? Learn about foreign transaction fees, FX markups and DCC, and how to avoid extra charges when spending abroad.

It’s common to have several different bank accounts to cover all your financial needs. You might have a current account, as well as a savings account, for example - or a multi-currency account for international travel and spending.

If you’re just starting out, or want to check that you have the best possible account types for your personal requirements, you may be wondering about the differences between popular account types. This guide has you covered.

We’ll walk through the difference between savings and current accounts, and look at why a regular current account interest rate might not suit your savings needs. We’ll also cover some of the multi-currency accounts Singapore citizens and residents may choose, including the Wise multi-currency borderless account.

You’ll quickly learn that there are many different types of current accounts - also known as checking accounts. That’s simply because different banks offer varying features, fees and benefits. This gives customers greater choice and control over the account that works for them.

While there are many variants on the current account them, current accounts typically have the following features:

Current accounts are great for managing your day to day spending and cash withdrawals. However, because the interest rates on current accounts are low, they’re not a great place to put your savings. We’ll cover some different types of savings accounts in just a moment which may be better suited for this.

Some current accounts will have fees or eligibility requirements you need to fulfil to open and operate them. The popular UOB current account has a minimum balance of SGD3,000, with a fall below fee of SGD7.50 payable if your average daily balance is under this level¹.

Other banks may arrange their terms and conditions differently. For example, Standard Chartered Singapore has a SuperSalary account which does not have a minimum balance requirement². However, one of the requirements of the account is that your monthly salary is credited there by GIRO.³

No matter what type of account you choose to hold your money in, you’ll want to know it’s safe. If you’re choosing a current account make sure you find a product provided by a SDIC member bank.

The Singapore Deposit Insurance Corporation (SDIC) protects deposits of up to SGD75,000 if a member bank fails⁴. That means that your money - up to a maximum of SGD75,000 - is safe if you put it in a bank which is a member of SDIC, even if the bank runs into difficulties.

All of Singapore’s major banks are members of SDIC - you can check the full list of SDIC insured providers online, too.⁵

Here’s an important question - what’s the difference between a current account and a savings account?

In broad terms, current accounts are designed to use for day to day spending and withdrawals, usually using your linked bank card. Savings accounts are usually used when you want to leave your money for a time, earn interest and build your wealth. For this reason, savings accounts usually offer better interest rates, but may not have all the convenient features of a current account.

| All that said, there are many different variants on account types available. You can find some savings accounts which offer linked debit cards and instant withdrawals - and some current accounts which have smart ways to earn interest or cashback on spending. Look closely at the terms and conditions of any account you’re considering, to make sure it matches your needs. |

|---|

A savings account is a good place to keep your emergency fund, or to save on an ongoing basis for your future spending needs. Here are a few common types of savings account you may choose to open:

Savings accounts pay interest - although the amount you’ll get, and the mechanism for calculating your interest can vary considerably from one bank to another.

For example, you may be interested in the DBS Multiplier account which allows you to earn up to 3% interest on savings, based on the way you use your account⁶.

There are different ways to give your interest a boost, depending on your age and which other DBS products you use, with base interest of 0.3% as a starting point.

Or, you may choose an account like the OCBC Bonus+ Savings Account which gives more interest if you save regularly and don’t make any withdrawals.⁷

A foreign currency or multi-currency account (MCA) may be for you if you make or receive payments in foreign currencies. A MCA could make life easier - and mean you save money - if you’re a freelancer working with clients based overseas, or if you love to shop online with international retailers for example.

Multi-currency accounts let you hold one or more foreign currencies, sometimes alongside your SGD balance. You can choose foreign currency savings accounts in popular currencies like US dollars or euros, or get a functional day to day MCA which lets you spend when you travel, and send and receive international payments easily.

One advantage of multi-currency accounts is that you can control how and when you convert payments from one currency to another. If you get sent a payment in a foreign currency to be deposited in your SGD account, it needs to be converted to Singapore dollars before it can be put into your account. That means you have to accept the rate offered by your own bank - or that of the sender - which may not be the best available.

You may also suffer if SGD happens to be weak at the time your payment arrives. Instead, with a multi-currency account you can accept the payment in its original currency and choose when and how you want to spend or convert it. This gives you more options and puts you firmly in control of your own money.

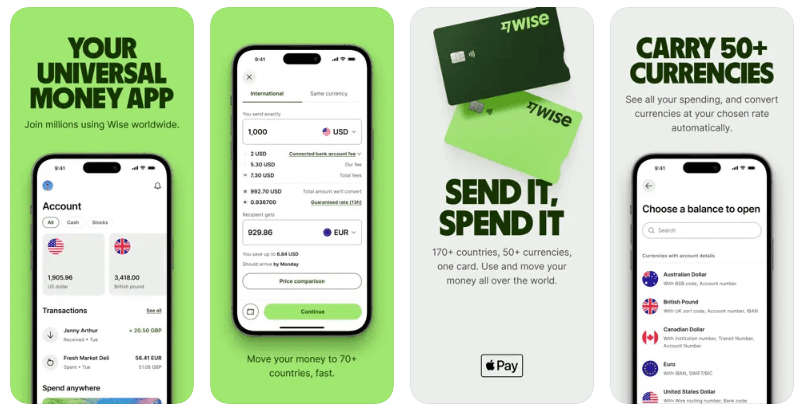

One great option if you’re looking for your own MCA is the Wise multi-currency account. You can hold and spend 40+ currencies from your account, and receive fee-free payments in major world currencies like British pounds, euros, US, Australian and New Zealand dollars. Accounts can be opened online quickly, and come with a linked debit card to make spending and withdrawing cash easy - no matter where in the world you are.

A final account type to think about is the Fixed Deposit account (FD). With a Fixed Deposit account you’ll lock away your savings for a pre-agreed amount of time, in return for an interest rate that’s typically better than the rate you’ll get on an easy access account.

Fixed Deposit accounts are popular when economic uncertainty means that investing in the stock market is not an attractive option. They’re also a good choice for people with existing investments who want to keep their money somewhere without risks - such as those approaching retirement and more interested in preserving than growing their wealth.

The rates and options available will vary over time, and based on the bank’s own policy. For example, at the time of writing DBS accepts Fixed Deposit amounts from new customers for only up to a maximum of 8 months⁸. Longer FD placements are available, but only to existing customers. The interest you’ll earn is based on the length of time you leave your deposit, and the amount you’re depositing. If, for example, you were to leave a SGD5,000 deposit for 3 months you’d earn 0.15% interest, while leaving the same deposit for 8 months will get you 0.6%.

Interest rates change frequently, and vary by bank - so shop around for the best deal and check all the terms and conditions thoroughly before you open an FD account.

Getting the right type of bank accounts for your different needs can mean you save time and money. Having a few different account types usually makes good sense, and can make it simpler to manage your finances across saving, spending and investing. Check out the account types above, before diving into more research to see which may suit your needs.

And don’t forget to look at the Wise multi-currency borderless account if you’re one of the many Singaporean citizens and residents who like to travel or spend with international retailers - or need to send and receive cross border payments.

All sources checked on 8 January 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Using your credit card overseas? Learn about foreign transaction fees, FX markups and DCC, and how to avoid extra charges when spending abroad.

Learn how Singapore income tax works for foreigners, including tax rates, residency rules, reliefs and how to file your return with IRAS.

Learn everything you need to know about sending an e-ang bao with DBS eGift.

Learn how to get new notes from banks in Singapore for Chinese New Year, including release dates, booking steps, ATM options, and alternatives if you miss out.

Learn how to send an e-hongbao or digital ang bao to loved ones near and far.

Compare the best no foreign transaction fee credit cards in Singapore, including fees, rewards, eligibility, and overseas spending benefits.