Bankwest exchange rate

How does the foreign exchange rate offered by Bankwest compare to Wise?

Planning to use a Bankwest money transfer? There might be a cheaper option

When sending money internationally, it pays to go beyond your bank and look for the cheaper options available. Avoid hidden fees by choosing a provider who'll show you where your money is going. Finance isn't fair unless it's transparent.

Wise gives you the mid-market exchange rate, with our small, fair fee – so you always know what you’re getting.

Compare Bankwest money transfer rate vs Wise

How expensive is the Bankwest money transfer rate? If you convert AU$1000 to GBP with Bankwest, you could lose almost AU$47 on each transfer. We regularly check our prices against banks and other providers to show you how much you could save with us (these prices were collected on 25/09/2019 and might have changed).

Wise was founded on transparency. It’s your money. We believe you should know where it’s going. It’s only fair.

| With Bankwest money transfer you will get | With Wise you will get | You could save | |

|---|---|---|---|

If you send AU$1000 to GBP | £516.20 | £542.14 | £25.94 |

If you send £1000 to AUD | $1,762.43 | $1,826.65 | $64.22 |

If you send AU$1000 to EUR | €581.60 | €612.56 | €30.96 |

If you send €1000 to AUD | $1,554.00 | $1,610.22 | $56.22 |

If you send AU$1000 to USD | $647.00 | $673.45 | $26.45 |

If you send $1000 to AUD | $1,420.25 | $1,463.79 | $43.54 |

How do exchange rates work?

Banks use the mid-market rate, also known as the interbank rate, when exchanging currencies between themselves.

They add hidden fees to the rate they give their customers. This is why you’ll see different exchange rates across providers – you’re paying the difference between the mid-market rate and the rate quoted by your bank.

Customers lose money to these hidden fees when they make a transfer – often without even realising.

What's the Bankwest exchange rate for online money transfer?

There’s only one true exchange rate – the mid-market rate. Banks and money transfer providers use this rate to exchange foreign currencies between themselves, but add hidden fees to the rates they give their customers. That means you get a more expensive exchange rate.

There’s no such thing as 0% commission – the fee is just hidden in the rate.

| Bankwest exchange rate | Wise exchange rate | |

|---|---|---|

AUD to GBP | 0.5162 | 0.545232 |

GBP to AUD | 1.7624 | 1.83391 |

AUD to EUR | 0.5816 | 0.616038 |

EUR to AUD | 1.5540 | 1.62329 |

AUD to USD | 0.6470 | 0.6779 |

USD to AUD | 1.4203 | 1.47493 |

Does Bankwest exchange currency?

Yes. Bankwest offers currency exchange in bureaux de change, in their stores and online. But when you buy travel money in cash – either in store, online or with click and collect – you could be subject to an unfair exchange rate with hidden fees. Use a travel money card instead to save when travelling abroad.

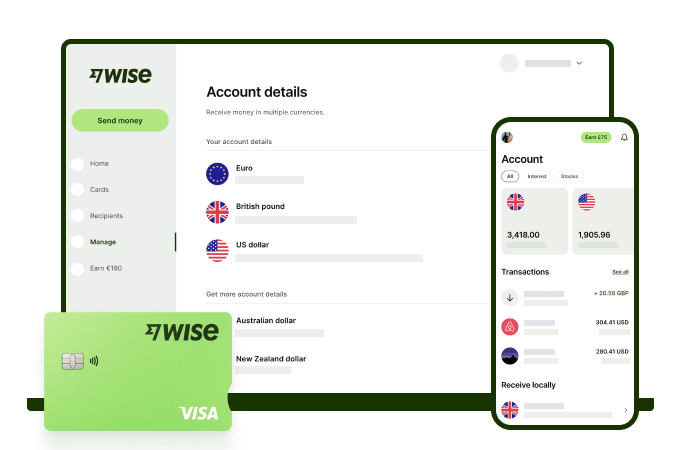

With the Wise multi-currency debit card, you can:

- hold over 40 currencies at once

- convert them at the real exchange rate

- and withdraw up to £200 per month for free from ATMs around the world

From the same people

that built Skype

Sir Richard Branson invested in Wise. Learn why.

45,000+ reviews on Trustpilot

Customers love Wise

Authorised by the UK Financial Conduct Authority

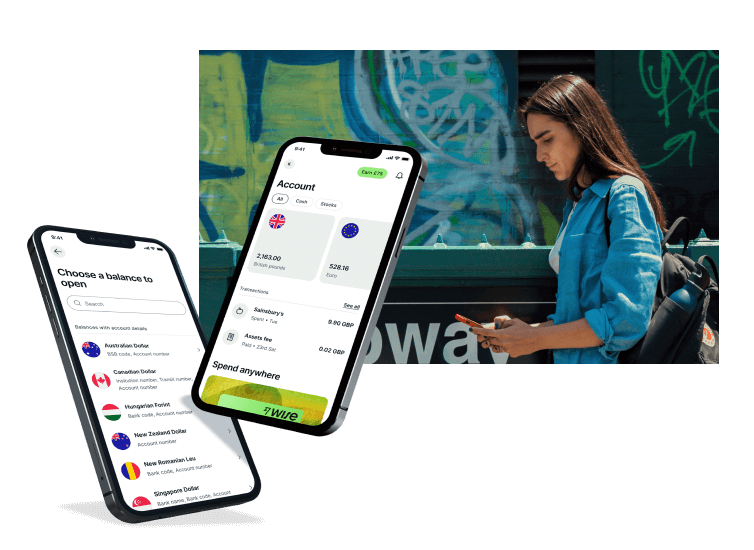

Buying travel money with Bankwest?

Buying travel money in cash can be expensive, as you won’t get the true mid-market rate. Use a travel money card – like the Wise borderless card – to store money in multiple currencies, convert at the mid-market rate, and withdraw or spend at ATMs and shops worldwide.