How Virtual Coworker saves around USD $60,000+ a year on global payments

Case study on how Virtual Coworker addressed their cross-currency challenges with Wise Business and how they played a part in testing batch payments.

If you’re looking for better ways to manage your business finances, you’ve probably seen Xero as one of the popular choices. It’s an accounting software tool that lets Australian businesses sort invoicing, payroll, expense tracking, bank reconciliation, and more, all from a single platform.

In this blog, let us explore more on the range of tools and features offered by Xero along with overview on cost and benefits of using it for day-to-day business. We'll also explore the how Xero Accounting can be integrated with business account solutions like Wise Business.

| Table of contents |

|---|

Sign up for the Wise Business account! 🚀

Xero is paperless, online accounting software built to make managing everyday bookkeeping tasks, like sending invoices and paying bills, handling payroll, and making sure internal records match bank transactions, much simpler and faster for business owners.

Designed with startups in mind, Xero basically has everything a sole trader or small team needs to make smart financial decisions without getting buried in admin or having to always defer to a specialist accountant.

Founded in New Zealand, Xero has grown into a global platform with 4.6 million paid subscribers¹. For businesses that are fed up with confusing spreadsheets and older, legacy software, Xero provides a much easier and accessible way (via the cloud) to manage money and all the legal obligations that go with it.

Xero is basically the central financial hub for your business. It connects directly to your business bank accounts, so all your transactions (income, expenses, etc.) flow into your system automatically.

Xero software also does most of the legwork for other tasks, automating workflows related to bookkeeping and accounting so you don’t have to manually sift through records to publish accurate reports.

There are lots of other useful features, too. With Xero, you can:

Because Xero is cloud-based and operates entirely online, you don’t need to fumble around with complex local software installs or worry about manual updates or backups. It’s easy to log in with a web browser or via the official mobile app to manage everything.

However, it’s not free. Xero uses a subscription model where you pay monthly for a specific plan, which we will cover later in more detail. You’ll also need to set up a dedicated business bank account to connect with Xero².

| 👆Read our guide on opening a business account in Australia |

|---|

Xero packs a huge range of tools into one platform — all designed to cut down on busywork and give owners more time to focus on growth. You can manage most of your financial workflow within Xero, and if something isn’t available natively, there’s usually a third-party app you can integrate from the app store to get things sorted.

Here are the main features of Xero accounting software³:

You’ll have to pay a monthly subscription fee to use Xero. It currently offers four plans in Australia: Ignite, Grow, Comprehensive, and Ultimate 10.

All the Xero plans allow users to complete essential tasks like reconcile bank transactions, track GST and submit BAS statements, and get cash flow and business snapshots.’ However, certain features are gated or tiered, with more ‘premium’ plans getting higher allowances and advanced tools, like project tracking. This gives you room to scale up as your business grows.

Here’s a Xero overview of how the four tiers compare in terms of pricing⁷:

| Xero Feature | Ignite | Grow | Comprehensive | Ultimate |

|---|---|---|---|---|

| Monthly fee | $35 | $75 | $100 | from $130 |

| Payroll | 1 person | 2 people | 5 people | 10+ people (max 200 people) |

| Claim expenses | ❌ | 1 user, $5 per additional user | 5 users, $5 per additional user | 10 users, $5 per additional user |

| Track projects | ❌ | ❌ | ❌ | 10 users, $7 per additional user |

Xero usually offers a 30-day trial, if you want to test the features before committing to a monthly plan.

Xero generally makes it much easier to run a small business. It automates many of the dull (but legally essential) bits, keeps your books tidy, and gives you a clear and accurate picture of your finances.

Here are some of the biggest benefits with Xero:

Xero’s bank feed connections and automated transaction categorisations do pretty much all the heavy lifting for bookkeeping, so you don’t have to slog through the task of manual entries and crunching numbers. While use cases vary, this is likely to save you multiple hours of work per month.

The Xero dashboard shows you everything you need to know — your latest bank balance, invoices, and bills, all in real time. You don’t have to wait for end-of-month reports to know how you’re doing. You can see it instantly and make better decisions on where to spend and save.

Xero’s invoicing tools cut the amount of time chasing payments by 50%⁸. You can use ‘pay now’ buttons, send friendly reminders to settle invoices quicker, and get a clear view of outstanding bills. Improving cash flow can make all the difference for small businesses.

Nine in ten Xero customers say Xero helps their business to stay compliant². Xero takes the hassle and stress out of tax season. It calculates GST, prepares BAS statements, and files data directly to the ATO. Again, any one of these tasks would usually take hours. Using Xero means less time pouring over figures and, perhaps most importantly, fewer mistakes.

You aren’t tethered to a single licence on a desktop computer. With Xero, everything is stored in the cloud, so you can send invoices from home or approve expenses during meetings with clients. All you need is an internet connection. This flexibility supports faster work for business owners and small teams.

Xero works best when it’s part of a broader financial toolkit. You can connect it to hundreds of business apps to see all your money in one place. When you link a Wise Business account, for example, all your international transactions ping straight into Xero, making reconciliation and cross-border payments much easier.

While Xero streamlines your domestic accounting, managing finances across borders can introduce new layers of administrative complexity.

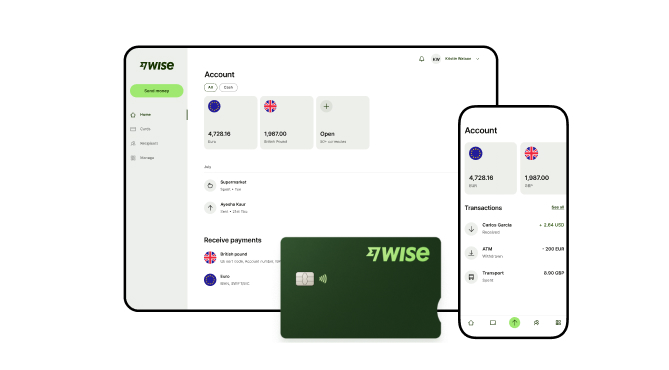

Wise Business helps solve this challenge by integrating directly with your Xero dashboard to sync daily transactions in over 40+ currencies. By feeding international payments and expenses straight into your accounting software, you can reconcile foreign currency accounts without manual data entry to help ensure your global bookkeeping remains accurate and up to date.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

**Capital at risk, growth not guaranteed. Interest is the name of a custody and nominee service provided by Wise Australia Investments Pty Ltd in partnership with Franklin Templeton.

1. Is Xero an ERP system?

No, Xero is not technically a full ERP (Enterprise Resource Planning) system, which lets businesses manage a wider range of core processes, like supply chains and customer relationships. Xero is primarily an accounting platform focused on cutting down on the admin related to business finances and payroll. However, it can integrate with ERP platforms.

2. Is Xero cloud-based?

Yes, Xero is 100% cloud-based. Everything works online, with data secured in the cloud rather than a local computer. This makes it easier to log in to Xero’s web-based portal across multiple devices and to collaborate with staff remotely. It also means updates and backups happen automatically.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Case study on how Virtual Coworker addressed their cross-currency challenges with Wise Business and how they played a part in testing batch payments.

Looking for the best credit card for small business in Australia? Compare top business credit cards and debit alternatives like Wise Business.

A complete guide to Stripe fees in Australia. We explain standard pricing, transaction costs, GST, handling surcharges, and saving on global transfers.

Learn how to take payments over the phone in Australia, including details about card machines, the benefits and risks, and how Wise Business can help.

Learn what Odoo is and how its ERP tools work. We explore key modules, Australian pricing plans, and how it integrates with Wise Business.

Learn about Zoho Books, it's key features, pricing plans, GST handling, and how Zoho Books compares with Xero and QuickBooks for business accounting.