Your Wise Card Transactions: Understanding Invalid Disputes

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

$1.5 billion. That’s how much you — our customers — saved in hidden fees last year. Not bad right? But how much did that really amount to per customer?

As it turns out, quite a lot. If you use Wise instead of your bank — you could be making bank. We’ve reached out to each of our customers individually to let them know how much they saved in 2019.

We love maths. But this time we let market researchers do their thing. They let us know the average fees people pay when they send from their local banks. And then we took how much you spent on our fees, from the average bank fee amount multiplied by the amount of times you sent. Et Voilà, savings galore.

We found that, on average, when you send $250 with Wise from:

AUD — it’s 7x cheaper

NZD — it’s 5x cheaper

If you’d like to find out more about how much banks are charging you in hidden exchange rate markups, head over to AU price comparison, NZ price comparison, UK price comparison.

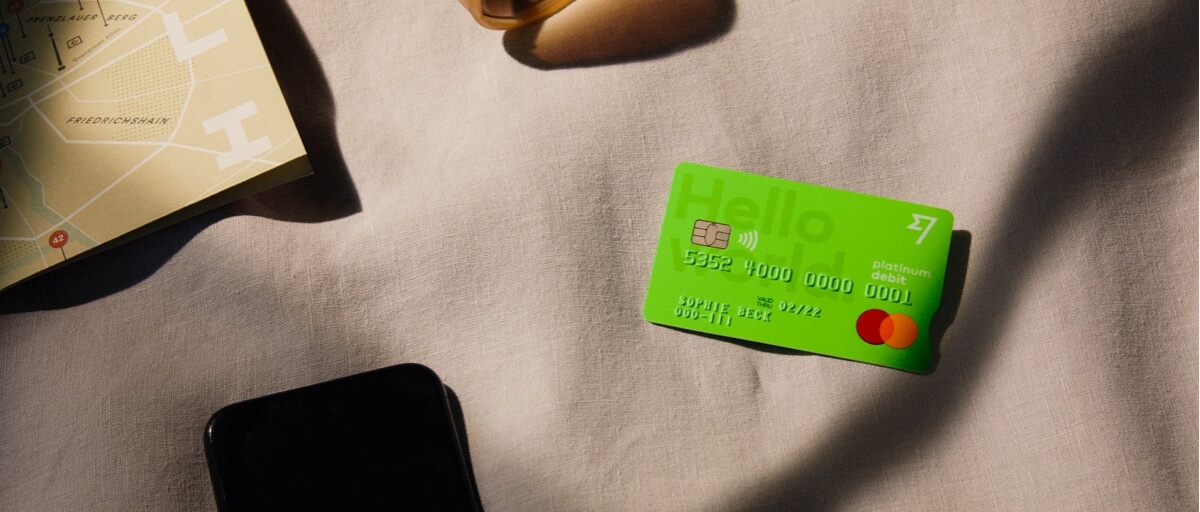

Our customers are also saving whenever they tap and swipe abroad. In 2019, we launched our little green card — the Wise debit Mastercard — in the US, Australia, New Zealand, and Singapore. So our customers could get the real exchange rate, wherever they spend.

From Kyoto to Kiribati, a beautiful island in the Pacific, it’s great to know that more and more people are getting the real exchange rate when they spend abroad. And it’s been a pleasure to join you all on your journeys.

And for those living their daily-lives or prefer stay-cations, we’re chuffed that you’re using Wise for groceries, gifts online, and all kinds of gadgets.

2020 — new decade, same mission. We won’t stop until money is truly borderless. That means the fastest, cheapest, and most convenient transfers possible.

But for now, say no to bank fees and start saving. Order your Wise debit card or send money with us — at the real exchange rate.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

From time to time, you might make a purchase with your Wise card and run into an issue — maybe something you bought didn’t arrive, wasn’t as described, or you...

Our mission is to lower the cost of moving money across borders. And since we started 13 years ago, we’ve made good progress, particularly over the past...

Detailed research by Wise reveals substantial savings compared to Singapore banks and services like Instarem, Revolut, and Youtrip by EZ link.

Discover how Wise outperforms 5 major New Zealand banks, PayPal, and Western Union, offering savings of up to 6x on international transactions.

Discover how Wise compares to 5 major Japanese banks and Revolut, offering savings of up to 6x on international transactions.

Discover how Wise compares to major banks and money transfer services, saving you up to 4x on international transactions.