How Virtual Coworker saves around USD $60,000+ a year on global payments

Case study on how Virtual Coworker addressed their cross-currency challenges with Wise Business and how they played a part in testing batch payments.

Running a cross-border business sounds glamorous, until you’re deep in currency conversions, time zones, and emails that start with “Just following up on that payment again.” For My Team Stars, growth was steady, cross-border payments became slower, and the administrative load increasingly complex.

The team wasn’t looking for a radical overhaul, but a solution that could keep pace with their expanding operations. What they discovered offered more than efficiency. It brought clarity, control, and consistency to every transaction. The rest unfolded quietly, but significantly. Read on to see how Wise became part of the story.

Industry: Chartered Accounting & Administrative

Solution: Professional accounting, bookkeeping and administrative services

No. of employees: 100+

Business HQ: Melbourne Victoria, Australia

What began as a spontaneous conversation between two long-time friends soon evolved into a thriving cross-border business. When Anthony Wong, a seasoned chartered accountant, visited his friend in Malaysia, the idea for My Team Stars was born. The moment wasn’t planned, but it was deeply instinctive. Within five minutes, Anthony knew they were about to build something significant.

Fast forward five years, My Team Stars Pty Ltd has grown to a nearly 100-person-strong team, offering outsourced bookkeeping and administrative services tailored primarily for Australian and UK businesses.

“It started as a lucky accident,” Anthony reflects. “But it’s become one of the most rewarding ventures I’ve been part of.”

Despite its unassuming beginning, this venture has quickly become a core part of a broader professional services ecosystem built on trust, compliance, and forward-thinking financial strategy.

My Team Stars operates in alignment with its sister company, Graphite Business Advisers (GBA), which Anthony founded over two decades ago. While GBA is a chartered accounting firm focused on real estate clients across Australia, My Team Stars is the execution arm, providing skilled offshore talent in Malaysia to manage bookkeeping, administration, and internal finance functions.

Together, these two entities serve over 300 clients globally, with My Team Stars working closely with both real estate agencies and accounting firms to provide reliable back-office support.

Anthony emphasizes that care, credibility and operational brilliance are the core pillars around which My Team Stars was built on. The firm emphasizes long-term relationships, high retention, and a strong cultural connection between team members in Malaysia and clients in Australia and the UK. With a majority of their employees based off in Malaysia,

“We invest in our people, from holiday celebrations to upskilling sessions. Our end-of-year events in Malaysia are bigger than the ones we host in Melbourne.”

As the team expanded beyond borders, what once felt simple started to get layered. Cross-border payments became harder to manage, and new regulatory and logistical hurdles began to surface. It wasn’t about managing people, it was about navigating systems that weren’t built for how they now worked.

As My Team Stars expanded, so did the complexity of its operations. Payrolls had to be processed across time zones, reimbursements had to arrive without delay, and vendor payments couldn’t afford to wait for bank processing cycles to catch up.

In the early days, Anthony partnered with traditional financial institutions: reliable, but not always favorable nor convenient, especially for a business expanding their borders. International transfers came with vague delivery windows and hidden fees. Exchange rates were rarely in the business’s favour, and reconciling monthly statements got even more complex as they started scaling up.

As Anthony recalls, “They were serviceable, but the rates were absolutely impossible to work with. Looking back, if I’d transferred the same amount of money today, I’d almost be bankrupt.”

Seeking an alternative, Anthony eventually discovered an alternative business payment provider that offered cross-currency transactions at affordable rates, but was far from seamless. Transfers would take overnight to reach Malaysia, meaning the business always needed buffers to ensure payments were processed without delay on the other end. The cost wasn’t only in dollars, but in anxiety, lag, and inefficiency.

And then, something shifted.

“I stumbled upon Wise Business through an online search,” Anthony recalls. “At first, we tested it cautiously. But soon I was asking, why am I still using the other platform when Wise is instantaneous? I get notified in 30 seconds that the funds are going through.”

With Wise Business, transfers that once took a night now cleared in seconds, or minutes. The difference wasn’t just speed, it was certainty.

This control made all the difference. Instead of reacting to the system’s delays, the team could now act in real time, supporting a global workforce, responding to market shifts, and moving faster than ever before. Today, Wise Business is no longer a contingency plan at My Team Stars.

While Anthony and his team focused on scaling the business and managing global client expectations, Wise Business quietly became part of their financial operations, handling international payments with consistency, speed, and transparency.

What began as a support tool soon proved essential, delivering measurable results in key areas like payroll, vendor payments, and cost management. Here's a look at the impact Wise Business has made behind the scenes:

| 15,000+ | 15+ | 80,000+ |

|---|---|---|

| Saved on cross-border transactions per year (AUD) | Hours saved on remittance time* | Monthly cross-currency transactions (AUD) |

* Transaction speed and cost claimed depends on individual circumstances and may not be available for all transactions. Information provided as of xx yyy 2025

Let’s take a look at the core areas where the team uses Wise Business to streamline their cross-border payments.

With employees based offshore, Anthony needed a reliable way to pay monthly salaries and cover ad hoc expenses. Wise Business enables him to send funds directly into local Malaysian bank accounts without dealing with SWIFT codes or traditional bank delays. Transfers typically land within minutes or a few hours, and are accompanied by real-time notifications.

The process is straightforward: The team logs into their Wise Business account, selects the currency to send from (usually AUD), and sees the real-time exchange rate and fees upfront. After confirming the details, the transaction is processed almost immediately. And Anthony receives a notification in his inbox almost immediately, letting him know the funds are en route.

As Anthony puts it, "I know the money will land where it needs to, almost instantly. It’s not just about being fast, it’s about knowing, with certainty, that your team won’t be left waiting,”

For Anthony, this certainty has become a core operational advantage, removing the guesswork from international payrolls, and ensuring his Malaysia-based team gets paid on time, every time.

Receiving payments from overseas was once unpredictable for My Team Stars, but Wise Business helped transform the process. When their clients made payments in their currencies, My Team Stars was able to receive and hold them into their Wise Business account. The team is then able to monitor exchange rates in real time and convert to AUD or other desirable currencies when favorable.

“Earlier, I’d just have to take whatever the bank was offering. Now, I just click ‘convert’ when the rates are favorable, and it’s done. So when our clients in the UK make payments, we receive the money and convert the funds in AUD with complete clarity on the exchange rate and fees involved.”

With transparent fees and conversion rates, Anthony is able to maintain control, choose the optimal time and method for conversion to benefit the business.

“When you’re moving large amounts regularly, you need systems you can trust. It’s the platform we trust to manage six-figure transfers with ease,”

As a chartered accountant and former auditor, Anthony values transparency, accountability, and airtight controls. Wise Business delivers on all fronts, with built-in features that support both security and scale:

As a chartered accountant and former auditor, Anthony has seen how essential it is to have complete clarity over financial records, especially when managing payroll, reporting to tax authorities, or simply ensuring funds are going where they’re supposed to.

Having spent over 28 years in the accounting field, Anthony understands the ways things can go wrong and how easily fraud can occur without a clear audit trail.

“We need that history. We need that for the tax office. If you see all the fraud cases, the majority of them are taken by the bookkeepers or the accountants.”

That’s why features like searchable transaction history and named recipient records aren’t just helpful, they’re non-negotiable for running an ethical, accountable business.

With Wise Business, accessing transaction history is quick and straightforward. That’s more than a convenience for Anthony—it’s a layer of protection. In a business where wages are paid across borders, having a clear transfer trail is critical for transparency and compliance.

My Team Stars currently processes around AUD 100,000 in monthly international payments via Wise Business. Wise allows the team to grow confidently without worrying about backend logistics. They’re already exploring new markets, such as New Zealand, and are working with clients in Hong Kong, Japan, and the UK. “Wise has become a silent partner in our growth,” Anthony says.

With plans to scale to 150–200 employees and expand service offerings, My Team Stars sees Wise Business as a key component of their financial operations infrastructure.

They’re also exploring advanced features such as multi-currency invoicing and payment links, with the goal of offering more flexibility to global clients without incurring unnecessary fees.

From a spontaneous coffee chat in Malaysia to a thriving global business supporting hundreds of clients and staff, My Team Stars is a story of opportunity embraced, relationships nurtured, and systems optimized.

Wise Business has played a pivotal role in enabling that journey, not just as a financial tool, but as a strategic enabler of trust, transparency, and seamless cross-border collaboration.

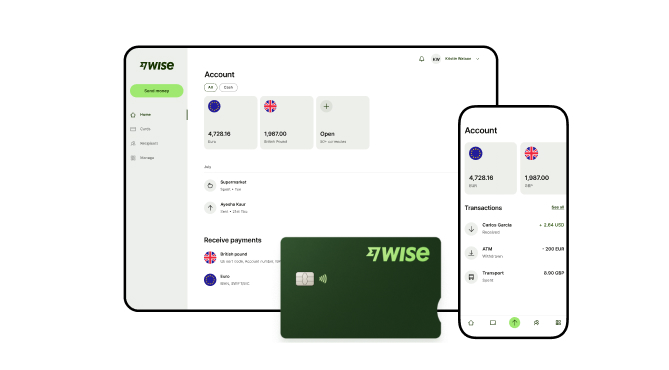

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

**Capital at risk, growth not guaranteed. Interest is the name of a custody and nominee service provided by Wise Australia Investments Pty Ltd in partnership with Franklin Templeton.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Case study on how Virtual Coworker addressed their cross-currency challenges with Wise Business and how they played a part in testing batch payments.

Read on how Prophit Systems saved up to 9x on global payroll by switching to Wise Business, saving over 10+ hours a month in admin time.

Case study on Conjointly, an Aussie-based survey and research platform, and how they saved 30% on FX costs and more with Wise Business.