How to avoid rip-off rates and costly cash

Are you planning a trip? Perhaps you've moved country, or about to? Don’t get stung by nasty fees and even nastier rates. Banks, brokers and PayPal are more...

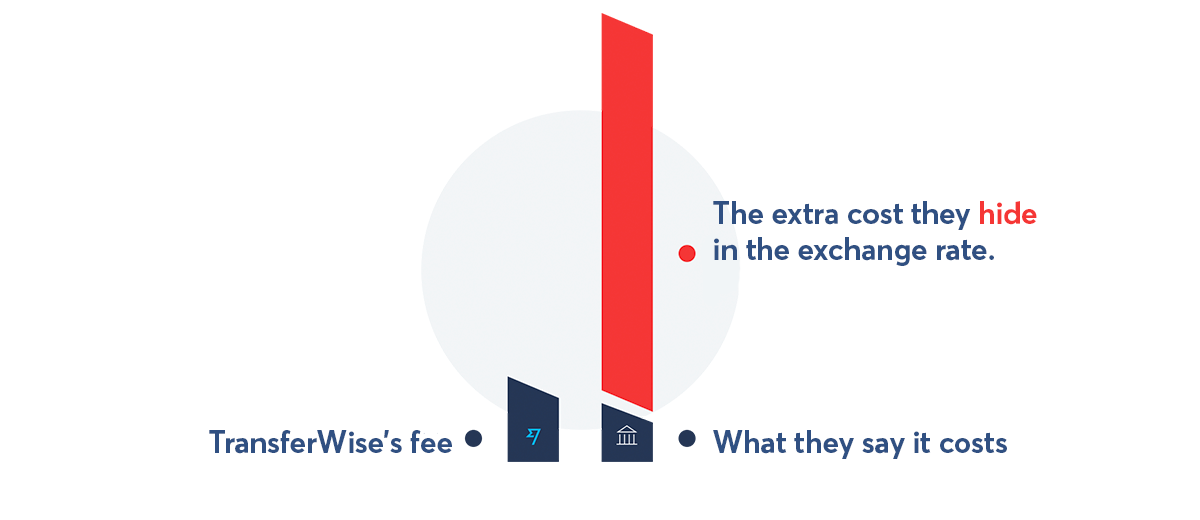

When you send or spend money internationally, banks and brokers mark up the exchange rate.

That bad rate can cost you 5% or more of the amount you’re sending—on top of any fees they charge. Here’s how:

Most people simply aren’t aware of this, however. That's because it’s nearly impossible to compare providers—the bad rates they give you are like an extra, hidden charge.

In fact, this problem costs people and small businesses billions of dollars in unfair foreign exchange fees every year.

At Wise, we're on a mission to eradicate all those unfair fees. Our account lets you send, spend, and get paid internationally for a fraction of the cost —with the real exchange rate and no hidden fees.

We never use an exchange rate mark-up. Instead, we convert your money at the real, mid-market exchange rate, and we show our full fees upfront – so more of your money gets to the other side.

| Sign up for free at wise.com, or download our Android or iOS app to save when you send, spend, or get paid internationally. |

|---|

Here's how Wise compares to your average bank:

That’s why over 6 million customers use Wise to transfer billions of dollars a month between over 70 countries, saving over $1 billion a year in foreign exchange fees.

Our prices vary between currencies. Find out how much your transfer would cost here, in this nifty calculator:

Or you can compare prices with other providers on our comparison tool—if we're not the cheapest option, we'll let you know. Transparency really is the name of the game.

You can sign up for a free account on wise.com, or in our iOS and Android apps. You can set up your transfers, manage your balances in 40 different currencies in a few clicks.

Some of our transfers even arrive instantly, but it varies between currencies. We’ll let you know how long yours will take when you set it up, and we’ll keep you updated via email each step of the way.

You even get local bank details in 30 countries so you can get paid like a local, fee-free.

And if you are eligible, why not sign up for our travel card? We send you instant alerts on all your payments, and you can freeze and unfreeze your card in a single click, if you’re worried you’ve lost it. And, of course, you always get that great rate—beats all those ATM fees, hey? Find out more here.

| Sign up at wise.com, or download our Android or iOS app to join the 6 million customers who are already saving. |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Are you planning a trip? Perhaps you've moved country, or about to? Don’t get stung by nasty fees and even nastier rates. Banks, brokers and PayPal are more...

If you’re a small business in Australia that operates overseas, Wise could save you a lot of time and money when you pay invoices in foreign...

If you’re a freelancer living in Australia with clients overseas, Wise could save you a lot of money when you get paid, compared to your bank or...

####Planning a move to a city abroad? Keep reading for the cities with the best quality of life globally. Mercer's annual report on the best cities for expats...