Compare Revolut Alternatives in Australia: Features and Fees

Compare Revolut and its alternatives in Australia on features and fees to find the best multi-currency account for your needs.

Alipay, one of China’s biggest mobile payment platforms, has become a go-to option for millions of users worldwide when it comes to handling payments virtually.

In this article, we’ll take a closer look at how Alipay can be used in Australia, including whether merchants can accept it, how to set up an account, and the payment options available to foreigners. We’ll also introduce Wise as an alternative solution for managing your money needs, that you can also link to your Alipay.

| Table of contents |

|---|

Alipay is an online platform from China that provides a range of digital services, including eWallet payment facilities.¹ It’s been adopted by tens of millions of people who use it to make in-person and online payments through the app. Most users are based in Mainland China, but Alipay is available to foreigners too.

There are two versions of the app, which are targeted at different markets.²

The Alipay app is designed primarily for use in China and integrates with Chinese banking and payment methods. Users can use it to pay for purchases, do online transfers, pay bills, and access services like wealth management and insurance.

Alipay International is geared towards foreigners who are usually based outside of Mainland China. It supports multiple languages and international bank cards, designed for cross-border e-commerce and to make travelling within China more convenient.

Alipay is generally considered to be a safe digital wallet with various security measures in place.⁷ Integrated into the app is a robust security system, which includes security controls, a digital certificate, the Green Umbrella APP, and Payment Shield.

Something to keep in mind, though, is that Alipay isn’t Australian-incorporated. This means it’s not part of the Australian Financial Claims Scheme that offers up to $250,000 cover per account holder, should the institution fail.

Alipay is a functional choice of payment method in Australia, but its use is still relatively niche when compared to popular alternatives like PayPal, Apple Pay, and Google Wallet.

While some Australian merchants choose to accept payments through Alipay, it has not been widely embraced yet. Some businesses, like Chemist Warehouse, have chosen to only accept it as a payment method for international orders.⁴

There are certain Australian banks that are making it easier for merchants to accept Alipay, if that’s something they decide they want to do. For example, ANZ supports Alipay+ payments through the QR code feature on their Worldline Move 5000 EFTPOS terminals.³

Australian citizens and residents can sign up for the international version of the Alipay app, provided they meet any eligibility criteria, have an acceptable debit or credit card, and can complete the joining process.

Step-by-step, here’s what you need to do to set up an Alipay account as an Australian:²

As part of the sign-up process, you will be asked at some point to verify your identity. For foreigners using Alipay, it must be a passport. You’ll also have to verify your face, which is done using the camera on your device.

Once the account is set up, you can link a payment card. On the front page of the app, you’ll see an option to “Add Credit or Debit Card.” Tap “Add now” then follow the prompts to add your credit or debit card details.

Foreigners don’t need to have a Chinese bank account to be able to use Alipay, because the international version allows you to bind your Alipay account to an international card instead.² Currently, the supported foreign cards include:

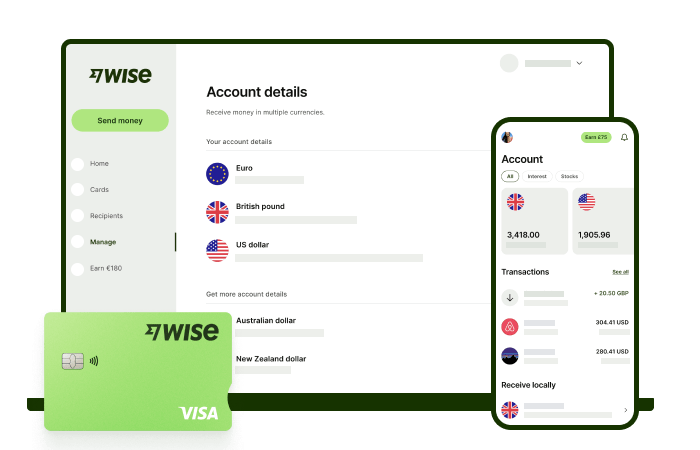

This means that the Wise card will integrate seamlessly with Alipay. One of the benefits of using a Wise card is that it completes any currency conversions at the mid-market rate. On top of that, the fees are low and transparent, with the option to open balances in multiple currencies, including AUD and CNY.

Using Alipay is fairly simple, especially if you’re used to using other digital wallets to make payments on your phone.

If you want to make an in-store payment with Alipay, there are two ways to do it.⁵

To ensure the payment goes smoothly, make sure you have enough funds on the linked card before the transaction is initiated.

Alipay’s money transfer services have limited functionality for foreigners, with the Alipay Quick Collect feature only being available to Chinese users.⁶ If you need to send money to an Alipay account, you can do it using a third-party money transfer service like Wise.

If you’re going to China or shopping in Chinese e-commerce stores, you’re going to need a reliable and easy way to make payments without getting ripped off by bad exchange rates. The Wise account and card can be a great solution for spending CNY with no hidden costs or sneaky rate markups by linking it directly to Alipay.

The Wise account is an easy way to save up to 5x when you send, spend, and withdraw money internationally. Just add AUD to your account and spend in CNY using the mid-market exchange rate. This makes it easy to top up your Alipay or use them directly for payments, ensuring you save money on CNY conversion rates.

Also, you can use Wise to send Chinese Yuan directly to Alipay users in China!

Looking for more? You can hold over 40+ currencies with your Wise account and spend with your linked Wise card here at home, or abroad wherever you’re travelling.

Here’s how to get your Wise card in just a few simple steps:

- Open a Wise account online or the Wise app in just a few minutes

- Top up your Wise account in the currency of your choice

- Order your Wise card for a low one-time fee

- Start spending with your free digital card right away, and link it to Alipay

- Your physical card will arrive in the post, and you can start spending with your virtual card right away

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you. Savings claim based on our rates vs. selected Australian banks and other similar providers in Jan 2025. Savings claim based on our rates vs. selected Australian banks and other similar providers in Jan 2025. To learn more please visit https://wise.com/au/compare

Please see Terms of Use and product availability for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Compare Revolut and its alternatives in Australia on features and fees to find the best multi-currency account for your needs.

Compare the best CommBank credit cards. Discover which CommBank credit card is best for you, from Qantas points to zero-interest options and travel perks.

Does your Bankwest credit card have travel insurance? Discover which cards still offer complimentary cover, the activation rules, and what it covers.

Planning an international transfer? Our Money Travels review covers everything from fees, exchange rates, and safety to help you decide if it's right for you.

Thinking about Hay Australia? In this Hay review, we break down the account features, card benefits, fees, and how it compares to alternatives.

Planning a large money transfer with ING Bank in Australia? Discover fees, daily limits, processing times, and alternatives.