Comparison of the best online brokerage accounts in Singapore

Looking for the best online brokerage in Singapore? Compare platforms like IBKR, Saxo and Moomoo on fees, features and more to find the right account.

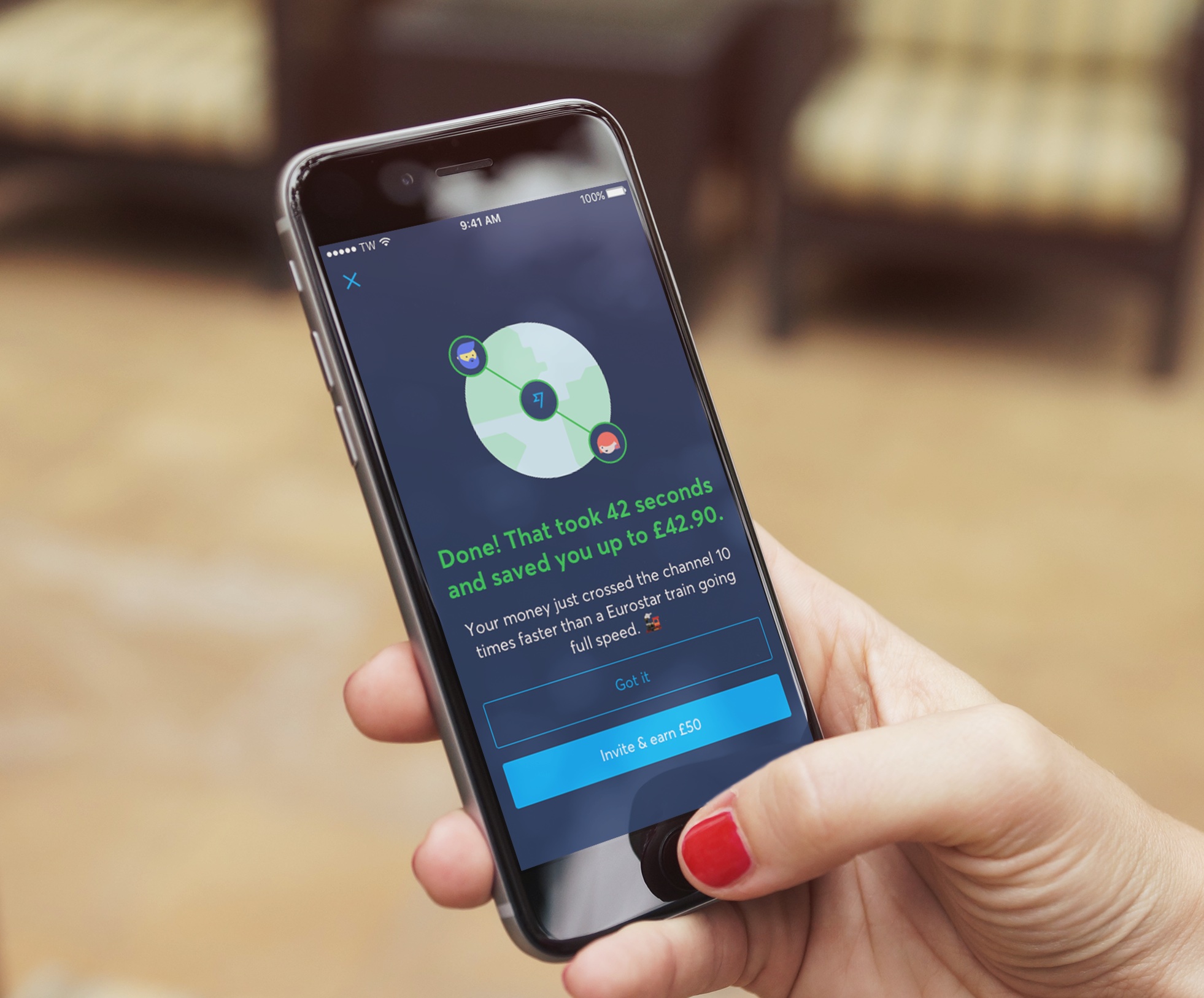

Wirex uses payment technology to help users in Europe and Asia-Pacific have access to cryptocurrencies through a wallet, app, and Visa card. It is among a relatively new crop of crypto and currency wallets that are helping make cryptocurrency spending easier, especially with a Visa card.

It also allows users to hold money in different currency accounts. But that doesn’t mean there aren’t fees or limits, on top of the volatility that currently exists with the cryptocurrency market. If you are interested in the intersection of payments and cryptocurrencies at Wirex, read on to know more.

| Table of contents |

|---|

| If you are looking for a cheap, seamless and fast way to shop and spend in 59+ fiat currencies around the world, definitely take a look at the simple Wise borderless account |

|---|

Wirex works through the company’s website and/or app on iOS and Android. It is essentially a wallet that lets you hold cryptocurrencies as well as a handful of global currencies. You can also buy, sell and exchange cryptocurrencies within the wallet. Here are the currencies you can hold if you are in Singapore¹:

Wirex makes security a priority as they are PCI DSS Level 1-certified and participate in Verified by Visa. Your cryptocurrency is kept in cold-storage, multisignature accounts to keep it secure. And Wirex offers Advanced Device Authorisation and 2-Factor Authentication to make sure it is only you getting in and out of your account.

And while the wallet is available to Singapore residents, the Visa card is still yet to be launched in the country. When it is launched, the Visa card will let you spend from the global fiat currencies that you hold in your wallet wherever Visa is accepted². If you’re looking for a global multi-currency card, check out Wise’s borderless card in Singapore.

To start, you will need to register for the wallet. You can do this through their website or by downloading the app by clicking on “Register with WIrex” and from there select the country of residence. You will then be prompted to enter your email address and create a password.

You should receive a confirmation email in your inbox which will have a link to confirm your account. From that link, you will be prompted to input your personal details like your address and contact number³. If you are doing this through the app, you will need to input a 7 digit number which you will receive by message.

Next, you will be required to verify your identity by uploading a copy of your passport, government-issued ID and a driver’s license. You also may be required to show proof of your source of funds. You will also be required to take a video selfie for additional verification.⁴ Once you are verified and have submitted your security word, you should be confirmed and ready to go.

Want a simpler way to spend money around the world that is free to set up? Wise’s borderless account is an easy way to load up on over 59 currencies around the world to then spend locally. Without the volatility or exposure to cryptocurrencies, Wise is seamless and easy to use when you are jet setting around the globe.

Wirex can be an attractive option if you are looking for access to cryptocurrencies and global currencies especially when it comes to fees. For Asia Pacific residents, there are fees when it comes to topping up the account and when purchasing new cryptocurrencies. Here is what it looks like⁵:

| For a cryptocurrency | For fiat/ traditional currencies | |

|---|---|---|

| External credit or debit card top up | 1% | free |

| Exchange | OTC rates + commission | free |

Beyond these charges, account maintenance, card maintenance, ATM or foreign transaction fees are all free for Asia Pacific residents.

There are however limits to how much you can top up and spend with a Wirex account⁶:

| Limit | |

|---|---|

| ATM | S$ 300 per day |

| Card Spend | S$ 5,000 per transaction |

| Top up by credit or debit card | USD $ 5,000 |

| Digital currency withdrawal | USD $ 10,000 per transaction/ USD $50,000 per day |

With a Wirex wallet, you can top up on global currencies, and buy, sell and exchange cryptocurrencies all from one platform. The wallet, which is the only product available in Singapore at the moment, is more for the trading of crypto and holding the global currencies.

But when the Visa card does become available, it will provide additional freedom to use your wallet like a normal account. To clarify, the Visa card is not linked to your cryptocurrencies and will only spend the global currencies in the account. A specific caveat for the Asia Pacific region is that any money held in MXN, CZK, CHF, and CAD in the wallet can not be used to spend against the card. But for the remaining currencies, an additional benefit is that there are no exchange fees or transaction fees when using the Wirex Visa card⁷.

When the Visa card does open up, it will provide you another outlet to take advantage of attractive exchange rates, free ATM withdrawals, and low fees when traveling overseas.

Wirex makes it cheap to spend overseas using their Wirex Visa card. With very low fees and no charges on ATM withdrawals, this can be an attractive option when it becomes available. The fact that Wirex can hold cryptocurrencies and global currencies in one account can make this card more useful for those who are using or dabbling in both.

One of the drawbacks however of Wirex is that there are only a handful of global currencies that they allow. The wallets are restricted to only USD, EUR, GBP, SGD, AUD, JPY, HKD, CZK, MXN, CAD, and CHF. So it will only make sense if you are looking at these currencies primarily, which can limit your use. If you are looking for a card that can be used in THB, MYR, CNY or IDR along with many more, take a look at the cheap and low cost Wise borderless card.

Wise can be your global payment partner. With access to over 59 currencies, you can buy and spend locally as you travel to neighboring countries or around the globe all from one account and card. You can use the card when you’re on holiday or business, or even when you are shopping online on Alibaba, Amazon, and Qoo10 from home.

Wise doesn’t use cryptocurrencies but instead uses smart technology to make it cheap for you to spend around the world. You will always get the mid-market exchange rate on every transaction, that is the same rate the banks use. For any top-up from SGD to another currency, all you will pay is one low conversion fee between .35-1%. That’s it. No foreign transaction fees or markups or commissions. It is simple, cheap and fast with the Wise borderless card. So if you are looking for a non-cryptocurrency wallet and card that is easy to sign up, look no further than Wise.

**Sources used for this article:**All sources checked as of 22 March, 2020

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking for the best online brokerage in Singapore? Compare platforms like IBKR, Saxo and Moomoo on fees, features and more to find the right account.

Looking to start trading? Check out our guide which compares top platforms like Moomoo, Tiger Brokers, and more to help you start investing

Learn how to invest in the S&P 500 in Singapore. Discover S&P 500 ETFs to buy, compare top brokers, and get tips on minimizing fees and tax considerations.

Considering the Maybank Family & Friends card? Read our 2025 review on its cashback, benefits, and fees. Find out if it's the right fit for your spending.

Compare the OCBC 90°N, VOYAGE and Premier Visa Infinite cards to find Singapore’s best OCBC miles credit card for your spending habits and travel goals.

Looking for the best credit card with free travel insurance in Singapore? Compare top cards like UOB and AMEX to get complimentary coverage and save on trips.