Best No Foreign Transaction Fee Credit Cards in Singapore (2026)

Compare the best no foreign transaction fee credit cards in Singapore, including fees, rewards, eligibility, and overseas spending benefits.

Singtel Dash is a mobile wallet in Singapore that includes international money transfer functionality. It allows users to send money to selected overseas destinations, currently covering over 35 countries and 12 currencies. The service is commonly used for cross-border payments such as supporting family members abroad or paying overseas workers, alongside local wallet features.

This guide outlines the key details of Singtel Dash’s remittance service, including fees, transfer limits, supported countries, and setup requirements. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

Singtel Dash is a mobile e-wallet operated by SingCash Pte Ltd, a Singtel subsidiary licensed by the Monetary Authority of Singapore (MAS). Despite the Singtel branding, the service is not restricted to Singtel mobile customers—anyone with a Singapore mobile number can register.

In addition to local wallet functions, Singtel Dash includes international remittance services to selected countries. Its main features include:

By default, the wallet has a transaction limit of S$1,000, which can be adjusted within the app depending on verification status.

Verification typically takes 1–2 working days, with confirmation sent by SMS.

For users who prefer in-person assistance, Singtel Dash also supports onboarding at selected service counters, including Lucky Plaza and City Plaza.

Singtel Dash supports remittance to over 35 countries, mainly across Asia-Pacific, Australia, and parts of Europe and the UK. Coverage focuses on common migrant workers and regional payment corridors rather than global reach.

Popular destinations include:

Asia-Pacific

Europe & UK

Delivery options depend on the destination and may include:

Availability, delivery methods, and limits vary by country.

Singtel Dash charges a fixed transfer fee that depends on the destination and payout method. Fees are generally low for selected Asian corridors, particularly e-wallet transfers.

However, the total cost of a transfer is made up of:

This means the effective cost can vary even when fees appear similar across providers.

Below are example fees for common corridors³:

| Country | Service | Fee (SGD) |

|---|---|---|

| Australia | Bank account | 4.00 |

| Bangladesh | Bank account / Cash pick-up | 3.50 |

| Bangladesh | bKash wallet | 2.00 |

| China | 5.00 | |

| China | Alipay / UnionPay | 10.00 |

| India | Bank account | 3.50 |

| India | Cash pick-up | 4.00 |

| Indonesia | Bank account | 6.00 |

| Indonesia | E-wallets (DANA, OVO, GoPay, LinkAja, ShopeePay) | 2.50 |

| Malaysia | Bank account / Touch 'n Go | 2.00 |

| Philippines | Bank account | 3.80 |

| Philippines | Cash pick-up | 4.50 |

| Philippines | GCash | 3.50 |

| Thailand | Bank account | 5.00 |

| United Kingdom | Bank account | 4.00 |

Fees and exchange rates may change, so users should always check the final amount in-app before confirming a transfer.

If you want to send money to other parts of the globe, you will be required to get another money transfer provider. Instead, why not download the free award-winning Wise app that lets you send money the cheap way to over 140+ different countries?

Open your free Wise account now

Transfer limits depend on your account type and verification status:

| Account Type | Daily Limit | Monthly Limit | Annual Limit |

|---|---|---|---|

| Non-Work Permit holders | S$5,000 | S$25,000 | S$100,000* |

| Work Permit holders | S$3,000 | S$3,000 | S$100,000* |

*Annual limit applies to total Dash wallet debit transactions, including remittance.

You can register up to 5 recipients on your account. Some destination countries may have additional transaction limits, for example, regular GCash users in the Philippines have a monthly limit of PHP 100,000.⁴

Transfer speed depends on the destination and delivery method:

Transfers initiated outside banking hours or on weekends may take longer to process.

Before you can remit money, you'll need funds in your Dash wallet. Here are your top-up options:

Free methods:

Fee-based methods:

Note: If you've enrolled in PayNow VPA/FAST, credit card top-ups will be disabled for your account.

Beyond remittance, Singtel Dash works as an everyday payment wallet:

Partner merchants include 7-Eleven, Deliveroo, Food Panda, Pizza Hut, Watsons, Sheng Siong, and Qoo10. The app regularly features cashback offers, referral rewards, and preferential exchange rates on selected remittance promotions.

Need help? Support is available through multiple channels:

While Singtel Dash can make the overseas transfers look easy, you might feel restricted in your international transfer. First, you can’t send more than S$ 30,000 per year. Then you can be hit with a high transfer fee on what you do send. Plus a hidden fee in the exchange rate, different from the mid-market rate. When it all adds up, Singtel Dash can end up costing you more than you expect.

Although Singtel Dash is convenient for everyday spending and local transfers, sending money overseas can be costly due to higher fees and less competitive exchange rates. Wise provides a more cost-effective option, enabling you to remit money home with transparent, low fees and real exchange rates.

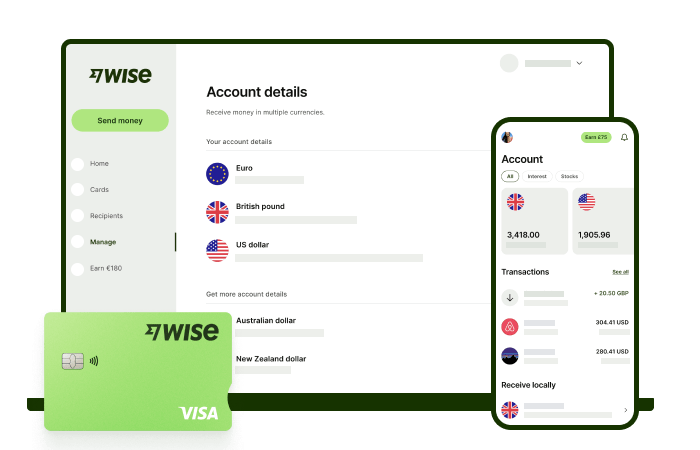

Wise international money transfers can be set up online or within the Wise app with low fees from 0.26% and the mid-market rate, to over 140+ countries. There’s no markup added to the exchange rate that’s used to convert your currency, which makes it easier to see exactly what you're paying for a transfer, and what the recipient will get in the end. Just transfer the amount indicated in SGD and let Wise do the rest.

Track your transfers easily when you create a free Wise account, and manage, hold, and convert your money in SGD and 40+ other currencies. You'll get the same great rates, and be able to track your transfers all from one place. As a bonus, you can also get 8+ local account details to be able to receive money in SGD, USD, GBP, and more.

✍️ Sign up for a free account now

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Compare the best no foreign transaction fee credit cards in Singapore, including fees, rewards, eligibility, and overseas spending benefits.

Learn how work permit holders in Singapore can open a bank account, including requirements, options, and how to receive salary payments.

Review the GXS Savings Account in Singapore, including interest rates, features, pros and cons, and whether it’s worth opening in 2026.

A detailed review of the Trust Savings Account in Singapore, covering interest rates, plans, fees, rewards, and who it’s best for.

A detailed review of the Mari Savings Account, including interest rates, fees, limits, cards, transfers, and how to open an account in Singapore.

Looking for the best online brokerage in Singapore? Compare platforms like IBKR, Saxo and Moomoo on fees, features and more to find the right account.