How to avoid credit card overseas charges when spending abroad

Using your credit card overseas? Learn about foreign transaction fees, FX markups and DCC, and how to avoid extra charges when spending abroad.

iRemit Singapore is a local arm of the global iRemit company. With iRemit Singapore you can send money to the Philippines either through their branch on the island or through the iRemitx app. But before you sign up, make sure you understand the hidden exchange rate fee in iRemit transfers. Take a look at what iRemit Singapore entails and if you want to use it for your next transfer to the Philippines.

| Table of contents |

|---|

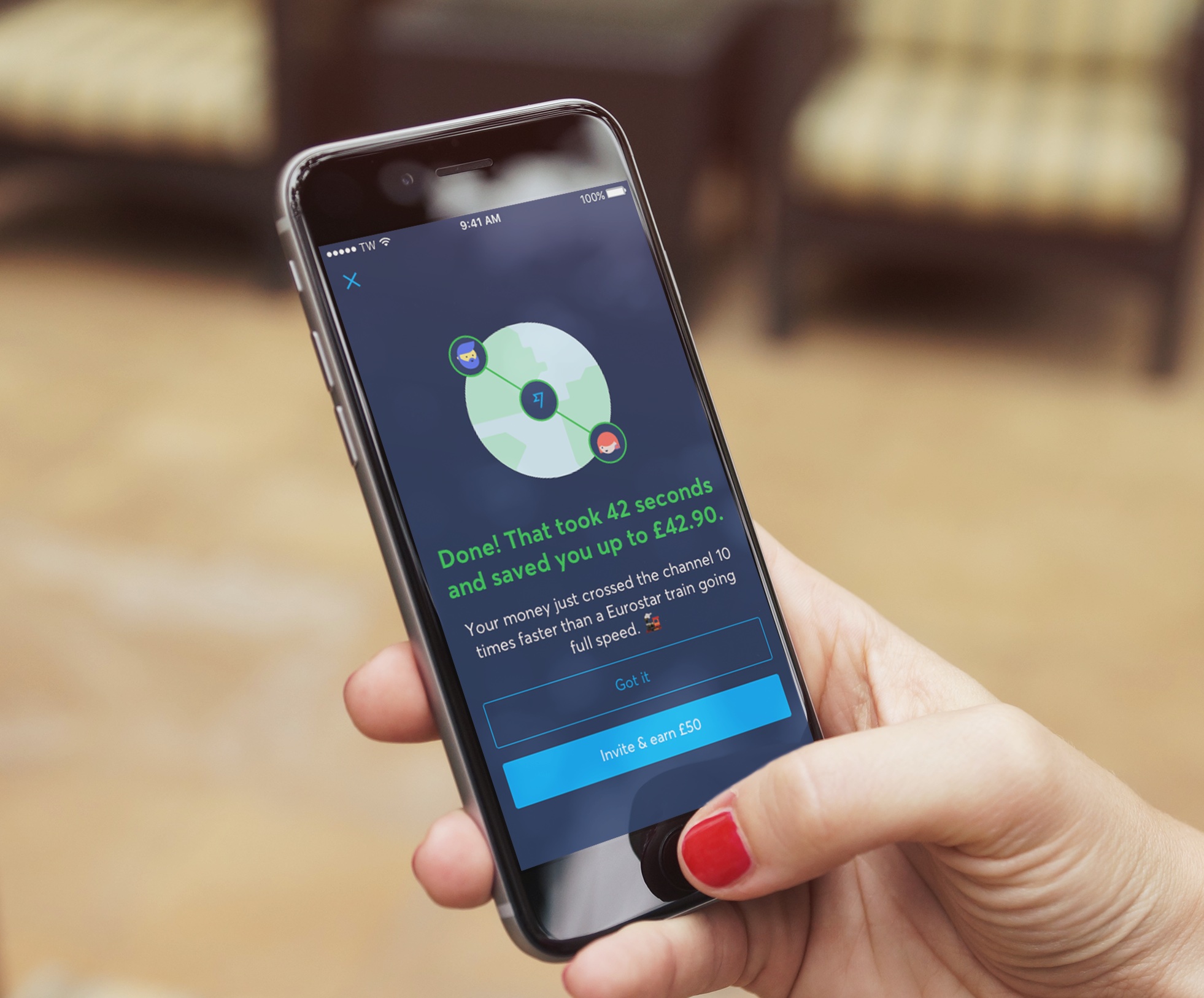

And if you want to have one award-winning app and account that lets you send money to over 150 countries around the world, look no further than Wise. With cheap transfer fees and the real exchange rate, you can save money on your next global transfer compared to other transfer services.

Open your free Wise account now

You can send money to the Philippines with iRemit Singapore in three different ways

As for receiving the money, you can credit any bank account in the Philippines or use one of the 20,000 available cash pick-up centres in the country with iRemit. Other services like door-to-door payment, payment for bills through iPay, and shopping through iShop are also available with iRemit affiliates.¹

To get started with iRemit, you can physically go to the branch with your government issued ID and fill out a form to open an account. If you are using the online method, you can sign up on their website with the ‘Join Now’ button. You will be asked to fill out your details and upload a copy of a government issued ID. This can be an NRIC card, passport or driver's license. Also, make sure you have a local Singapore phone number to sign up.²

iRemit Singapore has two different fees for remittances to the Philippines. The first is a transfer fee for the transaction itself. iRemit is not upfront with how much it will be, but customers have said to expect the fee to be between S$ 4-5 per transaction.

On top of this, there is a hidden exchange rate fee. If you compare the real exchange rate that you see on Google and the rate that iRemit offers, you will see a small difference in rates. iRemit makes their exchange rate weaker for customers so they are able to take the difference as a fee. So now not only are you paying a transfer fee, you are paying even more through the hidden exchange rate fee.³

Along with the transfer fee, iRemit is not upfront about how much you can send in a single transaction. Existing and past customers have noted that the maximum you can send is PHP 50,000 per transaction.⁴

Currently, you can expect a bank to bank transfer to take two business days to arrive. This may differ depending on your specific transfer and mode of delivery to your recipient in the Philippines. So check with iRemit to get the exact transfer time for your transaction.⁵

There are many ways to reach iRemit. You can reach the Singapore office directly at 65- 6516-9405 Monday through Sunday from 8am-8pm. You can also reach them directly on Whatsapp, Facebook or Viber, and by email at iask@iremit-inc.com. You will also have access to information about your transfers and help through the iRemitX app.

With friends and family living all around the world, you need a single provider that makes it easy for you to send money where it needs to go. That is where Wise comes in. With its one award-winning app, you can send money cheap, fast and easily right from your mobile. And the best part is that you will know upfront how much it will cost.

Unfortunately with iRemit it may be difficult to actually know how much a transfer to the Philippines will cost you. iRemit is not open or upfront with their prices beforehand, so to know your transfer fee you will have to register first. And there can be differing fees depending on how your recipient is getting the money in the Philippines.

But one factor to look at with iRemit is their exchange rate. They advertise their daily or weekly exchange rate on their social media and website. But when compared to the real exchange rate you can see the difference in rates. The real mid-market exchange rate is the rate that banks use themselves and the one you see on Google. It is also the exchange rate that you get with Wise. Let’s see how the hidden exchange rate fee pops up with iRemit⁶:

| Exchange Rate for S$ 1 | Filipino Pesos for S$ 1,000 | |

|---|---|---|

| iRemit | PHP 35.40 | PHP 35,400.00 |

| Real Exchange Rate | PHP 35.50 | PHP 35,500.00 |

| As of August 14, 2020 |

With iRemit’s hidden exchange rate fee, you lose PHP .10 automatically with every Singapore dollar you convert. It may seem small, but if you are looking to send S$ 1,000 or more, that can mean losing at least PHP 100 on a transaction. And this is on top of iRemit’s transfer fee.

Why lose money on hidden exchange rate fees when you can send money to the Philippines at the real exchange rate every time with Wise

Open your free Wise account now

If you want to send money directly to local bank accounts around the world at the real exchange rate and with one low transfer fee, Wise has you covered. You will never get a hidden fee or marked up exchange rate. By using smart technology, Wise is able to pass on savings to you by giving you one low upfront fee on your global money transfers. And you can sign up for Wise for free and send money directly from your mobile. Over 7 million people use Wise for their global money transfers. Sign up today and see how much you can save on your next transfer to the Philippines.

Sources used for this article:All sources checked as of 14 August, 2020

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Using your credit card overseas? Learn about foreign transaction fees, FX markups and DCC, and how to avoid extra charges when spending abroad.

Learn how Singapore income tax works for foreigners, including tax rates, residency rules, reliefs and how to file your return with IRAS.

Learn everything you need to know about sending an e-ang bao with DBS eGift.

Learn how to get new notes from banks in Singapore for Chinese New Year, including release dates, booking steps, ATM options, and alternatives if you miss out.

Learn how to send an e-hongbao or digital ang bao to loved ones near and far.

Compare the best no foreign transaction fee credit cards in Singapore, including fees, rewards, eligibility, and overseas spending benefits.