How to avoid credit card overseas charges when spending abroad

Using your credit card overseas? Learn about foreign transaction fees, FX markups and DCC, and how to avoid extra charges when spending abroad.

eRemit is an online money transfer service that lets you send money primarily to countries in Asia and Southeast Asia.

And while the app and website are better than going to a foreign exchange counter, eRemit requires you to make your remittance payments through a third party app or machine. Read on to learn more about how eRemit works and how much it can cost you when you want to transfer money regionally.

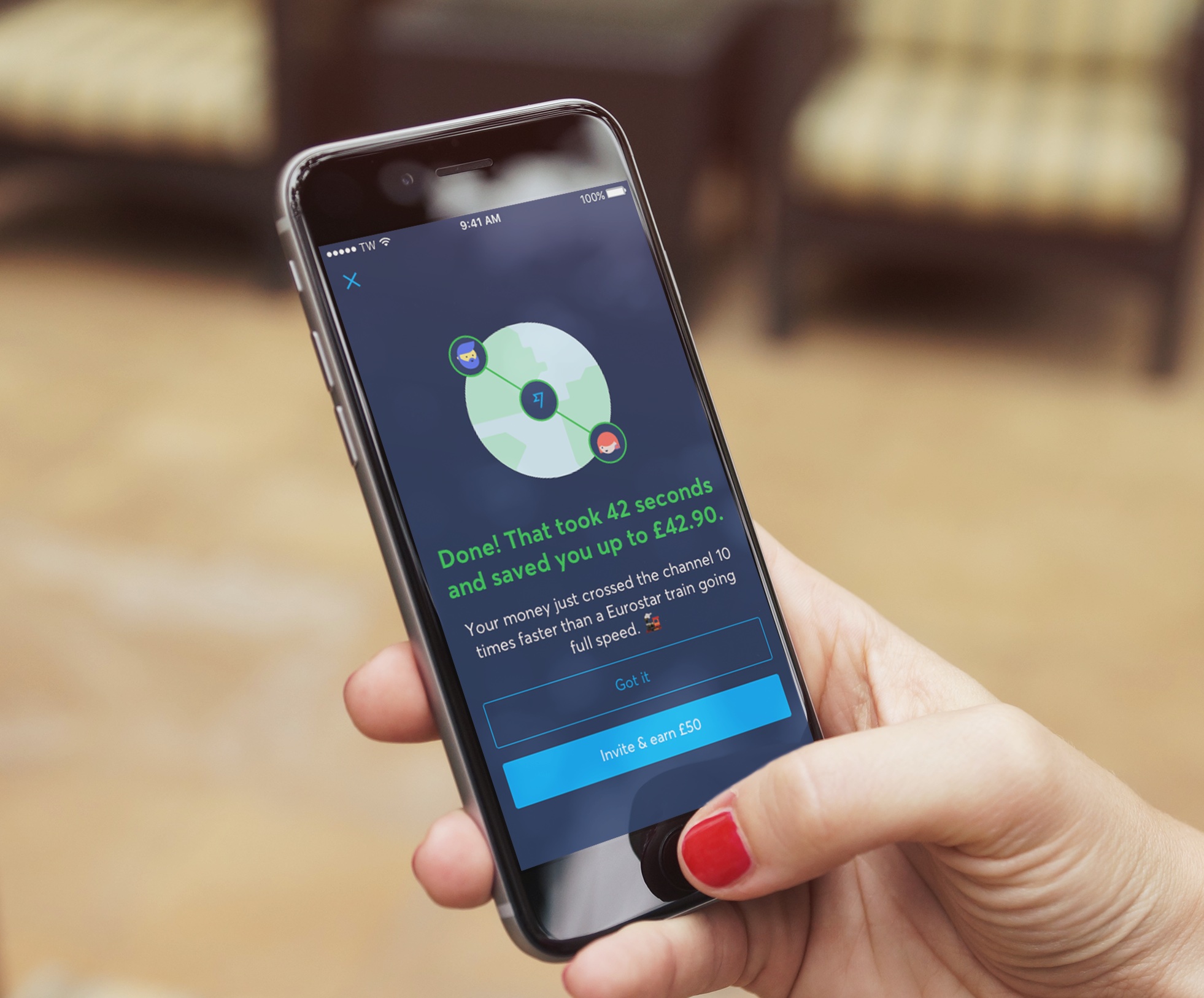

But if you want to send money to more of the world with less fees, try Wise. In a one-stop website and app, you can check the real mid-market exchange rate, get the delivery time and make a transfer, including payments, in just a few easy steps.

Open your free Wise account now

With eRemit, you can send money to the 13 different countries listed below:

| 🇦🇺Australia | 🇧🇩Bangladesh | 🇮🇳India |

| 🇮🇩Indonesia | 🇲🇲Myanmar | 🇵🇭Philippines |

| 🇲🇾Malaysia | 🇳🇵Nepal | 🇵🇰Pakistan |

| 🇱🇰Sri Lanka | 🇹🇭Thailand | 🇻🇳Vietnam |

| 🇨🇳China |

But the catch with eRemit is that it is a two part process to send money home. First you will have to submit the remittance through the eRemit website or mobile app.

Once you have done that, you are required to then go to any AXS machine in Singapore or download the AXS m-station app to make the payment. And remember, you have to make the payment within 3 hours or your transaction gets cancelled.¹

Before looking at how a transaction works, lets dig into how to first open an account with eRemit.

To open an account with eRemit, you have to be at least 18 years old and have a valid NRIC, FIN or Work Pass. And you need to make sure you have an active and registered Singapore mobile number. It can either be postpaid or prepaid.

You can then start by downloading the eRemit app from the Google Play Store or the Apple App store. You can also register at the eRemit website at www.eRemit.sg.

You can then use MyInfo to complete your registration, or manually upload documents for verification. For foreigners, the documents will include your FIN and a residential address proof.

Once you are registered, your account will be activated so you can start sending money. Make sure you have your recipients details like their full name, mobile number, address, bank account details, date of birth, nationality and the nature of the relationship on hand to get your transaction started.²

There are two fees that you can expect with eRemit. The first is a service fee levied by eRemit for the transaction. The service fee will vary depending on the country you are sending money to. Here is a quick look at the fee for sending S$ 1000³:

| Country | Fee |

|---|---|

| 🇦🇺Australia | S$ 8 |

| 🇮🇩Indonesia | S$ 3 |

| 🇲🇾Malaysia | S$ 3 |

| 🇱🇰Sri Lanka | S$ 4 |

| 🇧🇩Bangladesh | S$ 3 |

| 🇲🇲Myanmar | S$ 6 |

| 🇳🇵Nepal | S$ 6 |

| 🇹🇭Thailand | S$ 4.50 |

| 🇮🇳India | S$ 3 |

| 🇵🇭Philippines | S$ 3.50 |

| 🇵🇰Pakistan | S$ 6 |

| 🇻🇳Vietnam | S$ 6 |

| 🇨🇳China | S$ 8 |

The second fee that you can expect from eRemit is tucked away in the exchange rate you get for your transaction. eRemit sets their own exchange rate to be weaker, in other words lower, than the mid-market exchange rate.

The mid-market exchange rate is the rate the banks use themselves and the same rate you see on Google. By setting their rate lower than the mid-market rate, eRemit is able to sneak in a fee in the difference. And in turn, you get a hidden fee on every Singapore dollar you convert which means less money being sent home.

Check out the next section to see how this hidden fee can really add up when you're sending money with eRemit.

The maximum and minimum amounts you can send with eRemit will depend on which country your money is going to.

The maximum amount you can send through AXS is S$ 9,990 per transaction, and that has to include the service fee.

But the maximum you can remit per day is S$ 25,0000 and S$ 100,000 per calendar month.⁴

eRemit is not upfront with how much time it will take to send a transaction. The amount that you are sending, where it is going and how it is going to be delivered all factor into how much time it will take to get there. Once you sign up for eRemit and calculate a transaction, you should be able to see the delivery time.

You can reach out to eRemit customer support through WhatsApp at 88110202 everyday from 9am to 6pm. You can also drop an email at supportdesk@eremit.sg if you have any queries. In addition, you can also reach out to them through social media on Facebook and Instagram.

Want to send money globally without having to switch apps or go to a machine? Try Wise. You can send money to local bank accounts in over 60 different currencies right from the award-winning app, without ever leaving your house.⁵

If you want to send money with eRemit it can seem easy to do so with the app or through the website. But in actuality it may cost you more than you realize versus other competitors.

Let’s take a look at how much it will cost you to send S$ 1000 to friends in Thailand, and compare it to Wise. Wise will give you one transfer fee but also the real mid-market exchange rate on every transfer.

| eRemit⁶ | Wise | |

|---|---|---|

| Amount to send | S$ 1000 | S$ 1000 |

| Transfer fee | S$ 4.50 | S$ 8.54 |

| Exchange rate | 22.720 THB | 22.9498 THB |

| Amount recipient receives | 22,617.76 THB | 22,753.81 THB |

Just by switching to the easy-to-use Wise app or website, you can send close to 150 THB more to your recipients in Thailand. While eRemit’s transfer fee is lower, the weaker exchange rate ends up eating into the money being sent. So in this case, your friends will get more money in hand when you use Wise.

Open your free Wise account now

Wise lets you transfer money to local bank accounts in over 150 different countries with just a low transfer fee and a transparent mid-market exchange rate.

And you can do it all from the simple and easy to use website or app. You’ll be told the exchange rate, the fee, the delivery time and how to make the in-app or site payment right away. No surprises here.

That is why over 8 million people use Wise to send money overseas. And with smart technology, Wise makes your transfer fast too. And the best part is that it is free to open an account. Sign up today and see how much you can save on your next transfer overseas.

Sources used for this article:All sources checked as of 2 September, 2020

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Using your credit card overseas? Learn about foreign transaction fees, FX markups and DCC, and how to avoid extra charges when spending abroad.

Learn how Singapore income tax works for foreigners, including tax rates, residency rules, reliefs and how to file your return with IRAS.

Learn everything you need to know about sending an e-ang bao with DBS eGift.

Learn how to get new notes from banks in Singapore for Chinese New Year, including release dates, booking steps, ATM options, and alternatives if you miss out.

Learn how to send an e-hongbao or digital ang bao to loved ones near and far.

Compare the best no foreign transaction fee credit cards in Singapore, including fees, rewards, eligibility, and overseas spending benefits.