What's The Best Bank Account For A Singapore-based Sole Proprietorship?

Discover why it's important for Singapore sole proprietorships to maintain a separate business bank account and the best account options available.

A business debit card can be the best way to manage spending and expenses for yourself and your team. Make convenient purchases online and in person, withdraw cash when you need to, and have everything accounted for in a consolidated statement so you don’t need to chase and reconcile separate bills.

Choosing the right business debit card will take a bit of research, as different cards come with their own features and fees. This guide is a great place to start, with a range of the best business debit cards in Singapore, whether you’re looking for convenient day to day spending, or low cost international transactions.

Here’s an overview of the key features of our top pick of Singapore business debit cards:

| Maintenance fee | Foreign transaction fee | ATM fee | Cashback/ rewards | Mobile payments | Digital card | Early closure fee | |

|---|---|---|---|---|---|---|---|

| Wise Business Card | No maintenance fee | No foreign transaction fee | 2 withdrawals a month, to 350 SGD fee free. 1.75% after that | Currently limited | Yes | Yes | No |

| OCBC Business Debit Card | Up to 10 SGD/month | 2% | Up to 5 SGD/withdrawal | Yes | Yes | Yes | 50 SGD |

| UOB Business Debit Card | 35 SGD/month fall below fee for SGD business account 36 SGD/annual card fee | Fee may vary based on account type | Up to 5 SGD/withdrawal | Yes | No | No | 50 SGD |

| SC Business Debit Card | 50 SGD/month fall below fee | Up to 3.5% | Networked ATM withdrawals free Up to 60 SGD out of network fee | Yes | No | No | 500 SGD |

| DBS Business Debit Card | Annual fee 40 SGD | 3.25% | Fee may vary based on account type | Yes | No | No | 50 SGD |

| Maybank Business Debit Card | Varies based on account - 35 SGD fall below fee for PremierBiz account | 2.25% | 5 SGD | Yes | No | No | 50 SGD |

*Fees correct at time of research - 25 April 2022

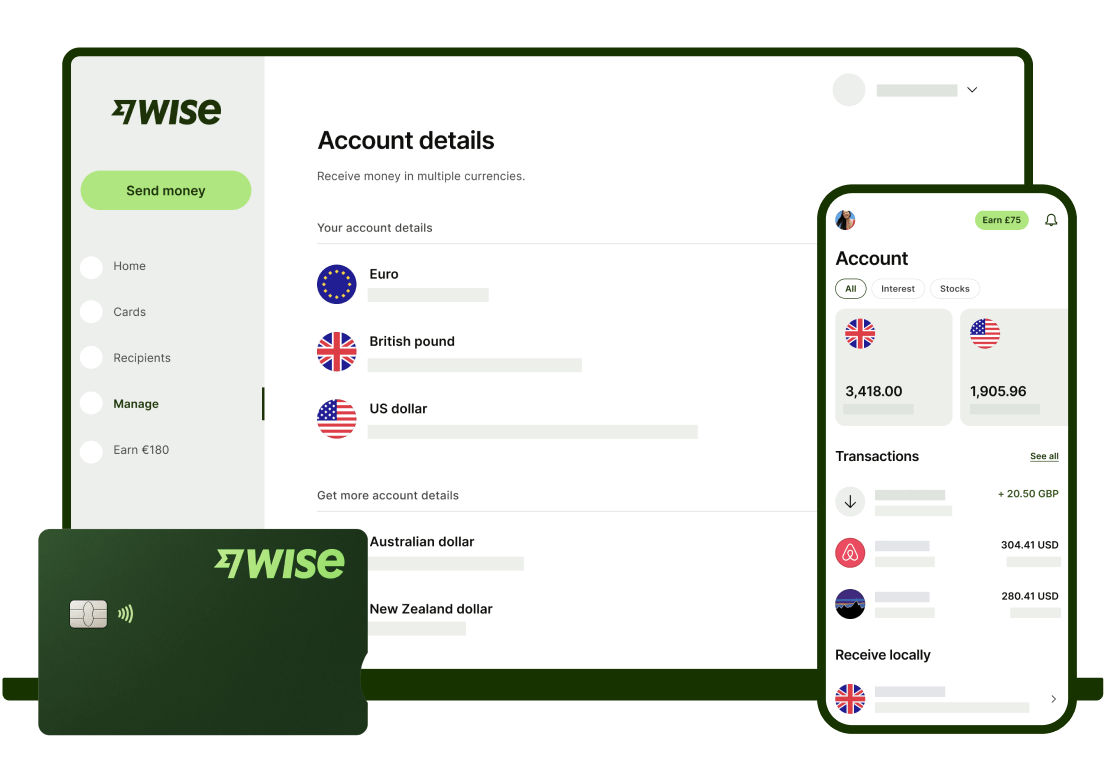

The Wise multi-currency business account and Visa debit card is perfect for anyone transacting in foreign currencies, allowing you and your team to spend internationally in person and online with no foreign transaction fees.

|

|---|

If you or your team need to travel for business - or if you have customers, suppliers or staff overseas - the Wise account can save you money, offering currency conversion with the real exchange rate and low, transparent fees.

Spend with your Wise business card to avoid foreign transaction fees which can add 2% - 3% to every purchase made with a regular bank, and get a better exchange rate every time. Get a full feature Wise business account for a one off payment of S$ 99, and order cards for yourself and your team for 4 SGD each.

Learn more about Wise Business

If you already have an OCBC business account you’ll be able to easily access either a physical or digital OCBC business debit card¹ for day to day spending.

|

|---|

Anyone with an OCBC business bank account can also access an OCBC Mastercard debit card - the digital cards are instantly available simply by logging into your online banking service. You can also order physical cards if you’d prefer.

If you don’t already have an OCBC business account you might be able to get one opened online, depending on your personal circumstances. Different accounts have different features and fees - including maintenance fees and early closure fees in many cases². Review the accounts offered to make sure you’re picking the right one for your needs.

Get a branded, all in one business debit card with the UOB business current account.

|

|---|

The UOB business debit card³ can be personalised to your company, to show your logo or other important information. Cards can be used for contactless payments globally, wherever you see the Mastercard logo displayed. All spend will attract a 0.3% cash back, and there are also other UOB member privileges and rewards based on your account usage.

The UOB business current account has a minimum balance of 10,000 SGD a month, with a fall below fee of 35 SGD a month if you fail to maintain this balance. There are also annual card and account fees to consider, plus an early closure penalty of 50 SGD⁴⁵.

Standard Chartered business bank account holders can apply for an SC business debit card⁶ to make it easier to spend and make withdrawals.

|

|---|

The SC business debit card offers automatic rebates of up to 15% on different spending categories, including office expenses, travel and more. There are also a range of perks for cardholders, featuring dining, lifestyle and travel benefits.

The fees involved in using the SC business debit card will depend on the linked business account you hold⁷. Costs and minimum balance requirements vary quite significantly so it’s worth weighing up your choices before you get started with a Standard Chartered business bank account.

DBS business debit cards⁸ are available to customers with a DBS business bank account, offering spending rebates, travel accident insurance and more.

|

|---|

You’ll be able to apply for a DBS business debit card if you have a DBS business bank account - or if you’ve not opened your account just yet, get the whole process started online. DBS business debit card customers can set their own transaction limits, make withdrawals and spend around the world, and unlock card holder benefits and privileges.

It’s worth noting that fees do apply to the card, including a 3.25% foreign transaction fee if you’re paying for something internationally when you travel or shop online⁹.

Maybank customers holding a corporate current account product can also get the Maybank Business Platinum Visa Debit Card¹⁰ for easy daily spending.

|

|---|

The Maybank business debit card allows contactless payments, and cash withdrawals around the world. You’ll be able to earn points on spending which can be traded in for airmiles, vouchers or other handy benefits - and if you book your travel using your card you may also qualify for some complimentary travel insurance to keep you and your things safe while you’re away.

The overall costs of using a Maybank business card will depend on the specifics of the account you hold. There may be a minimum balance to consider, with fall below fees applying if you don’t maintain that funding level. International card spending can also prove costly, with a 3.25% foreign transaction fee on all purchases¹¹.

Choosing the right business debit card for your needs can mean you save money, and get easy convenient ways to spend for both you and your team. Use this guide as a starting point to pick the best card - or cards - for your business. And don’t forget, if you’re transacting internationally, check out the Wise multi-currency business account and card as a smart way to save.

Sources:

Sources checked on 26.04.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover why it's important for Singapore sole proprietorships to maintain a separate business bank account and the best account options available.

Explore ANEXT Bank's business account features, fees, and benefits. Compare with Wise Business to find the best fit for your Singapore SME.

Learn about Volopay’s all-in-one spend management platform for businesses in Singapore. This review covers its features, fees, and key benefits.

Learn about the OCBC Business Debit Card, what it costs, how to apply, and what alternatives there are out there.

GXS Biz Account offers daily interest and easy transfers for Singapore sole proprietors. Learn about its features, fees, and rates in detail.

Get a full review of Citibank’s corporate cards, including everything you need to know about each card’s key features, benefits, fees and rates.