How to avoid credit card overseas charges when spending abroad

Using your credit card overseas? Learn about foreign transaction fees, FX markups and DCC, and how to avoid extra charges when spending abroad.

The Amaze Card offers a few different features, including options to link your existing Mastercard or top up a multi-currency wallet with PayNow. You can earn some InstaPoint rewards on wallet spending - but with changes to rewards and some fees linked in March 2025, the way you use Amaze may be set to change.

This full Instarem Amaze Card review looks at the Amaze Card benefits in full, plus how to use the Amaze Card and how it measures up against popular alternatives with a rundown of the Amaze Card vs YouTrip vs Wise card. Let’s dive right in.

| Table of contents |

|---|

The Amaze Card from Instarem allows you to either link Mastercard credit or debit cards, or top up your Amaze e-wallet using your card or PayNow, to spend in person and online, and view and manage all your spending in one place.

Amaze Cards have a few specific features:

Amaze is a little different to some other international spending cards you may have seen. With the Amaze Card you have a couple of options:

If you’re topping up your Amaze wallet you’ll only ever be able to spend the amount of money in the account. However, if you prefer to link a Mastercard, you can choose a debit or credit card, which can mean you can spend on credit through Amaze as well.

In this way, the Amaze Card can pull together different functions and features, and act as either a credit or debit card depending on how you set it up.

So why bother using Amaze then? Here are some of the Amaze Card benefits you’ll want to know about¹:

If you already have an Amaze card you’ll want to make sure you’re abreast of the changes coming in March 2025. Amaze has launched the enhanced wallet feature which allows you to add money with your card or PayNow, and convert to 11 foreign currencies for spending. However, there have also been a few bigger changes³:

If you use your Amaze Card as a prepaid wallet, you can spend up to the daily amount specified in your Instarem app. You can spend up to 15,000 SGD per transaction, with a 75,000 SGD annual limit³.

If you link one or more Mastercards to your account you can spend up to 50,000 SGD per transaction, or to the limit of the specific card in question, whichever is lower.

Amaze Card international spending uses the Amaze exchange rate, which Instarem states can include a lower admin fee and markup compared to the rates typically used by banks.

You’ll be able to see the rate that will apply in the Instarem/Amaze app once you initiate a transaction. Compare the rate you’re offered against the mid-market exchange rate to see the markup - if any - that’s been added.

The mid-market exchange rate is the rate used when banks and other institutions buy currency themselves. However, it’s not often passed directly on to retail customers. Instead, organizations add a markup to calculate the retail exchange rate. This is an extra fee which pushes up costs overall.

Comparing a few different payment options is usually the best way to get a good exchange rate for your specific purchase - there’s a comparison of Amaze vs some other popular payment services coming up later to start you off.

Many people in Singapore have benefited from using Amaze as a way of maxing out the benefits they can get from card providers, while also earning InstaPoints. One very common way to do this has been to pair Citi Rewards + Amaze to get the benefit of the Amaze exchange rate and InstaPoints, plus Citi Rewards on your spending.

You might have read about the Amaze card nerf on various cards from providers like DBS and UOB, which prevented card holders from stacking points. However, using the Citi Rewards card with Amaze is still possible - with one big proviso.

Unfortunately, as of 10 March 2025, Amaze is changing some of its features. One result of this is that you can’t get InstaPoints on spending from a linked card. This means that you lose out when you use Amaze and Citi Rewards. The other big downside is that the InstaPoints you earn can no longer be converted to cash - only to Krisflyer miles, at a pretty low rate of return. This might mean that the Amaze/Citi Rewards pairing isn’t as attractive or competitive.

So we've looked at how to use Amaze with Citi Rewards - but it is worth it now? This will depend on your spending patterns and your personal preferences. Using Amaze with your Citi card can still mean getting good exchange rates and Citi’s own rewards of up to 4 miles per dollar. You lose out on the InstaPoints - but in reality, the biggest issue will likely be if you’re using your card to spend domestically.

The card’s additional 1% fee on all SGD spending means that people using their Amaze card for domestic spending are hit by extra fees right away when spending here in Singapore. This may mean that the costs of the transaction outweigh the benefits you can get from Citi, particularly now that you may not be able to earn InstaPoints or cash back - essentially, you’re paying a higher rate for miles now.

Let’s look at how the Amaze Card from Instarem measures up against a couple of other card options available in Singapore - the YouTrip card and the Wise Account.

| Amaze¹ | YouTrip³ | Wise | |

|---|---|---|---|

| Account maintenance fees | None | None | None |

| ATM fees | ATM withdrawals not available | 5 SGD + any applicable ATM operator fees⁴ | Up to 2 withdrawals per month, to 350 SGD in value, fee free 1.50 SGD + 1.75% after that |

| Currency exchange fees | No specific fee, exchange with Instarem rates | No specific fee, exchange with Mastercard rates⁵ | Exchange with mid-market rates and low fees based on currency |

| Overseas payment fees | Instarem fees - full details shown in the Instarem/Amaze app | Available for 10 holding currencies with YouTrip Send - fees available in app only⁶ | Send to 140+ countries, fees based on currency |

| Available currencies for holding and exchange | SGD² | 10⁷ | 40+ currencies |

| Available currencies/countries for card spending | Any Mastercard supported currency | 150+ currencies | 150+ countries |

| Withdraw a balance back to your bank | Not available | No⁸ | Yes - withdraw in a range of currencies |

| Rewards and cashback | 1% cashback | Promotional offers and cashback available | Limited range of promotions available |

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

While Amaze from Instarem offers some neat features including the option to link multiple cards and see all your spending in one place, it does have a few fees to know about, and some limitations in terms of international use. You can’t receive foreign currency payments to your account for example, and ATM charges kick in from the first withdrawal you make.

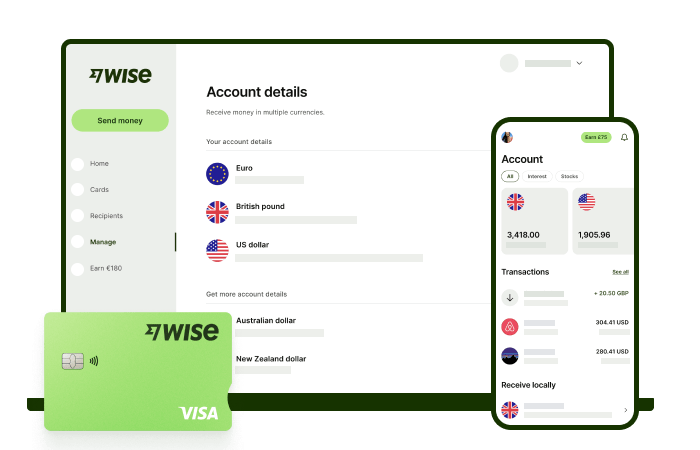

If you’re looking for a great all round option, check out the multi-currency Wise Account to hold 40+ currencies, send payments to 140+ countries, and get paid conveniently in select foreign currencies. You can also spend and make withdrawals - including some getting some fee free cash every month - with the linked Wise card.

If you use Amaze as a wallet and load a balance, you can earn InstaPoints on spending. As we mentioned earlier, this earning option was previously on all spending, and your points could convert to cash back. From March 10 2025 this changes - the new rules will be as follows:

You can no longer convert your points to cash back.

In addition to InstaPoints on wallet spend, you’ll continue to earn any points offered by your specific card if you’re spending with a linked Mastercard, rather than using Amaze as an e-wallet.

The Instarem Amaze Card lets you link one or more Mastercards for spending online and through Apple or Google Pay, both at home and abroad. You can also top up with a card or PayNow, to add SGD and convert to any of 11 currencies for wallet spending. You can earn InstaPoints on wallet spend, which can be converted to Krisflyer miles.

Because Amaze adds fees on some domestic spending, this is not a great option for most people looking to spend in SGD. If you’re interested in using the wallet for overseas use, or want to spend with a linked card to get the Amaze rates, it may be a good pick. However, you’ll need to review the available exchange rates before you decide.

Compare Instarem Amaze against alternatives like the Wise Account and card which lets you hold and exchange 40+ currencies, get paid in foreign currencies from a broad range of countries, send international payments to 160+ countries, and spend in 150+ countries. Wise uses the mid-market exchange rate with low, transparent fees, no ongoing charges and no minimum balance to maintain. Just get your account online or in the Wise app, and use it as and when you need it, for low cost international transactions in person and online.

Instarem Amaze lets you add funds to a prepaid wallet to use as a debit option, or to link Mastercard credit and debit cards for onward spending.

The Amaze Card is a Mastercard which you can either top up, or link to other existing Mastercard credit or debit cards for payments. You also can use PayNow to add funds to your Amaze Card.

The Amaze Card is compatible with Google Pay and Apple Pay.

You need to activate your physical Amaze Card before you can use it, although you can spend online before your physical card is available. To activate the Amaze Card:

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Using your credit card overseas? Learn about foreign transaction fees, FX markups and DCC, and how to avoid extra charges when spending abroad.

Learn how Singapore income tax works for foreigners, including tax rates, residency rules, reliefs and how to file your return with IRAS.

Learn everything you need to know about sending an e-ang bao with DBS eGift.

Learn how to get new notes from banks in Singapore for Chinese New Year, including release dates, booking steps, ATM options, and alternatives if you miss out.

Learn how to send an e-hongbao or digital ang bao to loved ones near and far.

Compare the best no foreign transaction fee credit cards in Singapore, including fees, rewards, eligibility, and overseas spending benefits.