Give your money a boost

Earn returns on EUR, GBP and USD by opening a Wise account and investing in a fund that holds government-guaranteed assets. Start with a cent, penny or dime. Spend any time, all while you grow. Capital at risk.

*Growth is not guaranteed and your money is at risk if governments default or interest rates go negative. Variable rates are based on 7 day performance as of 31/01/2024. See the past performance of each fund below.

Interest is offered in partnership with BlackRock and through Wise Assets. The funds aim to maximise current income through a portfolio of high quality short-term money market instruments. You may have to pay tax on your earnings — for example, capital gains tax.

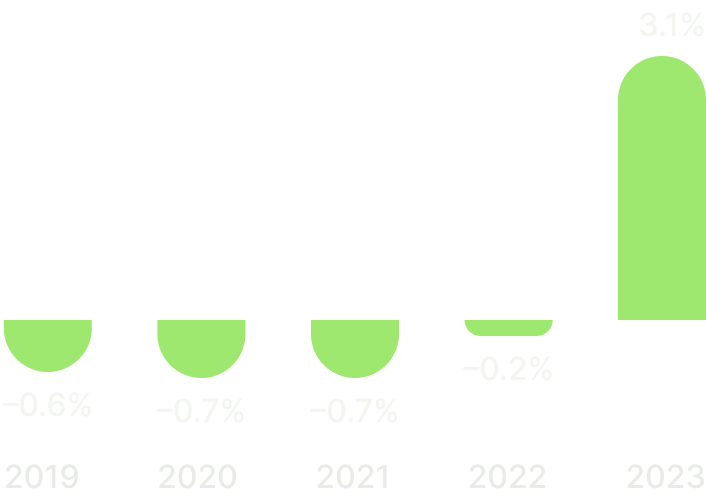

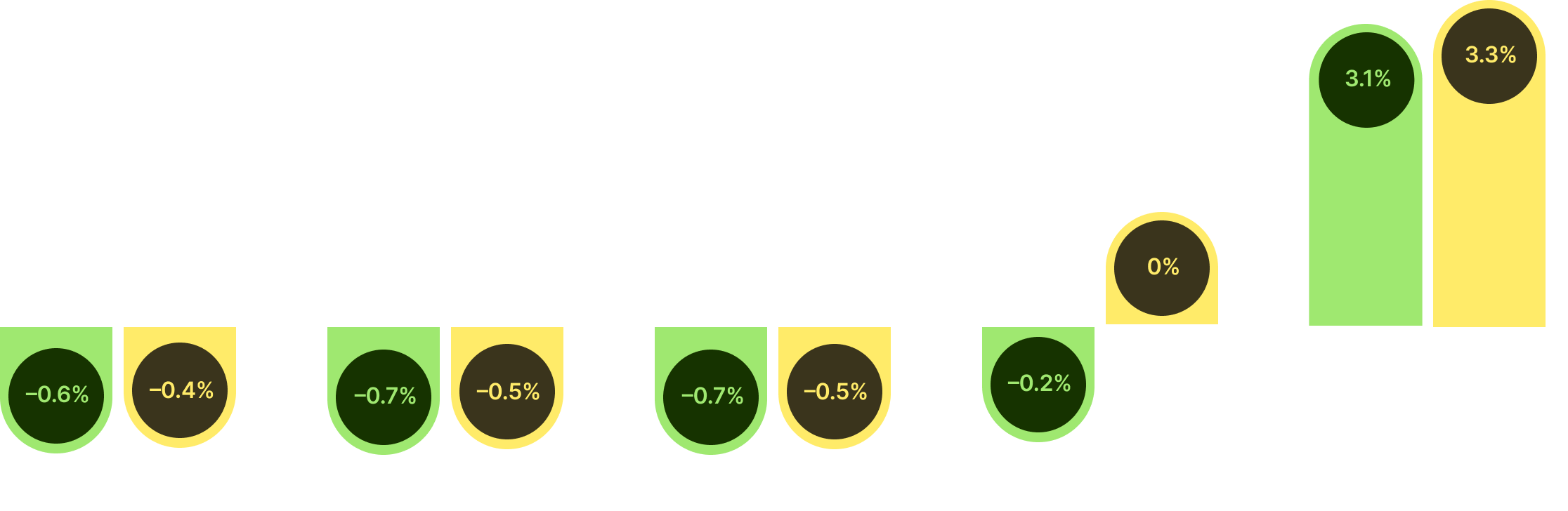

EUR fund tracks the European Central Bank rate

- Fund Rate

The graph shows past performance of the BlackRock ICS Euro Government Liquidity Fund. The fund has returned a 0.14% annual average over the last 5 years, excluding Wise fees. The current rates do not guarantee future growth and your return may increase or decrease as a result of currency fluctuations. For more on the fund's past performance, visit the BlackRock fund page.

FAQ

1 Investments in funds are never guaranteed and your capital can be at risk. Variable rate is based on 7 day performance as of 19/03/2024. This fund has returned a 1.31% annual average over the last 5 years, excluding Wise and fund manager fees. Interest is offered through Wise Assets. Wise Assets is a trading name of TINV Ltd, a subsidiary of Wise. TINV Ltd is authorised as investment firm and regulated by the Financial Conduct Authority (FCA). Our FCA number is 839689. We do not give investment advice, and you may be subject to pay tax. If you’re not sure, seek qualified advice.You can find more information about the funds on our website

.png)