Keep your money safe, and your business account secure.

Spend in any currency with Wise Business.

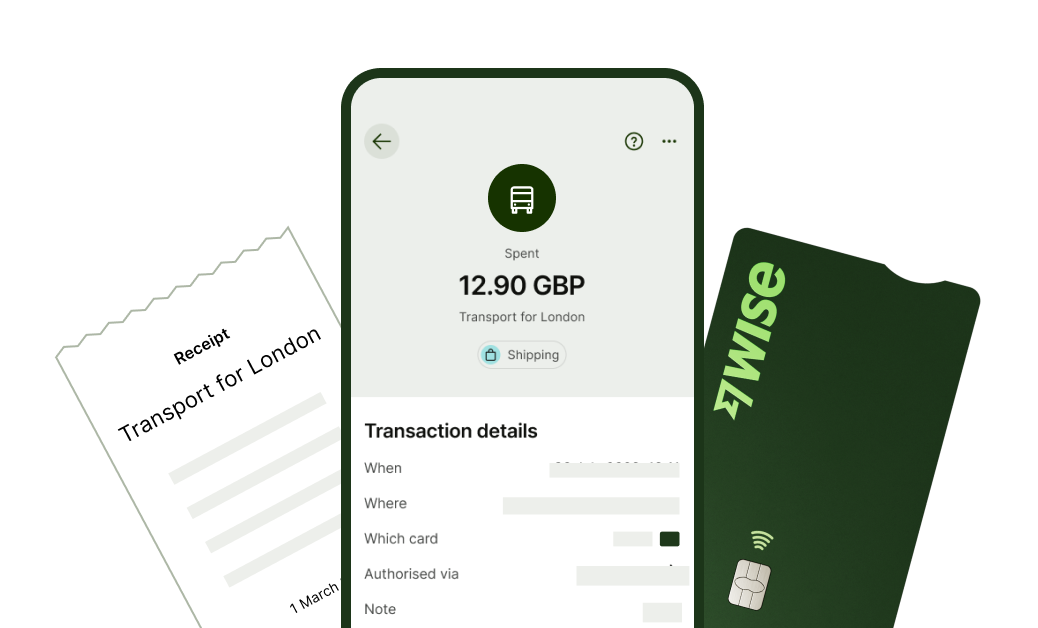

Get cards for you and your team to spend online and in-store — without foreign transaction fees.

Pay with the real exchange rate.

Pay in the currency of the country you’re buying from to save on conversion fees.

You can spend online or in-store in 55+ currencies and 200+ countries.

Keep track of what your team spends.

Team members can all have their own cards on your Wise Business account. So they don’t need to use personal cards for business expenses — and you can see what they’re spending in real time.

Spend before your card even arrives.

No waiting around for delivery. Your card details appear on your account as soon as you order.

So you can start spending with Google Pay or Apple Pay immediately — in-store and online.

FAQs

Start spending with Wise Business today

Order Wise Business cards as soon as your account is verified.