5 Ways to Stand Out and Boost Black Friday Sales

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Each business in all industries has one goal: a growing profit margin. Regardless of the industry and magnitude of the business, all business owners envision recording higher revenue year by year, and also enjoy unprecedented success.

When it comes to recording and monitoring the financial health of a company, the gross profit margin, along with other 3 profitability margins are necessary to measure a company’s success.

This article covers everything you need to know about gross profit margin, including its formula and the variables involved in its calculation.

| 💡Gross Margin is amongst the 4 profit margin types that are calculated in conjunction with each other in order to get a full picture of a company’s profitability.The four types of profit margin are: |

|---|

Gross Profit Margin is the percentage of Revenue that exceeds the cost of sale. It represents how well a company is generating revenue against the cost of producing the products and services.¹

It's important to understand the difference between Gross Profit Margin and Gross Profit as even though they are both profitability metrics, the formula and significance are different.

| 💡Note: Gross Profit is the money earned after subtracting Cost of Sale, also known as Cost of Goods Sold, from revenue while Gross Profit margin shows the percentage of revenue that exceeded the cost of Sales and represents how much revenue is being generated for each dollar/pounds of cost. |

|---|

Your Gross Profit and Gross Profit Margin shows how well you manage your operations particularly on minimising the production costs. However, these are just top line metrics that don't give you the full picture of your business’ profitability.

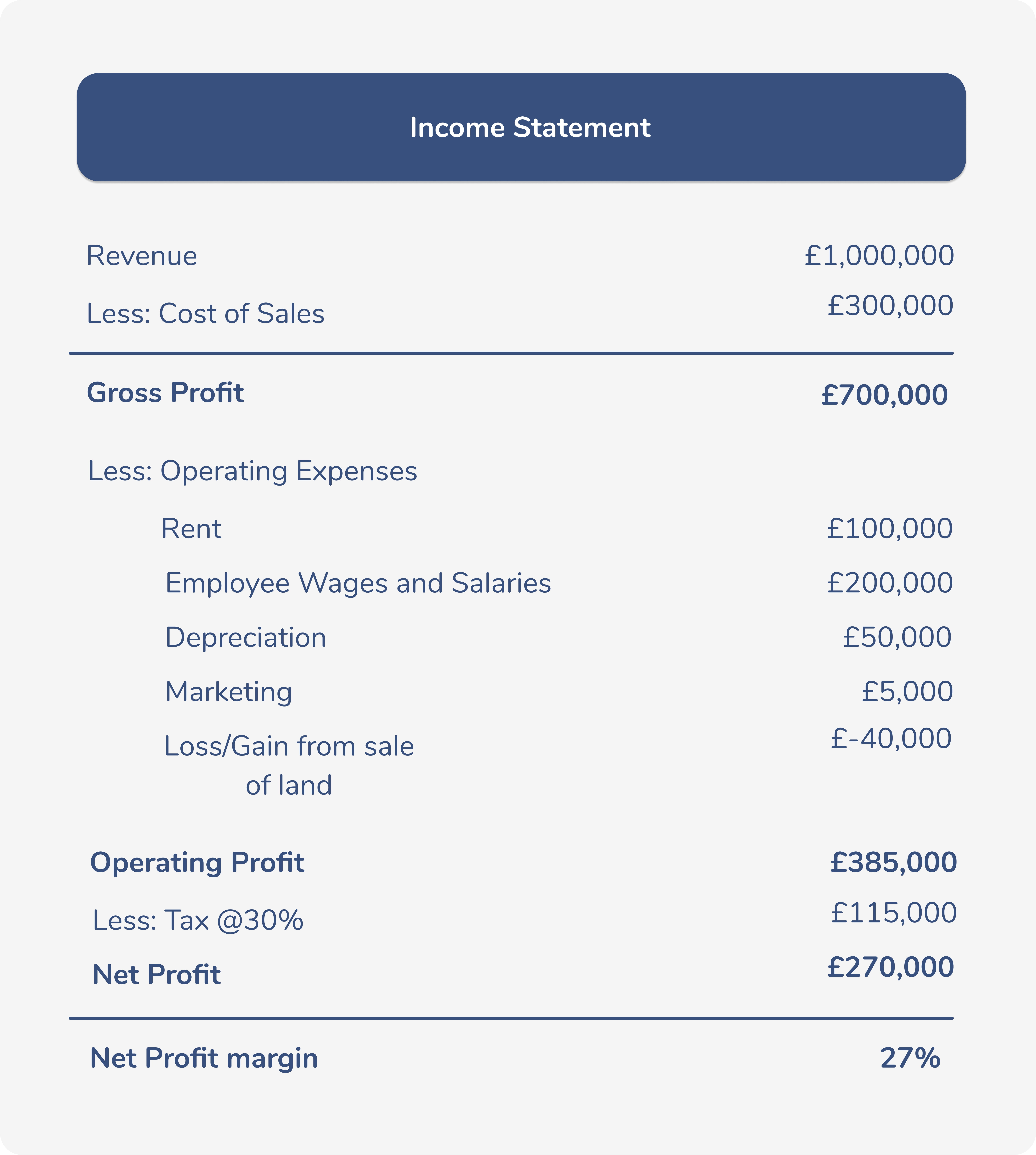

In Gross Profit, Operating and other expenses are not yet accounted for. If you look at the sample income statement below, you’ll see that other expenses will be deducted from the Gross Profit until we arrive to the Net Profit which is the bottom line/net income and is the main indicator of a company’s profitability as all expenses have already been deducted.

Knowing the gross profit margin is highly essential for any business, regardless of their size. This single factor can influence the company’s strategies and business decisions for the next year. For instance, if the company’s gross profit margin has significantly reduced from last year, they will be able to identify the underlying cause or problem that has led to the poor performance.¹

Similarly, if the gross profit margin significantly increases from the previous year, the business executives will be able to single out the decisions or methods due to which this has happened, and it will allow them to divert their focus and resources towards the tried and tested methods, so that they can expect an even higher profit margin for the corresponding year.

Another instance in which the company may expect a lower gross profit margin is when it has made drastic changes in its business model and is prepared for the lower profits for the current year. In any case, if the company knows its gross profit margin, it will be able to lay out the roadmap for the year to come, and also predict the profit for the next year.

| 💡💸Alternative Airlines saved over £75K in 9 months with Wise! |

|---|

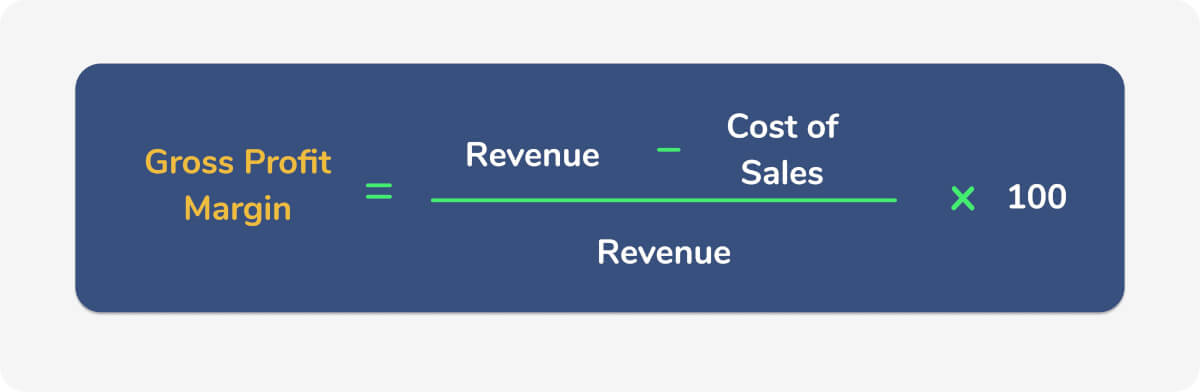

The formula for gross profit margin involves revenue and the Cost of Sales/Cost of Goods Sold. The formula looks like this:

Now that you know the formula used for calculating the gross profit, let’s have a look at it in detail, and also discuss the variables involved in the calculation. For this calculation, the Cost of Goods Sold is subtracted from the revenue. Let’s find out how you actually obtain the two variables used in the formula.

Revenue

The amount of income that the company has collected from the sales of its products or services.

Cost of Goods Sold

The Cost of Sales, or the cost of goods sold, refers to the cost that is involved in making a product or service ready for being sold. It determines how much each unit of a product costs to the company, and allows executives to calculate the gross profit margin accurately.

Usually, the Cost of Goods Sold involves variables such as the labour costs, utility and overhead costs, distribution or warehousing costs, shipping and freight costs in the case of raw material imports, and many others.

The cost of goods sold is calculated by adding the cost of purchases to the value of the beginning inventory at the start of the year, and the value of the ending inventory is subtracted from this sum in the end.

So, here is an accurate way to represent the formula for the Cost of Goods Sold:²

This formula is used by businesses of various industries all over the world to determine the cost of goods sold. Some companies also have their own hybrid formula that are based on these ones.

| Reduce your Cost of Sales when you import resources from overseas using a Wise account. Find out how! |

|---|

Now that we’ve covered Gross Profit and how to calculate it, we can proceed with Gross Profit Margin. We need to use the following formula:

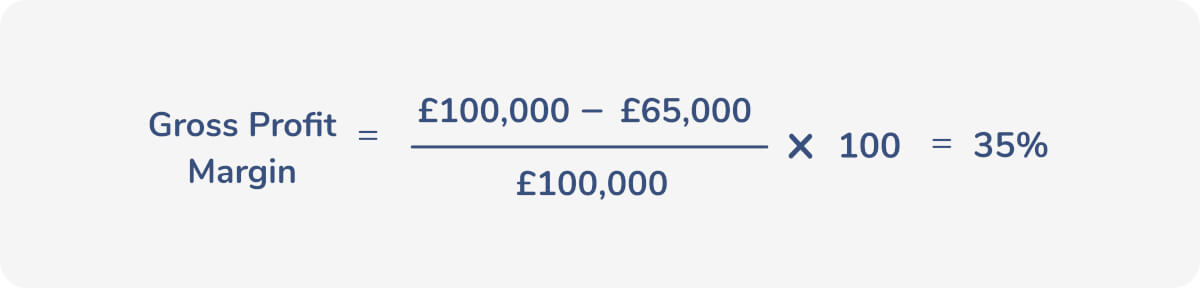

Let’s suppose that your revenue for the year 2020 was £100,000.

Moving on to the Cost of Sales, suppose that your beginning inventory was £50,000, the purchases amounted to £30,000 and the ending inventory was £15,000.

Therefore, by using the formula, the cost of goods sold would be £50,000 + £30,000 - £15,000 = £65,000.

Considering the above examples, our revenue is £100,000 and the cost of goods sold is £65,000. If we plug this into the formula, we get:

This means that 35% is the gross profit margin of the company for the current year. This also implies that 65% of the company’s profits made up for the cost of goods sold.

The company will use this figure and compare it with the past few years to see whether it has performed better or worse. Some companies may also choose to compare this figure with their competitors, as most companies disclose their gross profit margin for the stakeholders to see, which means this information is easily available for all to see.

In the example we shared above, the Gross Profit Margin came out to be 35%, but is this a good or bad value? The benchmark for a good gross profit margin varies from industry to industry, and the size of the company plays a major role in this regard.

Generally, a Gross Profit Margin of 5% is considered to be low, and a 10% margin is considered to be average. This implies that you need to have a Gross Profit Margin of at least 20% to classify it as good. Applying this in our previous example, it is safe to say that 35% is a Gross Profit Margin.³

So, as you can see, the Gross Profit Margin is considered to be a key metric to gauge the financial health and performance of any business, be it big or small. Whether your net sales amount to £10,000 or £10 million dollars, if you can manage to record a good Gross Profit Margin year after year, and also maintain lower Cost of Sales, your business will be in good hands.

All companies strive to reduce Operational cost and other business expenses to have an increasing profit margin. This requires more thorough research and analysis of your financial statement and business operations but simple and most common ways to reduce cost are:

If your business is production heavy, it's worth looking for a way to automate not only the core functions but also simpler ones. Automating speeds up production and increases efficiency and reduces labor costs.

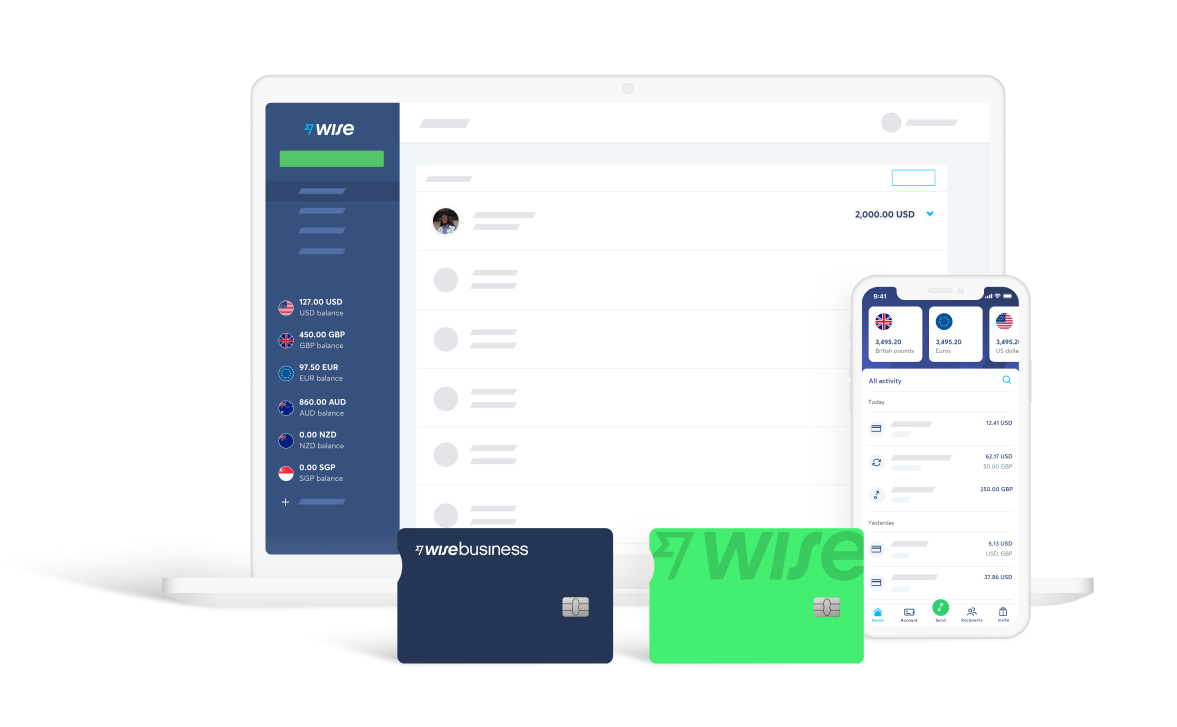

An account that can accommodate different currencies is especially useful for businesses who are dealing with payments in different currencies whether it’s to pay suppliers or receive payments from customers or offshore subsidiaries. Using services like Wise Multi-currency Account can help cut the cost on global payments and provide a more streamlined international financial management.

When you have a better overview of your inventory, forecasting would be a lot easier which helps avoid overstocking. Having a balanced inventory impacts your cash flow positively as you can avoid cash getting trapped in inventory purchases.

As you customer base grows, your need for inventory and raw materials also increase which means that you can review your contracts with existing suppliers and negotiate for discounts. Keep an eye on other providers and compare pricing as some suppliers might be better for larger orders.

One of the most common ways to cut operational costs is outsourcing, especially if you operate in locales with limited or expensive resources. You can outsource manufacturing or hire freelancers from other countries to do some of the business functions.

We’ve briefly covered Wise Multi-currency Account as a way to reduce cost on payments to and from overseas.

If you’re a business operating globally or have suppliers and contractors overseas, you need to know about Wise Multi-currency Account.

Wise is designed to help global businesses save money on international transactions and remove the hassle of having multiple bank accounts for handling different currencies making it the world’s most international account.

With Wise you can:

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Black Friday - Friday 29th November in 2024 - kicks off the end of year shopping period, with huge uplifts in on and offline sales as people grab a bargain...

Leveraging technology in business has always been a smart way to get ahead of the game. But with the fast pace of tech advancements we’ve seen recently,...

Read our guide to the best accounting software for startups in the UK, including QuickBooks, Sage, Xero, NetSuite, FreshBooks and FreeAgent.

Read our essential guide to the best business bank accounts for startups in the UK, comparing all of the most popular providers

Read our guide to the best online business bank accounts in the UK, including Tide, Starling, Revolut, ANNA and Wise Business.