How to send money from PayPal to Wise

Wondering if you can send money from PayPal to Wise? In this article, we'll cover the possibilities.

If you hold money in US savings bonds it’s important to know how to cash in government savings bonds most conveniently.

This guide covers how to cash in paper savings bonds and how it works for electronic bonds, across major bond series. Plus, we’ll also introduce Wise - as a smart way to manage your money across currencies.

Before we get started on how to cash in US savings bonds, let’s look at what they are.

The US government has been issuing savings bonds in various forms since 1935. When you buy a US government savings bond, you’re effectively lending money to the government, which then promises to pay it back with interest at a later date¹. Bonds are issued in different series, and each series may have its own features, such as a longer time to mature, or a different interest rate.

| 💡 Learn more about how savings bonds work in this full guide. |

|---|

We mentioned earlier that the US government has been issuing bonds since way back in 1935. Bonds have been issued across a range of different series over time, but bonds issued today fall into 2 different series options:

EE Bonds and I Bonds issued today can be cashed in at any point, as long as you’ve owned them for at least 1 year. If you cash in before 5 years is up, you’ll lose 3 months of interest when you do so. After 30 years, the bonds are considered matured, and no longer earn interest.

Both EE Bonds and I Bonds can be issued electronically. I Bonds can also be issued in paper form. You can cash in electronic bonds by logging into your Treasury Direct account. Paper bonds can be cashed in at some banks, or by returning the bonds along with a completed form to the treasury⁴. We’ll dive into more detail about how to cash in savings bonds, step by step, in just a moment.

It’s also worth noting that there are some situations we’ll not cover in this guide, but which have extensive resources on the Treasury Direct website which can help, including how to cash in savings bonds in your child's name⁵, cashing in bonds owned by someone who has died⁶, and cashing in bonds from overseas⁷.

| 💡 All of the details in this guide are correct at time of writing, 31st May 2023 - older bonds, or future issued bonds in any series, may have different features, cash in options, terms and conditions. Double check before you start to cash in any bond you hold. |

|---|

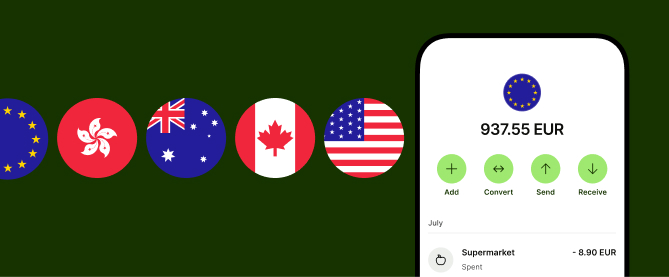

Wise is a Money Transmitter specializing in low cost currency conversion, international payments and multi-currency accounts you can operate with just your phone. Check out the Wise account as a straightforward solution for holding, sending, spending, receiving, and exchanging foreign currencies.

Open a Wise account either online or through the Wise app, to hold over 40 different currencies, spend globally with your Wise debit card, send payments to more than 80 countries, and get local bank details for up to nine currencies to get paid conveniently. Wise always uses the mid-market exchange rate for currency conversion, with transparent fees⁸.

See if Wise can help you manage your money with more flexibility, today.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Ultimately, it’s up to you when you cash in a savings bond, subject to the specific conditions of that bond.

Different US treasury savings bonds have their own conditions, but with the bonds being issued today in the I and EE series, you can hold your bond and continue to earn interest for up to 30 years. You can cash in a savings bond bought today in as little as 1 year, but you’ll lose 3 months interest if you cash in a bond you’ve held for less than 5 years.

The longer you hold a bond, the more opportunity you have to earn interest, up to the bond’s specific maturity date. If you hold a bond issued today for over 30 years, it’ll stop earning interest after the 30-year period is up.

If you hold electronic bonds, you can log into Treasury Direct to get an up-to-date bond value. Otherwise, there’s a handy tool on the Treasury Direct website that lets you calculate the value of your paper bonds easily⁹.

How much you can cash in depends on the specific bond you hold. For the I and EE series bonds currently being issued:

If you hold different bond types, the options for cashing in may be different - take a look on Treasury Direct to find the specific information for your bond type, including how to cash in series HH savings bonds¹⁰ and older paper bonds¹¹.

Let’s look at the step by step detail of how to cash in savings bonds, in 3 different ways.

Here’s how to cash in savings bonds that have matured, or after you’ve held them for at least 1 year, online:

- Log into your Treasury Direct account

- Go to Manage Direct

- Click the link for cashing securities

- Follow the prompts to cash in your bonds

You can also cash in paper bonds by sending them to the treasury:

- Download and complete FS Form 1522¹²

- If you’re cashing in 1,000 USD or more, get your signature certified

- Send the form and the bonds to the treasury at the address on the form

Some banks can also help you to cash in savings bonds. For example, if you’ve had a US Bank checking, savings or money market account for at least 5 years, you’ll be able to cash in bonds where you’re the owner or co-owner at a local US Bank branch¹³.

It’s important to understand the tax implications of the specific savings bonds you own. For example, if you have I or EE series bonds, interest is subject to Federal income tax, but not state or local income taxes¹⁴. However, there are different ways you declare the interest - either as you accrue it, or when you cash in your bond and actually get your interest. Get professional advice if you’re at all unsure about how to report your earned interest for tax purposes.

When you cash in your bonds you’ll need to get Form 10-99 INT either from the treasury or the bank that cashes your bond, for your regular tax return.

This guide should cover all you need about how to cash in savings bonds, with particular focus on how to cash in EE savings bonds and I savings bonds, as the series that are currently being issued. Treasury Direct has a wealth of resources about other bond types, or other scenarios which you might need to know about - and you can always get professional guidance and support if you’re unsure about any of the processes or tax requirements involved.

Not all banks will be able to cash in savings bonds, and some which do - like US Bank - may have eligibility criteria covering which customers are able to cash in bonds. Check the details with your own bank.

To cash in a paper bond you’ll need Form FSF 1522, and may need a certified copy of your signature. You can cash in electronic bonds online, by logging into your Treasuries Direct account.

The value of bonds depends on the type of bond and how long you’ve held it. You can check the value of electronic bonds on Treasuries Direct, and there’s a tool also to calculate the value of paper bonds, on the Treasuries Direct website.

Different bond types mature at different times. The bonds being issued today, in the I and EE series, mature in 30 years.

EE bonds issued today mature in 30 years. That means they no longer earn interest after that point.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering if you can send money from PayPal to Wise? In this article, we'll cover the possibilities.

For many of us who are first-generation Americans, financial literacy isn’t something we learn from our parents - and we’re definitely not taught about money...

Everything you need to know about Discover It balance transfer limits.

Save when traveling to Europe by reading our guide on avoiding ATM fees.

Sendwave vs Wise: Comparing features, benefits, and more. Explore this article for insights on international money transfers.

Should I exchange money before traveling to Europe? Gain insights in this article for making informed decisions about currency exchange before your trip.