5 Ways to Stand Out and Boost Black Friday Sales

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Planning to start a business in Romania? It’s a popular choice for foreign entrepreneurs and investors, thanks to its business-friendly tax policies, skilled workers and access to EU markets.

In this helpful guide, we’ll walk you through the process of launching a business in Romania from the UK. This includes details of company registration in Romania, what documents you’ll need and info on legal entity types.

We’ll also show you a smart way to manage your company’s finances in Romania and worldwide, using Wise Business - the ideal solution for international businesses.

💡 Learn more about Wise Business

So, what’s the Romania business environment like, and why does it attract so many foreign entrepreneurs and investors?

For starters, Romania enjoys a strategic position in Europe - granting access to the lucrative and extensive EU market. Romania also has a business-friendly climate and tax system, well educated and skilled workforce, and a low cost of living.

If you’re looking for business opportunities in Romania, the following are some of the fastest growing and most GDP-contributing sectors in the country:¹

- Agribusiness

- Defense

- Energy (Oil & Gas, Renewables)

- ICT (Information & Communications Technology)

- Health.

The business culture in Romania is hierarchical and quite formal, but the good news is that most people there speak English. This makes it a little easier for UK entrepreneurs to get started there.

To form a company in Romania, it’s mandatory to submit an application at the National Trade Register Office. You must also check that your chosen name isn’t taken by another organisation.

But before you can do any of that, you’ll need to decide on a legal structure for your new company. The different structures you can choose from in Romania include the following:

- Limited liability company

- General partnership

- Branch of a foreign enterprise

- Sole proprietorship

- Company limited by shares

- Limited partnership

- Public limited company

We’ll run through each in more detail below.

Known as a Societate cu raspundere limitata or SRL, this is one of the most common forms of business entity in Romania. It’s a company with 1-50 shareholders, where the capital is divided into equal shares of at least 1 RON. Shareholders are liable for the company’s obligations up to the limit of their contribution.

A general partnership or Societate in nume colectiv (SNC) has 2 or more shareholders, who have unlimited and joint liability for their contributions. However, there’s no minimum share capital required.

To open a branch (Sucursala) of a foreign company in Romania, there are minimal requirements. You don’t need share capital or shareholders, and the parent company is wholly liable for its branch.

This company type, known as a Persoana Fizica Autorizata, is for a single entrepreneur setting up a business on their own. They are solely responsible for the company’s obligations, but there is no share capital required.

Known as a Societate in comandita pe actiuni or SCA, this company type has a minimum share capital of €25,000 EUR (or the RON equivalent). It must have a minimum of 2 shareholders. The company has limited partners and general partners, the former only being liable up to the limit of their contributions. The general partners have management control and joint liability.

A Societate in comandita simpla (SCS) has at least one limited partner and one general partner. The limited partner is liable up to the extent of their share contributions, while the general partner has management control and joint liability.

But unlike with an SCA, there’s no minimum share capital required for a limited partnership.

Lastly, there’s a public limited company, also known as a _Societate pe actiuni _or SA. This is very similar to an SCA, in that it must have at least 2 shareholders and minimum capital of at least €25,000 EUR (or the RON equivalent).

However, in this company type, only shareholders have liability for the obligations of the company - and only up to the extent of their subscribed shares.

To open a business in Romania, you need to follow these steps:³

You may also want to consult with an accountant to ensure that your company records will comply with the rules and regulations in Romania.

You’ll need to have a number of documents ready. These include:³

- Articles of Association and Incorporation

- Proof of ID (such as a passport) for company directors

- A valid work permit - this is required by all non-EU nationals setting up an offshore company in Romania

- Proof of the registered company address

New to Romania or starting your very first business? You’re bound to have questions. We’ll tackle some of the most commonly asked questions below, covering everything from fees and costs to business tax.

Romania is an attractive place to do business, for a number of reasons. These include having a skilled and educated workforce, low labour and living costs, access to a wide EU market and business-friendly tax policies.

The process to start a business is similar to other countries, in requiring companies to apply for incorporation at a trade registry office. However, it can be a little slower than in other places.

It can take around 20 days to start a business in Romania, which is longer than the 9 days it takes on average across Southeast Europe.⁴

The fee to incorporate a company in Romania is €3,850 EUR (around £3,300 GBP).³

But there are also other costs to consider, including opening a local bank account and governmental fees. You may also have to pay an accountant and/or a solicitor if you’ll be using these services.

In total, you can expect to spend around €8,820 EUR to get your new company up and running.³

Check below the current conversion rate between GBP and RON.

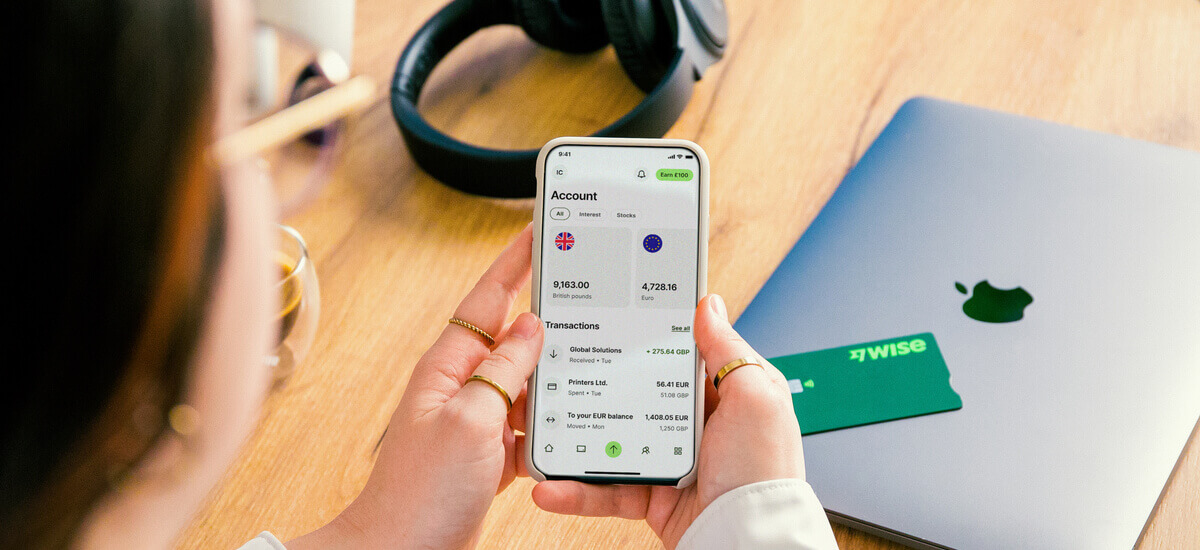

Wise Business account is a handy tool for UK business expanding abroad. Once you set up your business in Romania you can easily convert British Pounds to RON to hold money on the currency, receive Romanian Leu with your account details or set payments like a local. All conversion is done based on the mid-market exchange rate with low and transparent fees.

Get started with Wise Business 🚀

To start a business in Romania as a foreign citizen, you’ll need to ensure you have a valid work permit. You may also need a visa if you plan to live in the country to oversee the running of your business.

Romanian companies pay corporation tax of 16%. However, a reduced rate of 1% is available for microenterprises with an operating revenue of under €500,000 EUR, along with other eligibility criteria.²

A Romanian bank account will certainly be useful for your new business. But it’s also worth considering alternatives which could save you time and money when managing your finances internationally.

Open a Wise Business account and you can manage your company’s finances in 40+ currencies all in one place, including RON, USD, GBP and EUR. You’ll be able to pay suppliers and staff in their own currency, as well as receiving payments in multiple currencies.

You can even automate payments using the powerful Wise API to save even more time. See how it works here in our case study.

Wise payments are fast and fully secure (even for large amounts). Best of all, you’ll only pay low, transparent fees and always get the mid-market exchange rate.

This is the rate that banks use to buy and sell currency, and is widely considered the fairest rate you can get. When banks carry out currency conversions on behalf of customers, they usually add a mark-up or margin to the exchange rate. This makes it more expensive for your business, as less of your money reaches your recipient.

It’s quick and easy to open a Wise Business account, with a fully digital application, verification and on-boarding process. Check out the requirements here.

Get started with Wise Business 🚀

And that’s it - your handy guide to Romania company formation, covering the process from start to finish. You should now have all the information you need to get started on setting up your new company overseas. Good luck!

Sources used for this article:

Sources checked on 08-05-2024.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Black Friday - Friday 29th November in 2024 - kicks off the end of year shopping period, with huge uplifts in on and offline sales as people grab a bargain...

Leveraging technology in business has always been a smart way to get ahead of the game. But with the fast pace of tech advancements we’ve seen recently,...

Read our guide to the best accounting software for startups in the UK, including QuickBooks, Sage, Xero, NetSuite, FreshBooks and FreeAgent.

Read our essential guide to the best business bank accounts for startups in the UK, comparing all of the most popular providers

Read our guide to the best online business bank accounts in the UK, including Tide, Starling, Revolut, ANNA and Wise Business.