5 Ways to Stand Out and Boost Black Friday Sales

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Doing business in South Africa and have people working for you there? If you’re running payroll for your company and you have international workers, you may need to learn about tax codes in different countries.

You don’t necessarily need to know everything about how the tax system works in South Africa, but a working knowledge of the relevant tax codes can be really helpful.

In this guide for UK employers, we’ll run through the essentials you need to know about tax codes in South Africa. This includes how tax codes work there and what they mean, plus a list of common tax codes you’re likely to come across.

We’ll also show you how to make paying overseas employees easier using solutions like Wise Business.

💡 Learn more about Wise Business

Tax codes are a way of telling an employer how much tax to deduct from an employee’s pay. They’re part of the Pay As You Earn (PAYE) system in South Africa. They’re also used when individuals submit their tax return at the end of the financial year. This is known as the IRP5.

The income tax system in South Africa is managed by SARS, the South African Revenue Service.

Established in 1997, SARS is the nation’s official tax collecting authority. It works with both employers and employees, as well as businesses of all sizes, to administer the South African tax system and customs service. So if you need information or advice on tax in South Africa, in relation to running your business or paying employees, SARS is the place to go.

Employers of people working in South Africa need to make sure that they’re using the right tax codes when running payroll. If the wrong code is used, it could result in the underpayment or overpayment of income tax.

Understanding the tax system in another country can of course be very complicated. To avoid making a costly mistake or spending too much time getting to grips with income tax, it could be well worth working with an expert. A local accountant, tax consultant or payroll service based in South Africa could be extremely helpful.

South African tax codes are used to identify different types of income. The most common tax code is 3601, which refers to income received as part of a basic salary from employment. This is the code that will apply to most employees earning a salary when working for your company.

But there are also tax codes relating to commission payments and travel allowances, annual bonuses and one-off payments. There’s a whole separate set of tax codes relating to deductions, pension fund contributions, tax credits and employer contributions too.

Tax codes are most likely to be used as part of an annual tax return, known as the IRP5 and submitted by individuals at the end of the tax year. However, employers should still be aware of them just in case they do impact on PAYE and running payroll at any point.

Tax codes in South Africa are primarily made up of four numbers, usually starting with a 3. This is unlike in some other countries such as the UK where tax codes are made up of a mix of both letters and numbers.

To help make payroll just a little easier for you as a UK employer, here’s a quick look at some of the most commonly used tax codes in South Africa:¹

| Tax code | Meaning |

|---|---|

| 3601 | Income from basic salary amounts |

| 3605 | Annual payments such as annual bonuses and one off payments |

| 3606 | Commission payments |

| 3701 | Travel allowances (subject to PAYE) |

| 3702 | Reimbursive travel allowance (on assessment) |

| 3703 | Reimbursive travel allowance (non-taxable) |

| 3713 | Other taxable allowances, such as phone or computer expenses, or other earnings subject to PAYE |

| 3810 | Fringe benefits, such as employer contribution to medical aid |

| 3699 | Gross employment income (taxable) |

| 3696 | Non-taxable earnings |

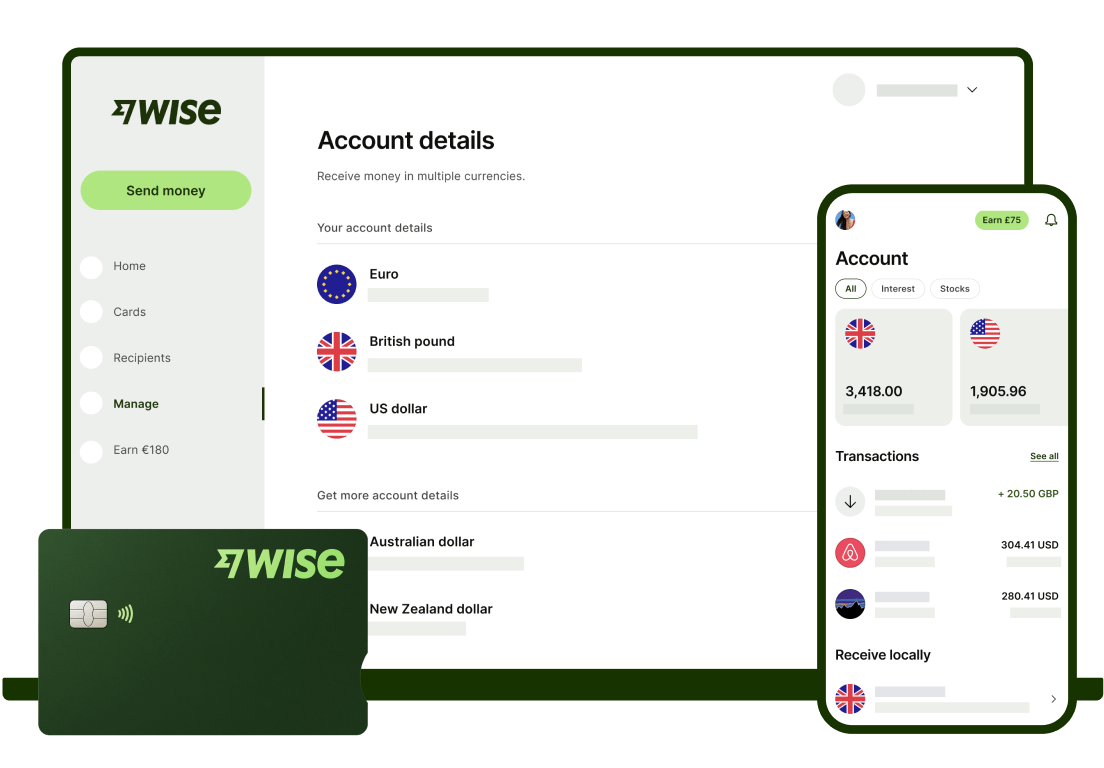

Income tax can be complicated, but paying your staff doesn’t have to be. If you have employees spread across branches in South Africa, the UK and other countries worldwide, you can pay them all quickly and easily using Wise Business.

Open a Wise Business account and you can pay up to 1,000 people at once using the handy Batch Payments tool. It’s even possible to automate payments with the Wise API to save time. Plus, you can seamlessly integrate your accounting tools and other business software with your Wise Business account to keep things running smoothly.

Not only does Wise Business save you time on payroll, but money too. With Wise, you can send global payments in multiple currencies and the mid-market exchange rate. If you have an international workforce or have expenses to pay in other countries, this could save your business a bundle.

Wise Business also has lots of other useful features. This includes cards for managing expenses, local account details so you can get paid faster in your client’s currency, and much more.

Get started with Wise Business 🚀

And that’s it - our helpful guide to income tax codes in South Africa. We’ve looked at how tax codes work and why you need to know about them as a business owner with branches and employees in South Africa. Plus, a list of common tax codes so you can start familiarising yourself with them.

This should act as a useful starting point as you get to grips with your obligations as an employer in South Africa. But don’t forget that if you need help, it’s always a good idea to consult a specialist for expert tax advice.

Sources used for this article:

Sources checked on 29-04-2024.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

Black Friday - Friday 29th November in 2024 - kicks off the end of year shopping period, with huge uplifts in on and offline sales as people grab a bargain...

Leveraging technology in business has always been a smart way to get ahead of the game. But with the fast pace of tech advancements we’ve seen recently,...

Read our guide to the best accounting software for startups in the UK, including QuickBooks, Sage, Xero, NetSuite, FreshBooks and FreeAgent.

Read our essential guide to the best business bank accounts for startups in the UK, comparing all of the most popular providers

Read our guide to the best online business bank accounts in the UK, including Tide, Starling, Revolut, ANNA and Wise Business.