Get your Business Summer Ready ☀️

Summer is a prime time for boosting sales, especially if your business is in an industry like fashion, travel or outdoor gear. But in order to capitalise on...

In a highly competitive business landscape, staying ahead means keeping up with the latest trends and harnessing cutting-edge technology to streamline financial processes. Open Banking has proven to be a game-changer, reshaping how businesses manage payments of all kinds, including their UK tax payments. Wise is proud to be one of the payments providers enabling businesses to pay their taxes on the HMRC website through Open Banking.

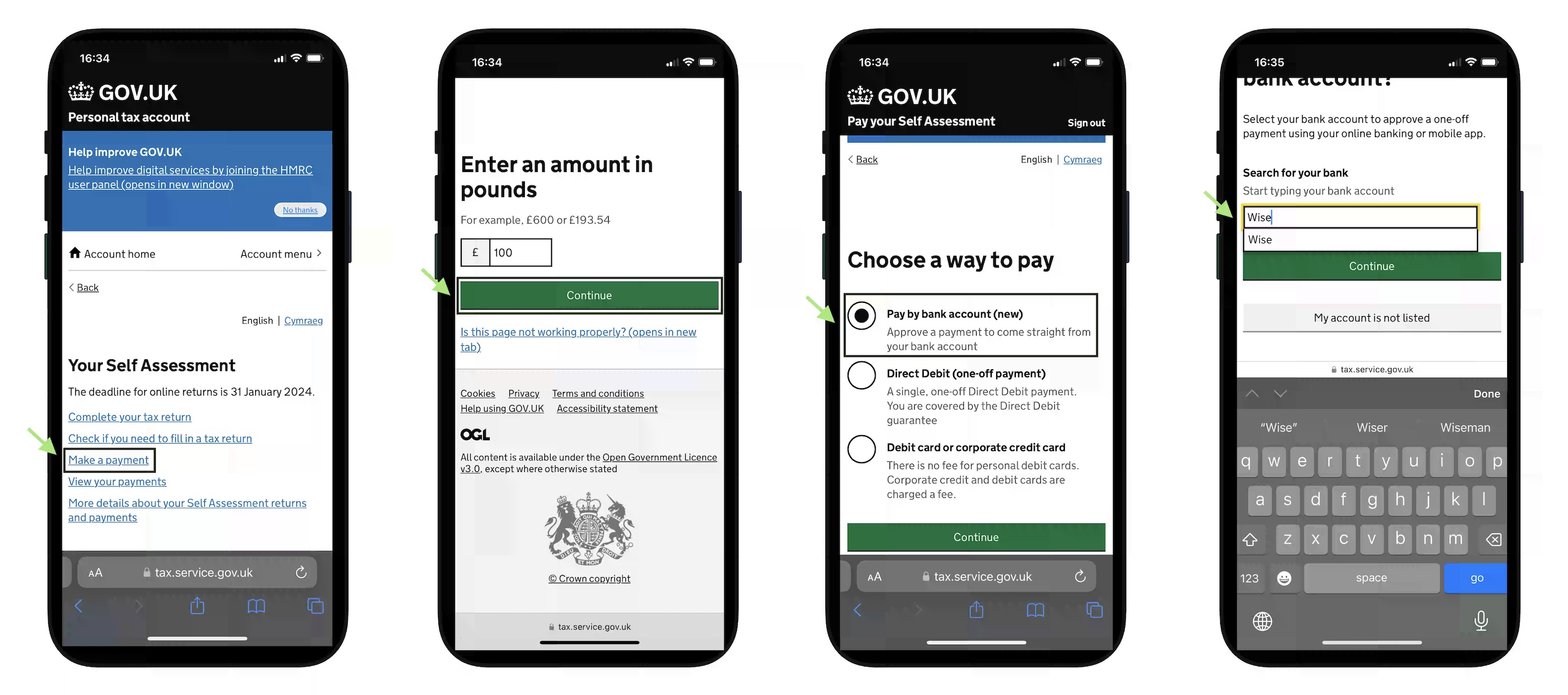

In this article, we'll illustrate how the feature works and its role in simplifying financial processes. We will also provide a guide to how to use Wise Business to pay your taxes through Open Banking, removing the need to enter debit card, credit card or account details into the HMRC website.

| In this article: |

|---|

Open Banking enables individuals and businesses to share their financial information seamlessly and securely with trusted third providers through Standardised Application Programming Interfaces (APIs). In the UK, Open Banking is a secure and simple way to help the UK's businesses manage their finances more effectively – and become more resilient, productive and profitable.

Open Banking is regulated by the Financial Conduct Authority (FCA) and is subject to the Payment Services Regulations 2017, which brings into UK law the second EU Payment Services Directive (PSD2).

Open Banking offers significant advantages for businesses, including reducing the risk of human error in inputting details, simplifying tax payments, enhancing financial transparency by providing real-time access to financial data while enabling smoother cash flow. It's estimated that 7 million businesses and consumers in the UK already use Open Banking (Open Banking, 2023).

In March 2021, HMRC made history by becoming the world's first government to integrate Open Banking into its payment processes. This has enabled individuals to opt for 'pay by bank account' when paying their taxes, with HMRC using Ecospend as the authorised third-party provider for this process. Ecospend enables sole traders and businesses to pay tax for a variety of tax regimes, including Self Assessment, VAT, Corporation Tax and PAYE for employers directly from their accounts. Since Ecospend’s integration was rolled with HMRC, more than £2.3 billion in self-assessment taxes have been paid via Open Banking (Open Banking Expo, 2023).

According to HMRC, once the customer has given their explicit consent, they pass the following information to Ecospend:

Ecospend

|

|---|

|

How Ecospend uses data

According to the HMRC website, Ecospend uses the data provided by HMRC to make a payment request to the individual’s bank or account provider. Ecospend then fills in the payment reference and amount requested by HMRC, and the user then signs into their online banking or fintech app to approve the payment. By selecting ‘Approve this payment’, the user consents to their data being shared with Ecospend for the purposes of processing the payment, and the funds are taken from the user’s account without the need to input sensitive account details and information into the HMRC website.

Who authorises Open Banking?

Open Banking operates under the strict regulations of the Financial Conduct Authority, ensuring that all data sharing and financial transactions occur in a secure environment. Customers need to give explicit consent for their details to be shared through Open Banking, they retain control over their data throughout the process and can revoke consent at any time.

Things to know before you start

- Make sure you have sufficient funds in your Wise Business account to make this payment

- You can pay using any of your balances - whether it's British Pounds, Euros, or US Dollars. If you choose a currency that is not British Pounds, we will auto-convert it for you with the same low, transparent fees as if you would convert it manually yourself. By using this feature, you can ensure your tax payments are coming from the balance you want to pay in, with a quick and seamless conversion at the mid-market rate, helping you to better manage your cash flow and accounting processes.

- Your consent to Pay by Bank account through Open Banking is only provided per payment.

Log In to your HMRC account: If you've paid your taxes before or registered with HMRC, you can go ahead and log in to your HMRC account.

Go to the Payment Section: Once logged in, navigate to the website section that allows you to pay and manage your taxes. For sole traders, this will be under ''Self Assessment''.

Select the payment: Once you click "Make a Payment," a screen will appear allowing you to enter the amount you wish to pay.

Choose Open Banking as your payment method: Choose "Pay by Bank Account" to pay your taxes through Open Banking.

Select Your Wise Business Account: Select Wise as your account provider, review the payment amount, and click "Approve this payment."

Authenticate your payment: Once in your Wise app, it's time to authenticate your payment. Make sure you've selected your Wise Business account to make this payment. You'll now see the option to choose what balance you'd like to use - you can pay using any of your available balances, and we'll auto-convert them for you into GBP. When you're ready, click "Authorise."

To pay from any of your non-GBP balances, simply choose your preferred currency. An additional screen will appear to show you the conversion details and cost of your payment including our transparent fee and the live mid-market exchange rate.

Last but not least: Remember to log out of your HMRC account to ensure the security of your information. You can always review your statement within the Wise Business account to verify that the payment has been processed correctly.

To learn more about Open Banking and how it works for paying taxes, visit the HMRC website, to learn more about Ecospend and its role, click here.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Summer is a prime time for boosting sales, especially if your business is in an industry like fashion, travel or outdoor gear. But in order to capitalise on...

We're introducing global (Swift) account details for receiving Swift payments in 17 currencies with Wise Business.

Discover how to open a Tide Business Account in the UK. We'll cover requirements, step-by-step and account features.

Read our comprehensive guide to the Revolut Business debit card, covering everything you need to know.

Read our review of the Tide Business savings account, including interest rates, limits and how to open an account.

Read our review of the Revolut Business savings account, including interest rates, limits, FSCS protection and how to open an account.