Get your Business Summer Ready ☀️

Summer is a prime time for boosting sales, especially if your business is in an industry like fashion, travel or outdoor gear. But in order to capitalise on...

Opening a local business account can be a real challenge, especially if you're not a local. It often means dealing with lots of paperwork, making several trips to the branch, and in the end you might get stuck with long waiting times, monthly fees and restrictions.

The Wise Business account enables you to set up local account details and start receiving money from anywhere in the world in 9+ currencies including USD, GBP, EUR and more, making operating overseas, getting paid, and taking your business to new places really easy.

Once you have a Wise Business account set up, getting local details is hassle-free and fast, with no fees or charges, so you can accept your business payments in no time and get paid like a local, without the need to set foot in a local branch. You can easily use your various account details to pay subscriptions, direct debits, just as you would with an account.

Whether you accept business payments from your customers or take care of payments to your international staff, freelancers or suppliers, Wise Business enables you do so in a multi-currency account that lets you track your payments in the currency you need.

Simply set up a balance from within your app to share with your customers in minutes. Start receiving payments or setting up direct debits like you would with a UK account number and sort code, US routing number, Euro IBAN and several other major currencies.

The currencies available depend on where your business is registered. See more.

Let's take a closer look at why having local account details and an international business account can be highly advantageous, regardless of the size of your business.

Exporting Businesses: Any UK based business exporting overseas, whether it's the US, Canada or European countries will need local account details to get paid. With a Wise Business account, you can receive payments from your international customers using local account details, minimising the fees associated with cross-border transactions. Similarly, you can use the Wise account to pay your overseas suppliers directly in their local currencies, ensuring that they receive the agreed-upon amount without deductions and with low exchange rates.

E-commerce Businesses: Suppose you run an online store that sells handmade jewellery. Customers from various countries are interested in your products. By utilising a Wise Business account, you can offer local account information for key markets like the US, Europe, and Australia and more. This lets international customers pay in their own currencies, eliminating the confusion of foreign exchange rates and reducing the likelihood of abandoned carts due to unexpected fees. Whether you're selling on Amazon, Etsy or just withdrawing money from any other platform, Wise Business account lets you do so easily and fast.

Global Freelancers and Consultants: Freelancers based in the UK with clients based in the US, Europe, or Australia may lose lots of money on international payments. With a Wise Business account, you can provide your clients with local account details in their respective regions, and then convert it in the Wise app to GBP, using our mid-market exchange rates and low fees to save money on international conversions.

Travel and Hospitality Industry: Suppose you manage a tour agency that organises adventure trips around the world. By incorporating local account details from key markets into your payment process, you make it easy for travellers to pay for their trips in their preferred currencies. This reduces the risk of travellers being discouraged by additional charges and fosters a sense of transparency. As a result, your agency can attract more international clients and offer a smoother booking experience.

If you sell on marketplaces such as Amazon and Upwork, use e-commerce tools such as Shopify or payment platforms or such as Stripe, you can withdraw earnings in different currencies directly into your Wise Business account.

We’re proud to be participating in Amazon’s Payment Service Provider programme, so you can have peace of mind when receiving payments from Amazon Seller Central. The way you use Wise to receive payments from Amazon will not change and you can use your Wise account details to receive payments like a local.

How to withdraw money from Amazon

If you’re an ecommerce seller, you can open a Wise Business account to get paid from Shopify in a range of currencies with no receiving fee. You’ll also get the mid-market exchange rate whenever you need to switch from one currency to another within your Wise account, or to make a transfer. That can mean you pay less for your international transactions, compared to using your regular bank or Shopify. How to withdraw money from Shopify.

You can link your EUR, GBP, USD, AUD, NZD, SGD, RON, PLN and CAD account details with Stripe. The supported currency can depend on your location. More on receiving money from Stripe.

Withdrawing money from Etsy in the currency the customer paid in offers a range of advantages for both sellers and buyers. Firstly, it eliminates the need for high currency conversion fees, ensuring that sellers retain more of their hard-earned profits. This straightforward approach fosters transparency and trust between sellers and Etsy, as the platform aligns with the global marketplace's diverse currencies. For buyers, paying in their local currency simplifies the shopping experience, avoiding confusion and potential additional charges. Getting paid from Etsy.

How to receive money from abroad:

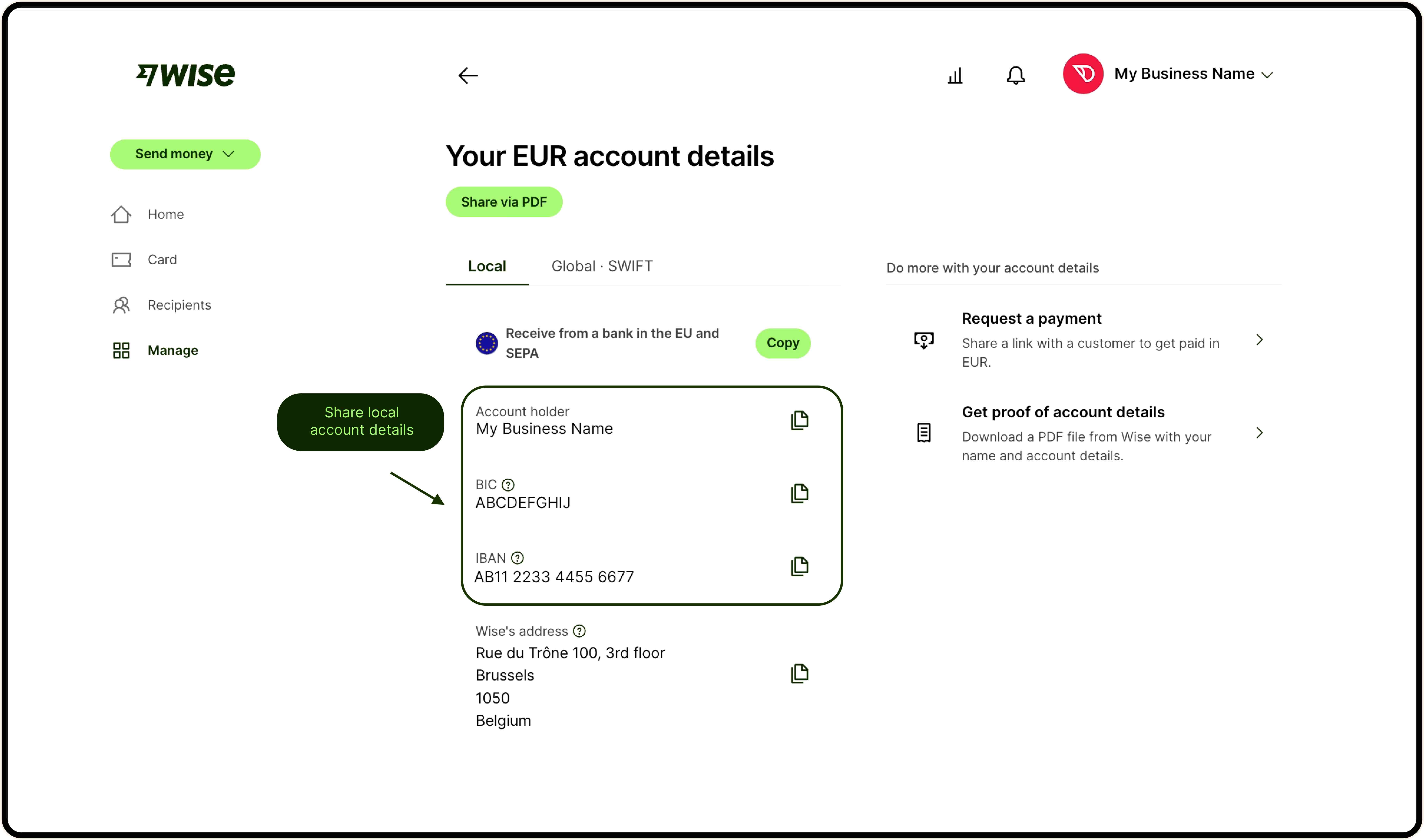

First you need to open a Wise balance in the currency you want to receive money in. You can do this from Home in the website or app. Click Get account details — you’ll need to complete some requirements if it’s the first time you’re getting account details. Share these account details with your clients or customers, to get paid easily. You’ll receive their payment directly into that balance in your account.

Download a proof of account details and share via PDF

Some merchants, such as Amazon or PayPal, might ask you for confirmation that your account details are held in Wise. You can download a proof of account details document and share it with them. As a business account holder, you can also use the “Share via PDF” feature. This is useful if you want to share your account details with your clients to get paid into your Wise business account. The document is currently available only in English and only for EUR, USD and GBP balances.

Ways to receive international payments

Once you have your local account details set up, there are several ways you can choose to get paid by your customers.

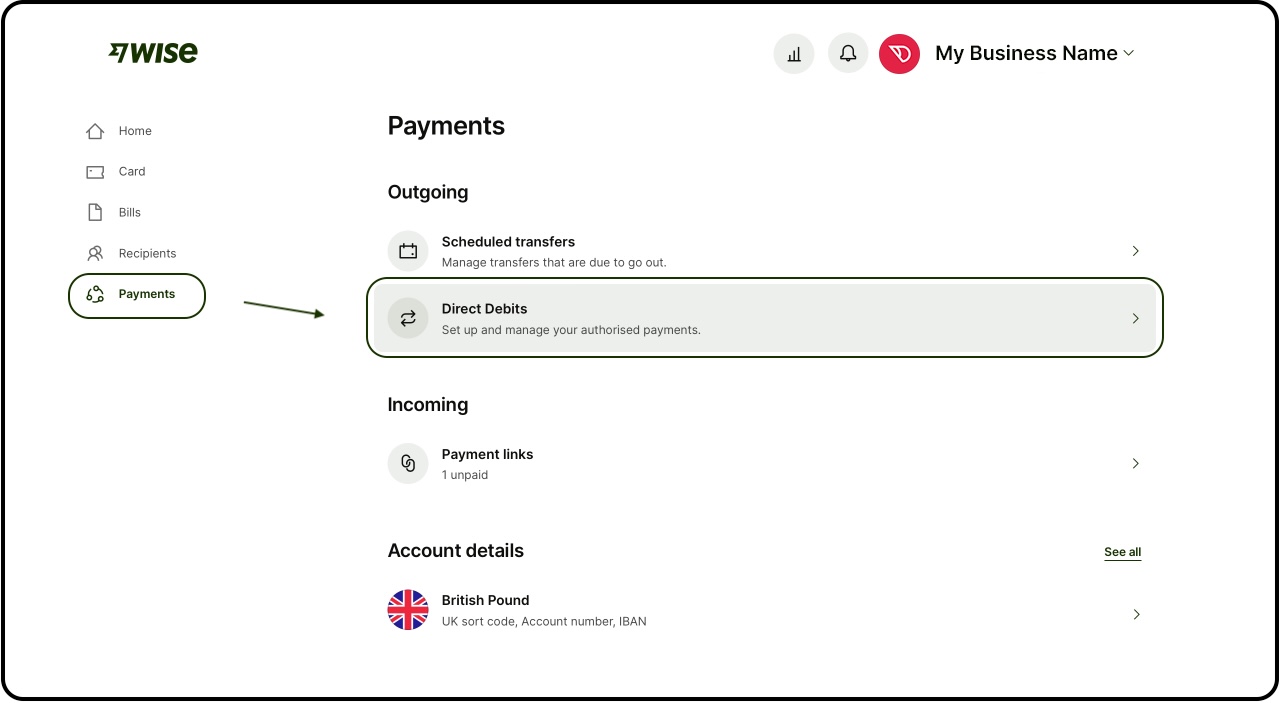

Setting up direct debits can benefit your business, ensuring your payments are always on time, reducing the risk of late or missed payments. With the Wise Business account, you can pay recurring expenses in multiple currencies including USD, EUR or AUD without the need to pay foreign transaction fees.

To set up a Direct Debit in your International business account, just give your Wise account details to the company you want to pay. They might ask you to fill in a form in person or online, or ask you for your account details over the phone.

Once you’ve given the company these details, it’ll take a day or two for them to set it up. Check with them that they’ll set it up electronically.

If you don’t hold the currency you need to pay, you can still set up the Direct Debit. We’ll automatically convert it for you from the balance that has the lowest possible conversion fee.

Digital payments are now business as usual, so at Wise we’re constantly working on new ways to help you get paid quickly, affordably, and seamlessly. With Wise Business account, you can now send a simple link to request payments from customers via bank transfer. All you need to use this feature is to have account details set up to receive into. To generate a request payment link, simply go to the balance you want to be paid into, click the green ‘Receive’ button at the top of your screen, then ‘Request a payment’. Or, under ‘Payments’ go to ‘Payment links then click ‘New payment link’. Then add your link to an email, invoice or message and hit send.

You can choose between Single use links or Reusable. Reusable Payment Links don’t expire and enable you to charge different customers the same amount without the need of setting up a new payment link every time.

And that’s not all. We can now automatically detect if you are requesting payment from a Wise customer and give them the option to immediately pay from their Wise account using our fast money transfer service, in 40+ currencies. You can also get a QR code for your customer to scan and pay you — straight to your Wise account.

We're giving Wise Business account holders the ability to get paid by their customers using their credit or debit card. You'll need to apply to get paid by credit or debit card, and once it's approved you'll be able to start taking payments straight away.

We’ll tell you when your customer has paid, and we’ll email them proof of their payment, plus you'll also get notified when your money arrives to help you manage cash flow.

We currently support Visa and Mastercard payments in AUD, CAD, CHF, CZK, DKK, EUR, GBP, HUF, NOK, NZD, PLN, RON, SGD, and USD. Find out more about how to get paid by card.

Wise Business simplifies international transactions by offering local account details in 9+ currencies. Businesses can efficiently track and receive payments in their preferred currencies, enhancing financial flexibility and streamline their cash flow by setting up direct debits or sending request payment links to get paid, just like a local without the need to step foot in a branch.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Summer is a prime time for boosting sales, especially if your business is in an industry like fashion, travel or outdoor gear. But in order to capitalise on...

We're introducing global (Swift) account details for receiving Swift payments in 17 currencies with Wise Business.

Discover how to open a Tide Business Account in the UK. We'll cover requirements, step-by-step and account features.

Read our comprehensive guide to the Revolut Business debit card, covering everything you need to know.

Read our review of the Tide Business savings account, including interest rates, limits and how to open an account.

Read our review of the Revolut Business savings account, including interest rates, limits, FSCS protection and how to open an account.