Transit numbers in Canada.

Are you using a Canadian bank account to send or receive domestic or international wire transfers? Always use the right branch transit number to avoid delayed transfers, and payment cancelations. And if you’re transferring internationally, save on fees with Wise.

What is a transit number?

In Canada, banks and other financial institutions identify their branches with a unique transit number (also known as branch numbers). A transit number is made up of five-digits and together with the institution number they form a routing number.

- The transit number - five digits - shows which branch you opened your account at.

- The institution number - three digits - identifies your bank.

- The account number - seven to twelve digits - identifies your individual account.

Bank routing numbers are used to process cheque and electronic transactions such as funds transfers, direct deposits, digital cheques, recurring loan and bill payments.

Where is the transit number on a cheque?

Your bank transit number and institution number can be found at the bottom of a cheque.

The transit number (five digits) identifies which branch you opened your account at.

The three-digit institution number identifies your bank.

The account number (11 digits) identifies your individual account.

If your account number only has nine digits, as on the cheque account number below, simply add two zeros in front (like this: 00123456701).

There's a cheaper way to send money abroad.

Sending domestic payments with your bank can be easy enough. But international transfers are a different story. Thanks to high SWIFT and cross-border fees, they can be very expensive and time-consuming.

To get the best deal, it pays to look for specialist services. Many of which take a new approach, and skip the usual costs of sending money around the world.

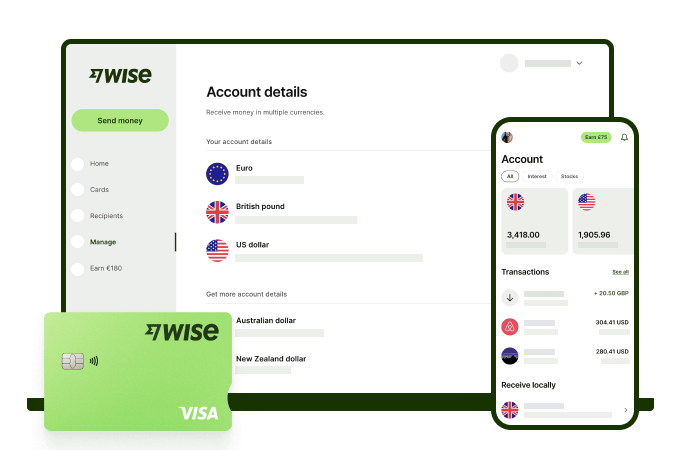

Try Wise for fast, secure and cheap cross-border payments. All over the world.

How to find your transit number?

Here are some of the ways to find your transit number:

- On this website – We've listed transit numbers for some of the biggest banks in Canada.

- Online banking – You’ll be able to get your account, institution, and transit number by logging into online banking.

- Cheque, bank statement or deposit slip – bank-issued cheque or bank statement.

If your bank transit number is only four digits long, add a 0 in front of the number. Example: Branch 1011 is 01011.

If your account number only has nine digits but a form requires 11, simply add two zeros in front. For example, 123456789 is 00123456789.

To make sure the bank can process your payment securely and quickly, you should always check transit numbers – including numbers on this page – with your bank or your recipient.

Select your bank

Select your bank

What are transit numbers used for?

Banks use bank transit numbers for all sorts of financial transactions. You might need one if you want to do any of the following:

- Set up a direct deposit, or pay bills automatically from your Canadian bank account

- Have payments like a salary or pension deposited into your account

- Pay in a checque

- Make an Interac e-Transfer or electronic funds transfer (EFT) to someone in Canada

Transit numbers FAQs

Transit numbers, SWIFT codes, BIC and IBANs – what’s the difference?

You’ll need a few details to send or receive a wire transfer – either here in Canada or internationally.

Transit numbers help identify banks when processing domestic electronic fund transfers or wire transfers. But only in Canada. You don't need one to make a payment to your friend in France, for example.

SWIFT codes, like transit numbers, also identify banks and financial institutions. This time for international payments. They're sometimes known as BIC codes (Bank Identification Codes)

IBANs (international bank account numbers) identify individual bank accounts. They're issued by many banks in Europe, but banks elsewhere in the world are starting to adopt them as well.