To our 11 million customers,

Here are the money borders we lowered in Q3.

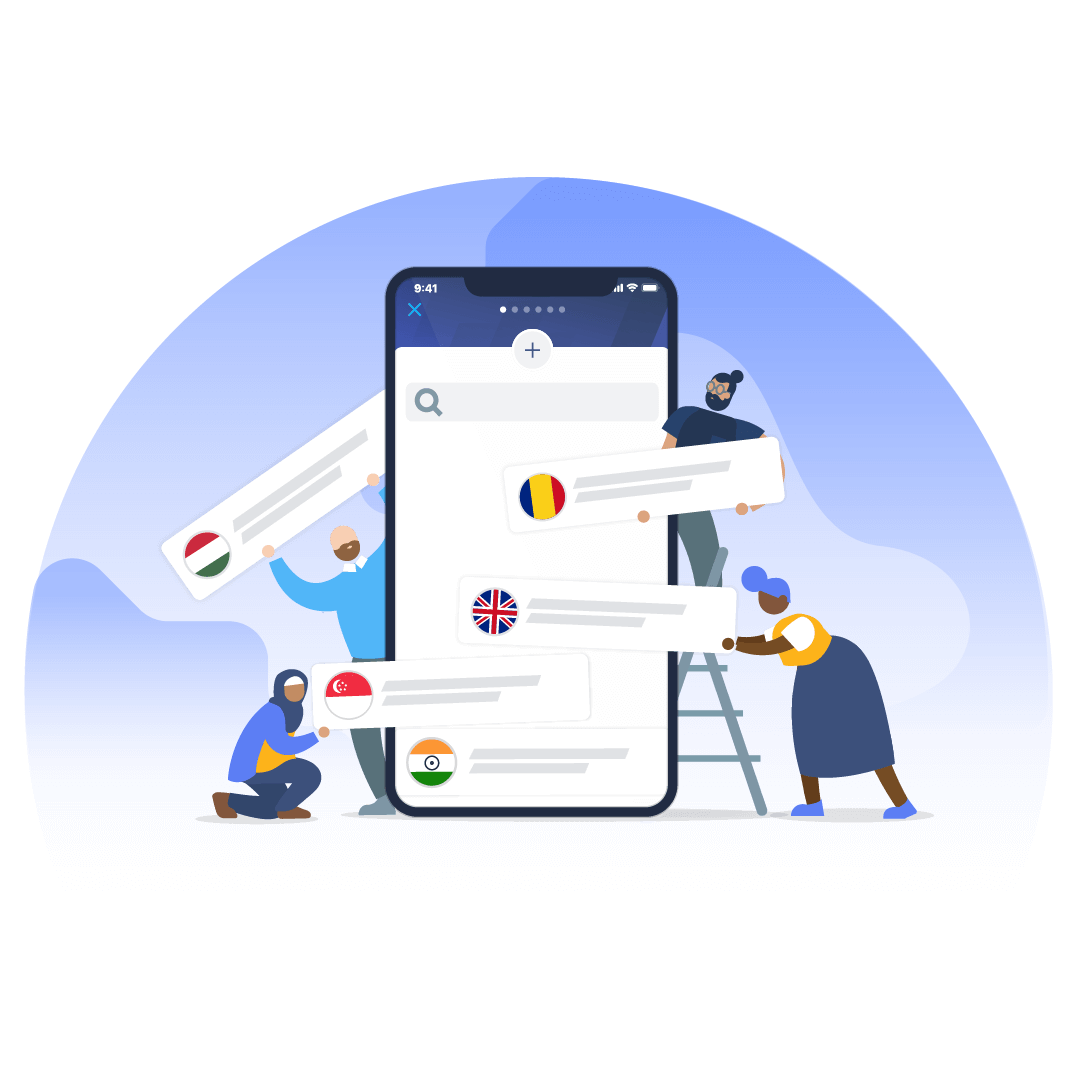

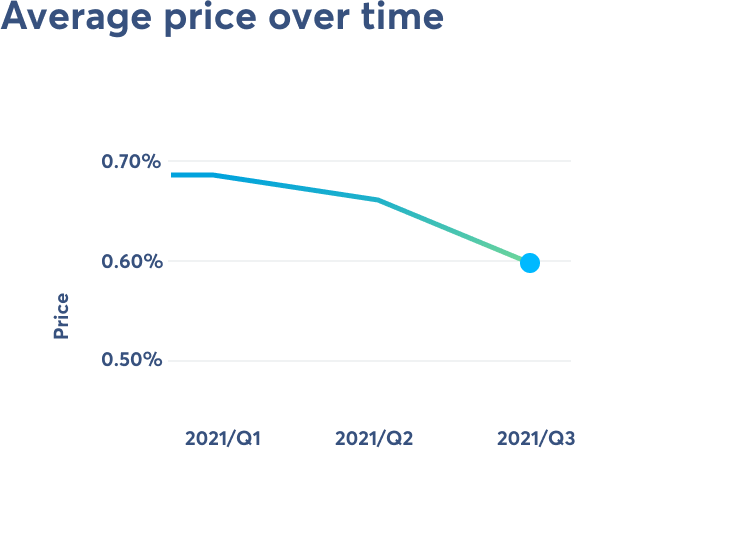

Fees are now lower for 1.7 million of you: Our average fee dropped from 0.67% to 0.62%. That means better deals on 100s of currency routes.

40% of all transfers arrived instantly: Our fastest yet — and up from 38%.

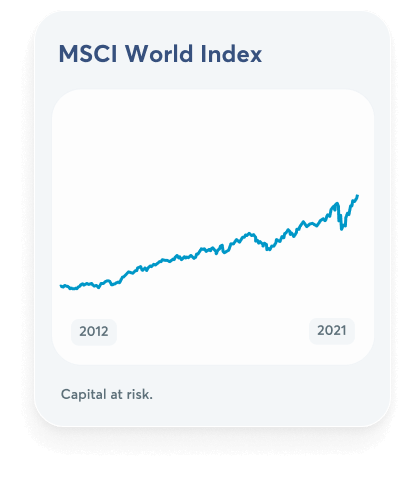

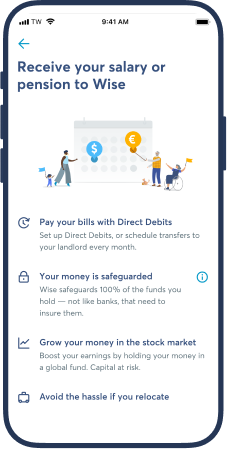

UK customers can grow their money: Those in the UK can now put their money to work, while still being able to spend and send as normal.

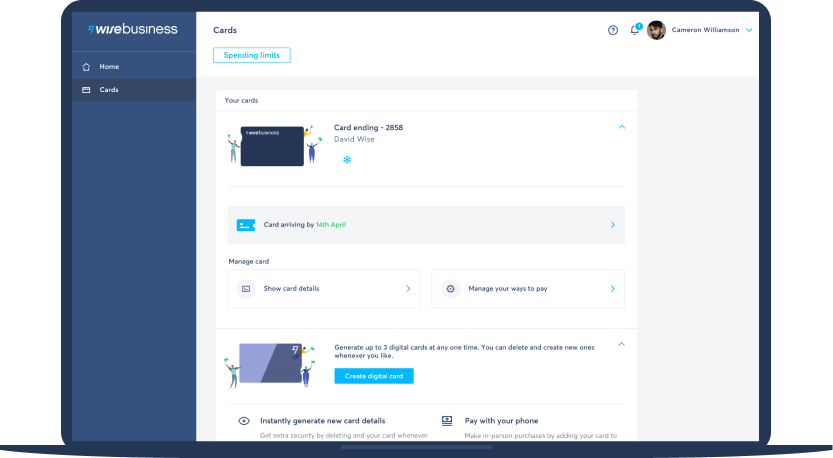

Employees expenses made easier: Your team can now spend directly from the business account and view their own transactions. Within the limits you set, of course.

(1).jpg)

.jpg)