Mission Round-up.

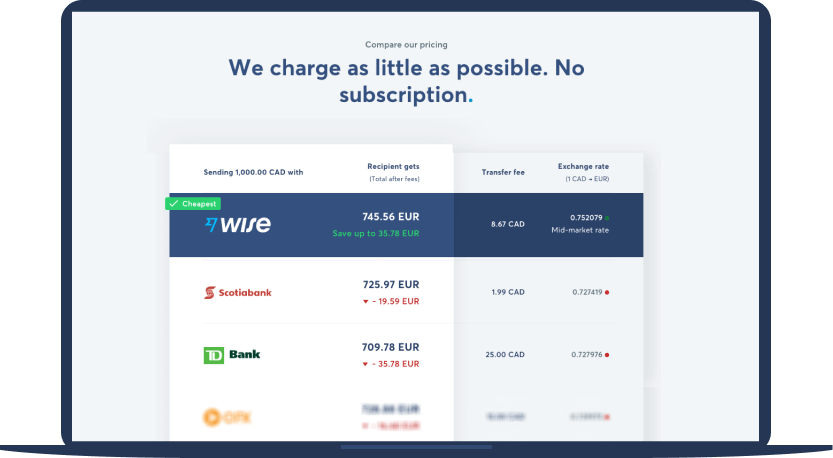

The last few months of currency volatility have presented some new challenges. In spite of these, 5.5 million of you moved £27 billion with us and saved over £560,000,000 on cross-currency transactions * compared to other providers.

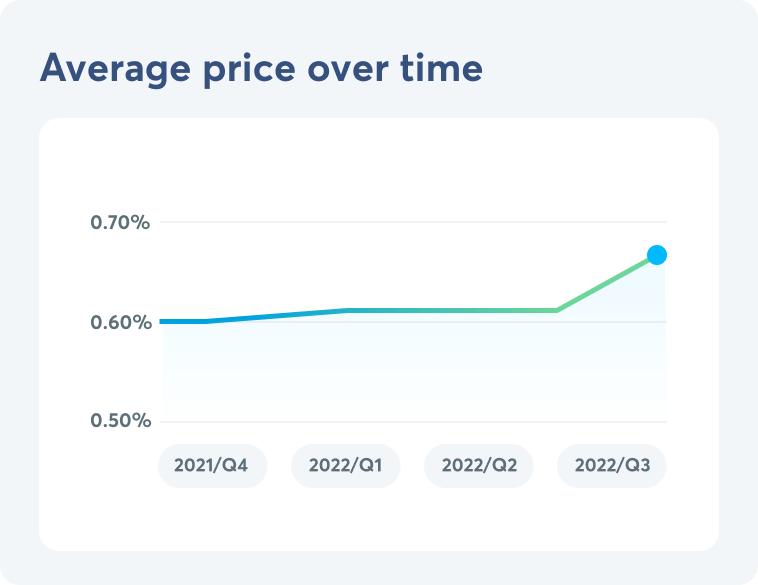

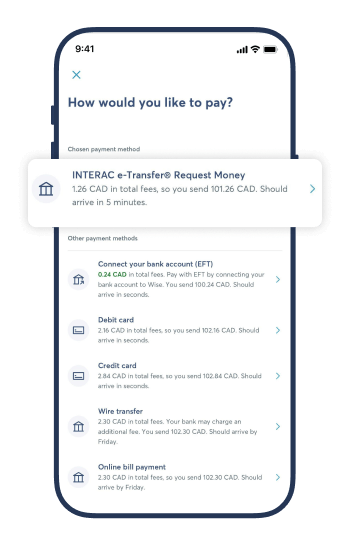

While our average fee for sending money didn’t get closer to zero, we stayed steady on speed and made big strides for customer convenience.

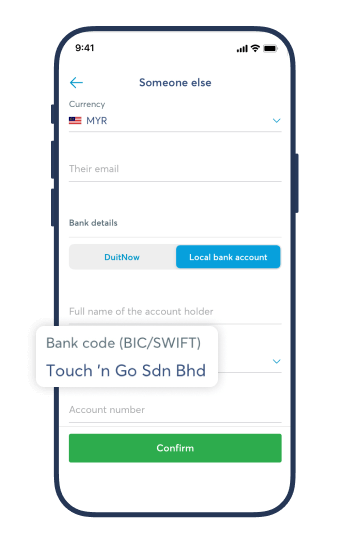

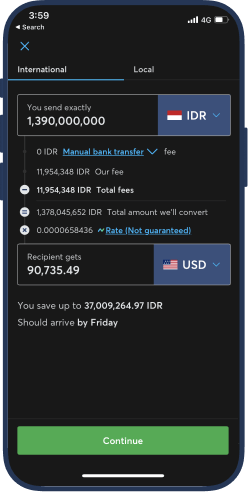

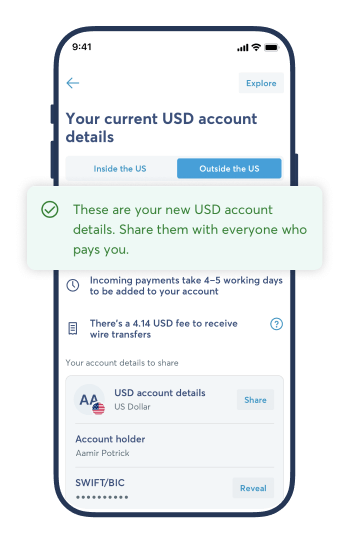

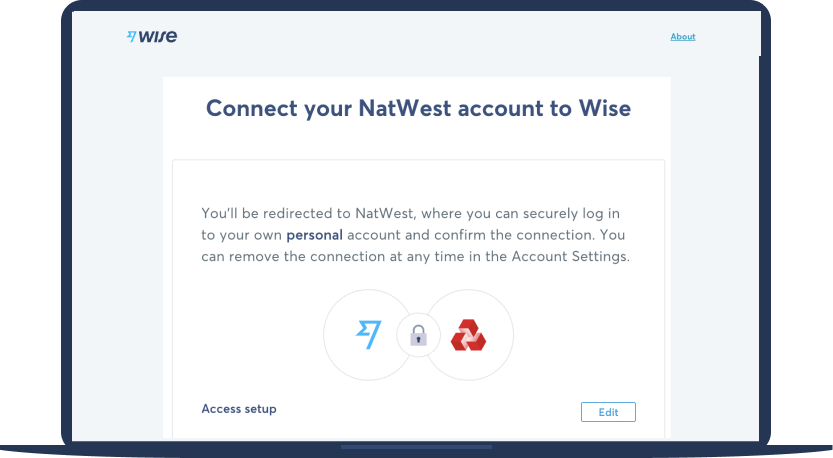

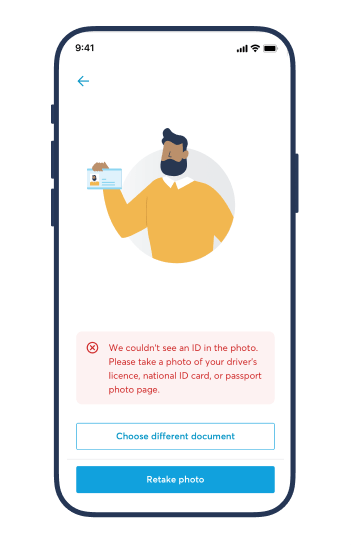

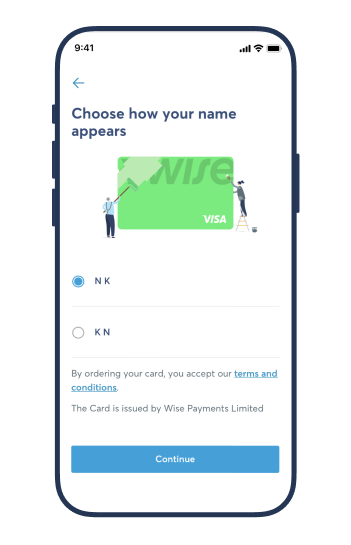

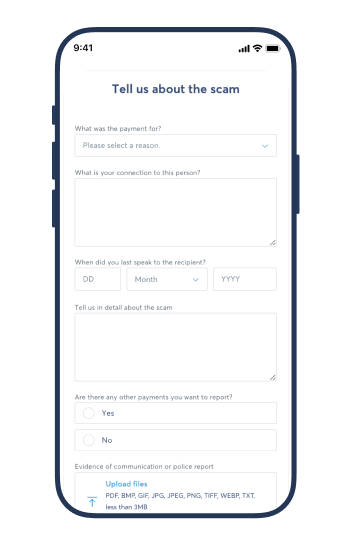

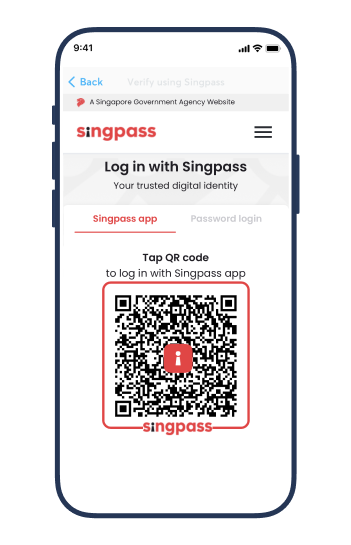

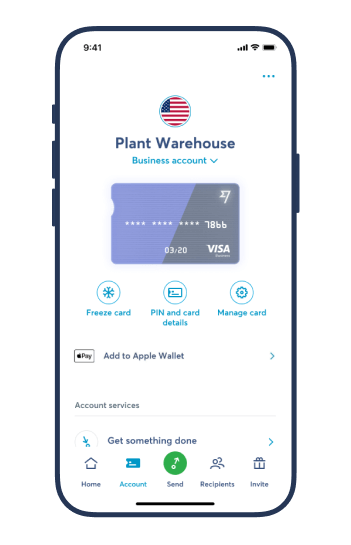

It’s now faster to get a Wise card, get issues resolved, and get your ID verified. We finally enabled wire transfers in the US and enabled another 103 countries to receive US dollars. We are also much better at spotting and preventing scams, and have made it easier for you to report suspicious activity to us.

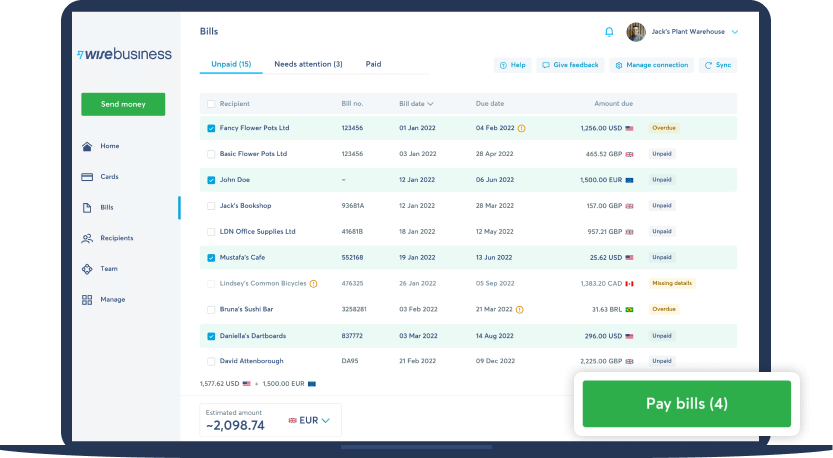

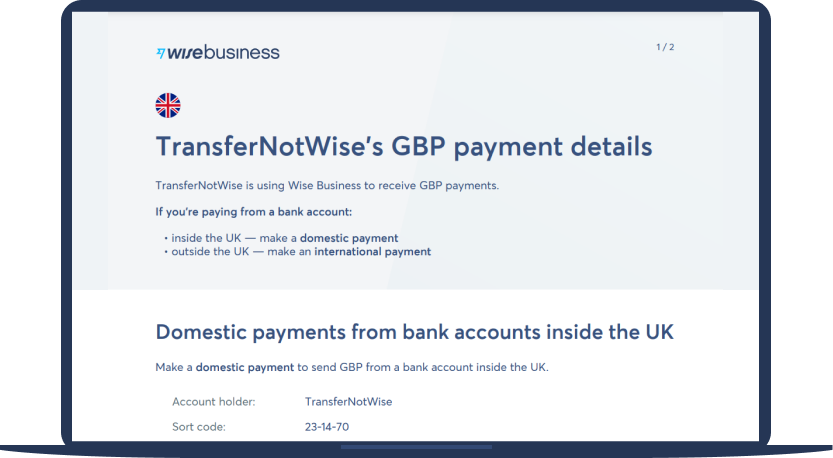

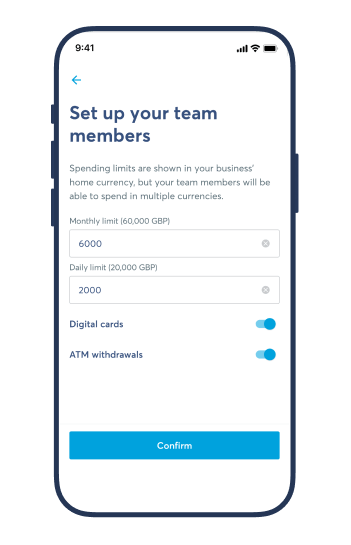

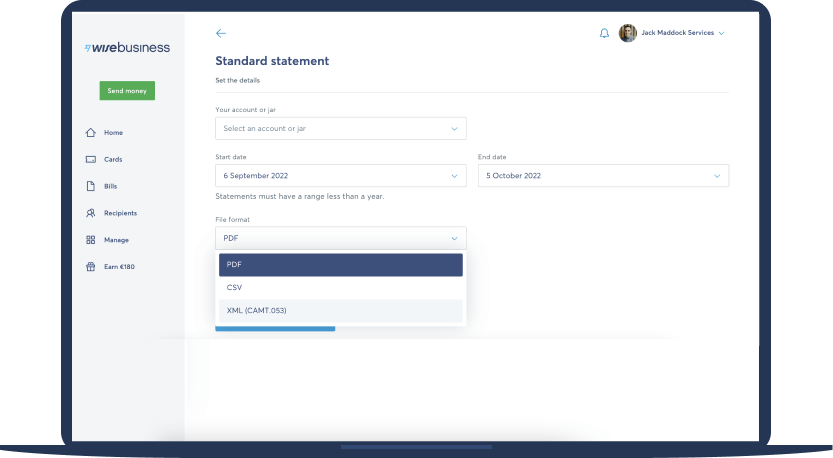

For our Wise Business account holders, you can now bulk pay bills with Quickbooks, send limitless transfers to business recipients in China, and get paid directly through Wise.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)