Writing to our 10 million customers,

So, how did we do in Q2?

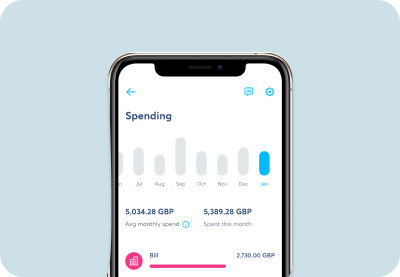

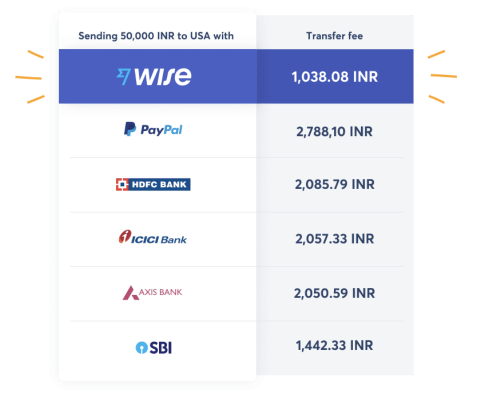

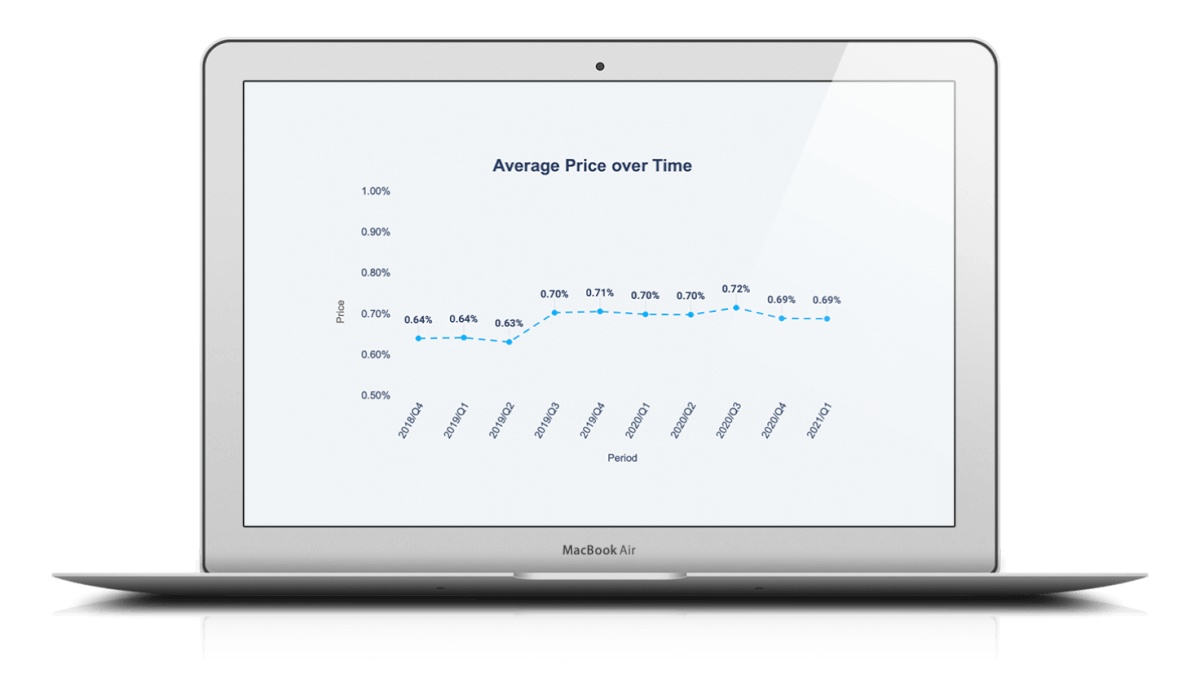

Our average fee dropped to 0.67%: Fees are now lower when you send money from seven of our currencies, or when you send money to 15 of our currencies.

We stayed steady on speed: 38% of all transfers arrived instantly in Q2 (same as Q1).

We (finally!) launched in India: Indian residents to send money to 40+ countries at the real exchange rate, with lower and more transparent fees.

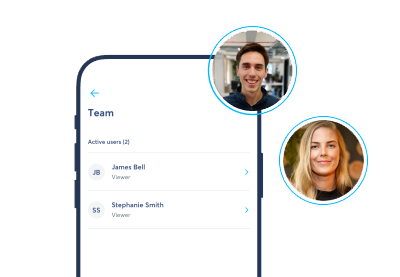

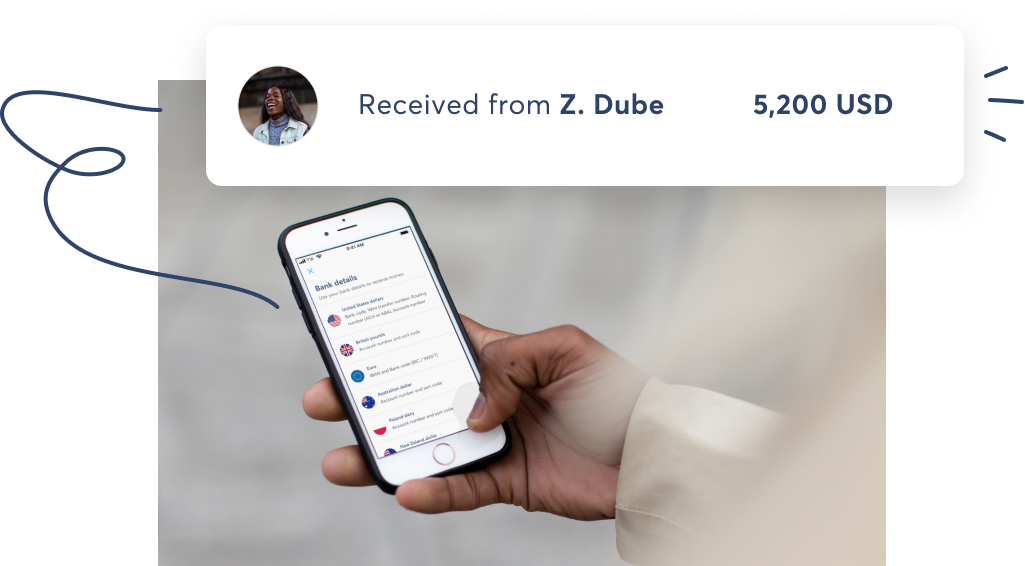

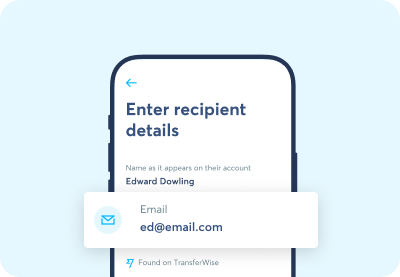

We’re making it more convenient to send money: Nearly 1 million customers opted in to receive money from other Wise customers with just their email address.

copy.png)