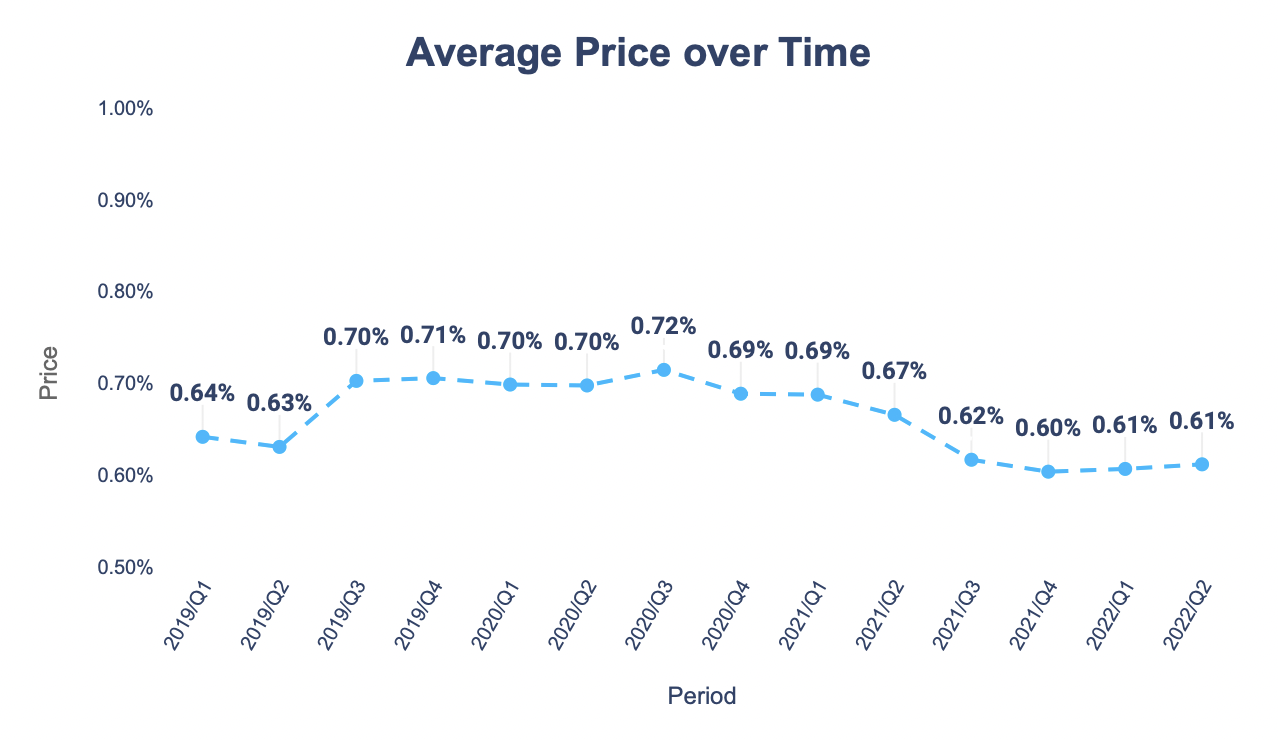

Q4 2023 Mission Update: Price

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

In the 2nd quarter of 2022 we unfortunately had to increase our fees on some of our routes. Although our average price stayed at 0.61% as we decreased fees on others.

In fees we reflect our cost, when cost goes down we pass it on to you as lower fee, and the same holds inversely too, which is why our average fee did increase this quarter. The cost increase on some of our currency routes was driven by 2 main factors: the cost of our servicing teams to implement additional verification steps , and the impact of macroeconomic events, such as the conflict in Ukraine.

On a good note - we did decrease fees on some of our currencies thanks to our renegotiating with, or integrating with, new partners decreasing costs there.

Overall in Q2 2022, we:

For our customers this means:

Changes in our fees are reflecting changes in cost in three main categories:

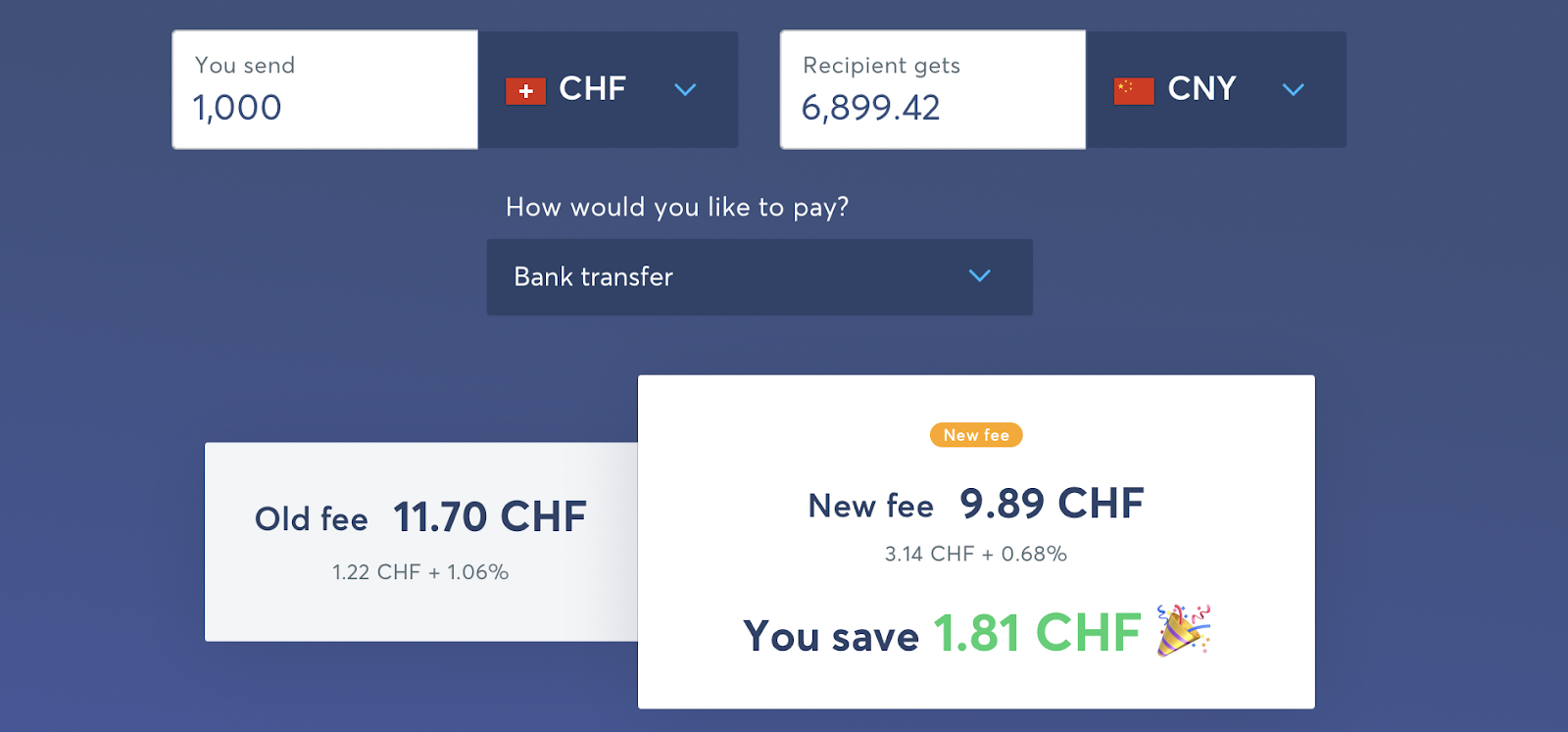

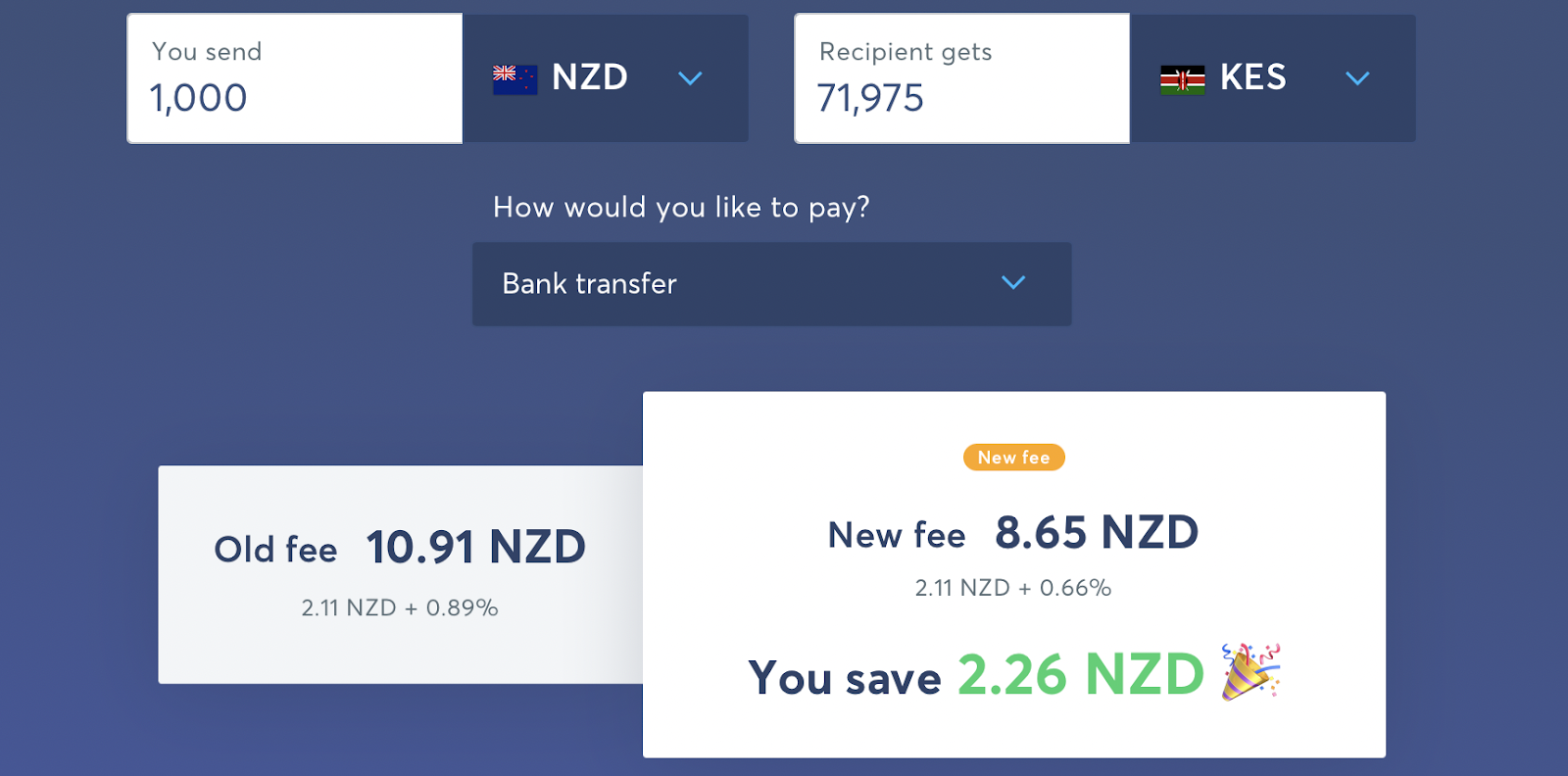

One of our new integrations with a partner in Mexico led to decrease in costs we need to pay -which allowed us to pass these savings to you. Similarly we have new partners for KES and AED which allowed us to decrease fees.

Macroeconomic events like inflation in the Turkish Lira, or War in Ukraine led to more uncertainty in global markets. This means higher costs for trading some currencies - as this change has been significant we unfortunately had to reflect this in our fees - such as on sending to Turkish Lira or TRY or Czech Koruna..

Additionally, our holdings charge on Euros increased due to the negative interest rates in the Eurozone. Meaning it costs us more money to hold larger amounts of EUR for our customers. This is unfortunate, and our Treasury Team is actively working on portfolio optimisations to eliminate our need to pass this charge onto you.

Recently we’ve implemented additional verification checks to keep your money protected. This means our Servicing Team cost increased and was reflected in our fees.

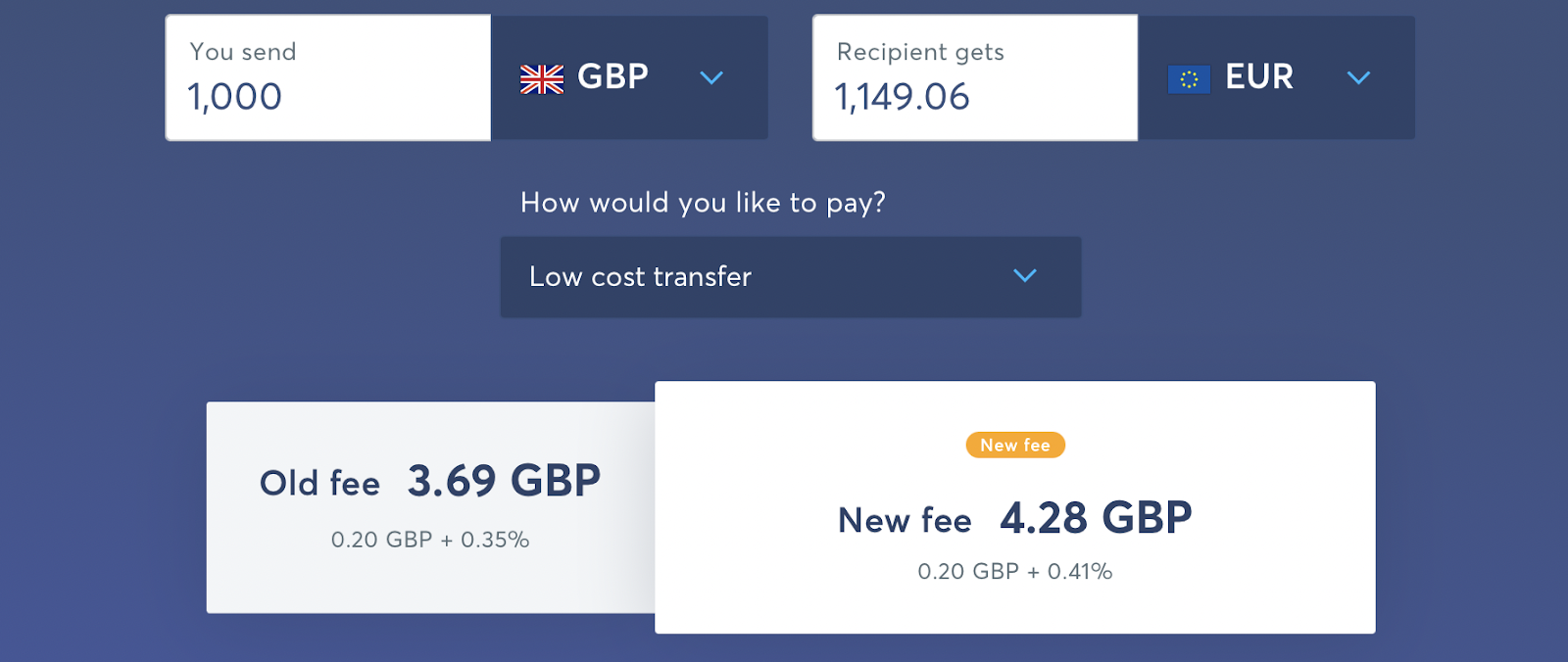

You can compare fees before and after in our pricing calculator, or see below couple examples:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Our average price stayed at 0.67% in Q4 2023. Overall, this quarter we 😞Increased fees on sending USD to countries outside the USA when using the SWIFT...

Speed In Q4, 61% of our transfers were instant, meaning they were completed in under 20 seconds. That’s an increase of 1% from Q3. What's changed? We’ve been...

We believe that the world’s a richer place when money moves fast and flows free. That’s why we work hard to ensure our product is as convenient as can be,...

Maximum Speed: Moving at the Speed of Light At Wise, we are committed to providing our consumers with the best possible experience when it comes to...

The key indicator that we’re offering a truly convenient product is your ability to use Wise without any hiccups. That’s why we’re measuring convenience (or...

We aim to make sure that using Wise is as convenient as possible – so you can manage your money hiccup-free. And we measure that convenience (or lack of it)...