How to send money from PayPal to Wise

Wondering if you can send money from PayPal to Wise? In this article, we'll cover the possibilities.

Need to pay someone in another country? You could use your bank, but it could be faster and cheaper with an online transfer service.

One option available in the US is Paysend. If you’re new to the UK-based fintech firm, read on. We’ve put together a full review of Paysend, covering everything you need to know. This includes features, fees, security and more

We’ll also look at an alternative - Wise. You can send money worldwide with Wise, for low fees and great exchange rates.

Launched in 2017, Paysend is a financial technology company based in the UK - although it operates in many countries worldwide. It has around 7 million customers. ¹

It’s an online international transfer platform, designed to make it easy for people and businesses to send money between countries.

There’s also a Paysend app, available from the Google Play and Apple App store for compatible devices. This lets you send and track transfers on the move.

Once you’ve signed up for a free Paysend account, you can send your first transfer in just a few clicks or taps. We’ll run through how to do it, along with the information you’ll need, a little later in this guide.

Even though Paysend is headquartered in the UK, you can use it in the USA. It offers transfers to over 100 countries around the world.¹

This includes:¹

Paysend’s main service is international transfers, but it also has a handful of other features you should know about.

This includes:

Now we come to the important question - how much does it cost you to send money with Paysend?

Paysend fees are really easy to get to grips with, as the service only charges a fixed, flat fee of $2 per transfer.² This is for all transfers where the recipient gets their money in the local currency, no matter the destination or how much you’re sending.

Alongside the upfront fee, it’s always a good idea to check out exchange rates for currency conversion when you’re sending money overseas.

Paysend claims that its exchange rates are “extremely competitive”³, and as close as possible to the mid-market exchange rate. Also known as the interbank rate, this is considered to be one of the fairest you can get.

However, it’s likely that similar to some other providers, Paysend will add its own small margin to the exchange rate. This enables the company to make a profit on the transfer.

Unfortunately though, it makes the transfer more expensive for you. We’ll show you how much it’ll add to the cost in just a moment.

If you want excellent exchange rates with no margin on top, use Wise to send money internationally. It’s a great alternative to Paysend, and could even work out cheaper.

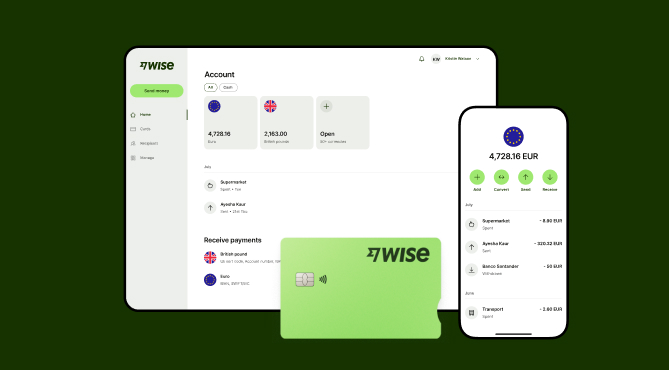

Wise is a money service business, offering a multi-currency account, international money transfer services and a debit card.

Open a Wise Account online and you’ll get all these fantastic benefits:

It’s quick, easy and free to open a Wise Account online. And there’s even a handy Wise app, so you can manage everything from your phone.

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

To give you a better idea of how much the exchange rate can affect the overall cost of an international transfer, let’s run through a quick hypothetical transfer.

Let’s imagine you want to send $1,000 to a friend or family member living in Germany. Here’s how much it’ll cost with both Paysend and Wise, when you factor in both the transfer fee and exchange rate for each:

| Provider | Transfer fee | Exchange rate | Recipient receives |

|---|---|---|---|

| Wise⁴ | $6.82 USD | 0.910900 - mid-market rate | €904.69 EUR |

| Paysend⁵ | $2 USD | 1.1144 | $895.57 EUR |

(Fees as of 09/08/2023 - Payment method is ACH.)

Ready to send your first transfer with Paysend? There are two ways to do it - online, or in the Paysend app.

To send money online with Paysend, follow these steps:

And here’s how to send a payment through the Paysend app:

In many cases, Paysend transfers are processed and delivered to the recipient instantly.

However, it can potentially take up to 3 working days for transfers to arrive.⁶

Paysend does have some transaction limits, which are divided by tiers:²

Most new users are likely to be Tier 1, although you can contact Paysend to find out your personal transaction limits or request for your limit to be increased.

So, is Paysend a trusted company? And what security measures does it have in place to protect your money and your transfers?

The first thing to know is that Paysend is a licensed money transmitter in the US, with the regulatory agency varying depending on the state.

It offers the following security features:

Paysend reviews on TrustPilot are also pretty positive, as it has an ‘Excellent’ score of 4.3 out of over 32,000 customer reviews.⁷

And that’s it - everything you need to know about Paysend. We’ve covered it all, from features and fees to supported countries and transfer times. You should now have all the info you need to decide if it’s the right choice for you.

Just make sure to compare alternatives before hitting ‘send’ on that transfer, looking at exchange rates as well as upfront fees. As we’ve seen here, alternatives such as Wise may work out cheaper thanks to a better exchange rate.

Sources used for this article:

Sources checked on 09-Aug-2023.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering if you can send money from PayPal to Wise? In this article, we'll cover the possibilities.

For many of us who are first-generation Americans, financial literacy isn’t something we learn from our parents - and we’re definitely not taught about money...

Everything you need to know about Discover It balance transfer limits.

Save when traveling to Europe by reading our guide on avoiding ATM fees.

Sendwave vs Wise: Comparing features, benefits, and more. Explore this article for insights on international money transfers.

Should I exchange money before traveling to Europe? Gain insights in this article for making informed decisions about currency exchange before your trip.