6 Best ecommerce payment providers

Discover the best ecommerce payment providers in the Uk to optimize payments and drive growth.

Managing expenses can be cumbersome, especially when the business uses traditional means like company credit or debit cards. The volume of transactions and the documents used to track these expenses can make the reconciliation process complex. The use of “P cards” or “purchase cards” can help simplify the approval process and manage expenses in a more efficient way.

This article will explain the benefits of p cards and what makes these instruments a better alternative than the traditional way of managing expenses.

| 💡 Effortlessly manage all expenses in one place with a Wise employee expense card |

|---|

As the name suggests, a P-card can be used for making a purchase. An employee uses the card to make a purchase of goods or services that a company requires. So, why not a company credit card? There are several drawbacks to these credit cards that will be discussed later.

By using P-cards, the employee does not have to go through the approval process of an invoice before funds are disbursed. This is particularly useful for small businesses in which the number of transactions may be high and the number of personnel maintaining an oversight is small.

A P-card can be used to pay different types of expenses incurred by a business. Some of these are:

1. Payment for procuring raw materials. P-cards offer additional flexibility like selecting the vendors to which the charges can be made using a P-card

2. Traveling expenses for an employee going abroad for business purposes.

3. Small expenses like the purchase of office equipment for which the P-card can be used directly without formal approval. This ensures a certain amount of funds is available, and the employee does not need to endure an approval process.

4. Utility bills for small businesses

| 💡 Note. If your business makes frequent multi-currency payments, it might be worth getting a Wise employee expense cards so you can effortlessly manage employee expenses no matter the currency without the hefty fees. |

|---|

A P-card can be considered an advanced version of a corporate credit card with many customizable features. While there is normally a limit to the number of corporate credit cards issued, the limit is usually not capped for P-cards.

The limit for each P-card can be set beforehand, with the approval process adjusted to meet specific requirements. For example, if an associate needs to make a purchase of $50, then the business can allow the employee to use the amount without any further approval. However, if the amount is $500, a manager may need to verify the transaction. In terms of usage, the P-card is very similar to traditional cards available.

A P-card can be issued in the name of each employee. They can be in physical form or can be in virtual form. It is generally a high-level designate who has the authority to issue a card for an employee.

The limit and usage are defined for each card depending on the seniority and function of the employee. The P-cards are managed using a central account, and control functions monitor the account’s activity. Employees can also log in to access the cards issued in their names.

A P-card offers numerous benefits that the traditional methods fail to provide. Unlike corporate credit cards that are generally issued only to managers, P-cards can be issued in the name of employees working at a lower level.

The built-in approval system for P-cards ensures that the transactions are monitored on a real-time basis. Contrary to this, items on a credit card are usually reviewed once the statement is issued. P-cards also offer a safer option since the issuance of these cards can be completed virtually.

In addition to corporate credit cards, there are other options available that businesses can make use of:

1. Prepaid card: A prepaid card has to be pre-funded and is not linked to a bank account. The amount used is limited to the funds available, and the card needs to be reloaded every time the balance is reduced. Issuing a prepaid card can be cumbersome if the number of employees using the card is large. There is no approval process that can be put in place for a prepaid card as well.

2. Fleet card: A fleet card can be considered to be a specific type of corporate credit card, but is particular to the transportation industry. The usage of these cards is limited to a specific purpose and the account must be settled similarly to a credit card. These cards are given to drivers and other employees to not claim a reimbursement every time they incur an expense

3. One card: This is another type of credit card with low annual fees. The characteristics are similar to a credit card, and it is beneficial as an entry-level card for people who have not owned a credit card before.

Credit cards or other versions of it give access to credit for small businesses. For a p-card, the bank account needs to be adequately funded before an employee can start using it.

Given the ability to issue a large number of P-cards, managing these cards can be difficult, especially when the volume of transactions is large. Since small value transactions generally don’t require approval, employees can misuse this facility for their personal use.

To its merit, the flexibility that P-cards provide is unmatched compared to the alternatives that have been discussed in the earlier sections. The instruments circumvent the need for a complex approval process for small transactions.

The providers also ensure that the platforms can upload invoices and other proofs for the expenses incurred. Unlike a credit card that issues a monthly statement, the reports can be immediately generated for costs incurred using a P-card. This enables the Finance controllers to monitor the activities on a real-time basis and flag any suspicious expense immediately.

| 💳 Only let employees see & spend what they need with purchase receipts integrated to your accounting software - get a Wise expense card |

|---|

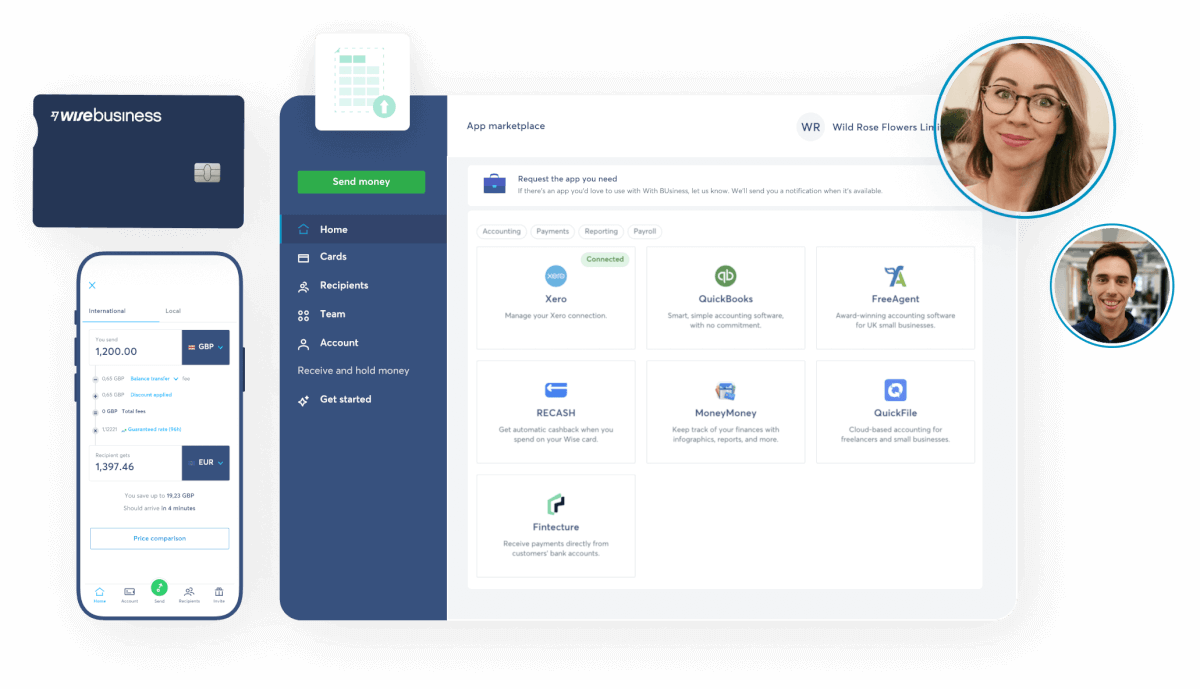

A Wise employee expense card is perfect for businesses operating in multiple currencies and locations. Wise is the maker of the world’s most international account and cost-effective payment solutions and now a multi-currency expense card. SMBs can effortlessly manage expenses in multiple currencies with no monthly subscription fee and exchange rate mark-up.

Purchase receipts are also integrated into your accounting software for faster account reconciliation. So if you’re a business who’s looking to expand globally or operating in multiple currencies, you might want to consider getting a Wise account.

This card offers an excellent reward point system and has a flexible billing system similar to a credit card. It also offers an online management tool to monitor expenses. A significant drawback of the card is the fee levied for issuing each card.

The card issued by Wells Fargo does not have an annual or a monthly fee, but the card does not offer a reward point system as lucrative as the one provided by One Card. The App enables users to log in and manage reports related to expenses and invoices. The card is also beneficial for employees traveling abroad.

The card offers a host of features that make it a favorite among mid-sized businesses. These include an easy payment process, working capital management, and expense tracking. A significant drawback is that the card is not available for small businesses that do not meet a revenue target set by the company.

This card allows setting limits on expenses, and the online portal is also user-friendly. The card does have upfront fees and monthly fees unless a minimum expense target is met.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the best ecommerce payment providers in the Uk to optimize payments and drive growth.

Discover the best digital vat software for small businesses to improve efficiency and streamline financial management.

Learn how predictive analytics in accounts receivable can improve efficiency, predict late payment, forecast cashflow and streamline financial management.

Read our guide to the venture capital process and best practices, for both VC investors and startups looking for funding.

Find out how to extend your startup funding runway, with strategies and tips for UK startups funded by venture capital.

When is venture debt right for your business? Find out here in this essential guide, covering what venture debt is, pros and cons and more.